North Dakota Debt Adjustment Agreement with Creditor

Description

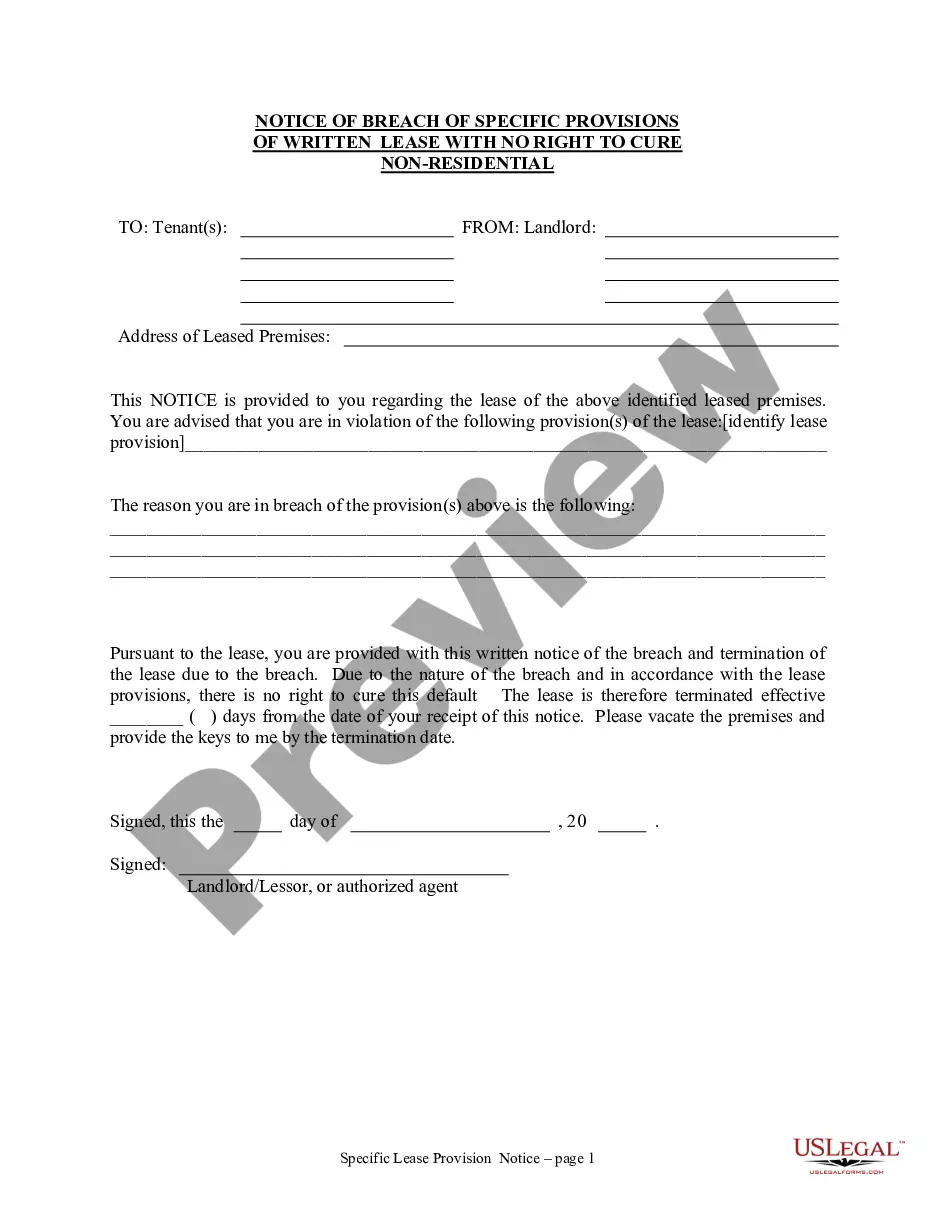

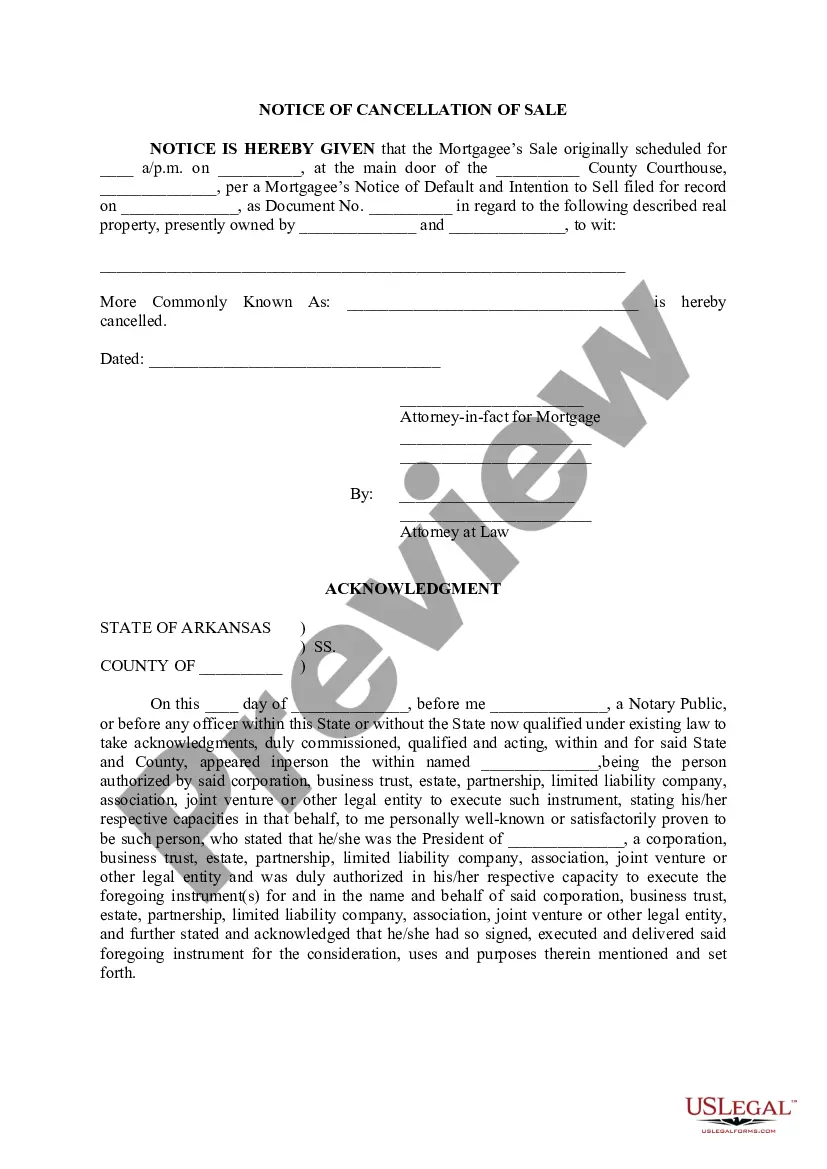

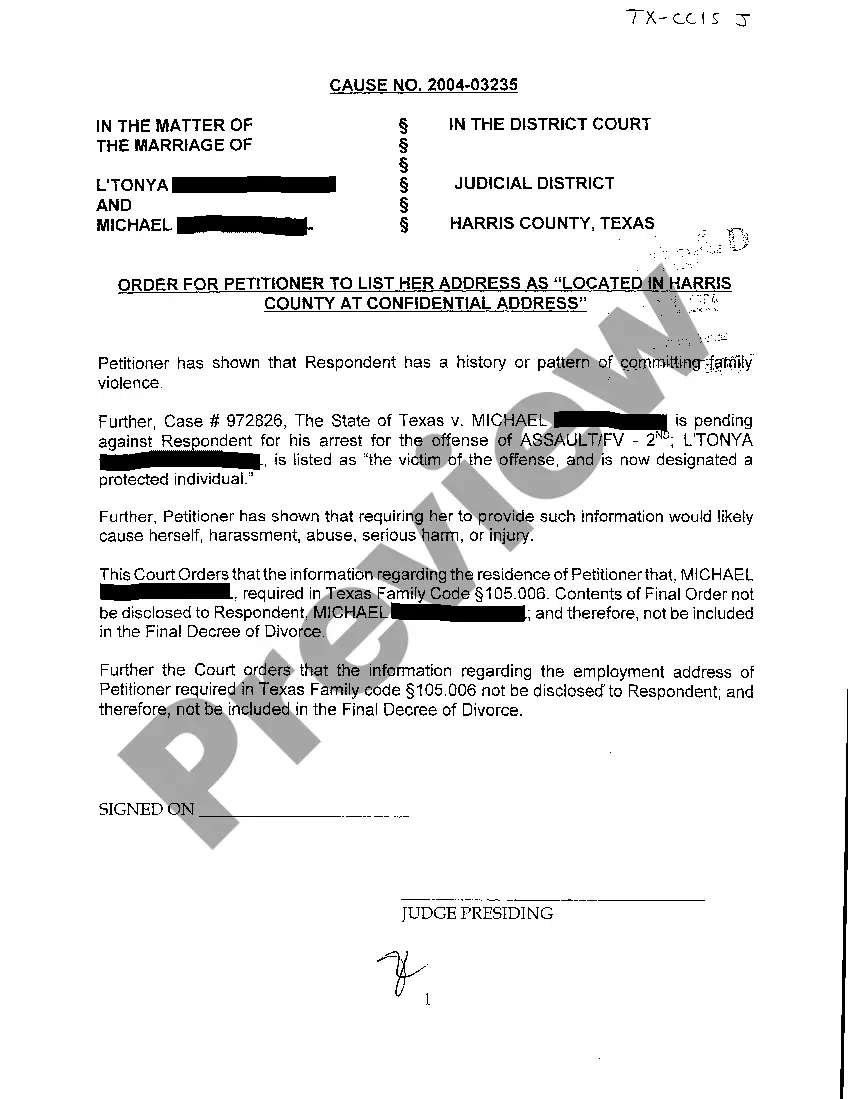

How to fill out Debt Adjustment Agreement With Creditor?

US Legal Forms - among the largest repositories of legal documents in the USA - provides a vast assortment of legal document templates that you can obtain or create.

By utilizing the website, you can discover thousands of forms for business and personal purposes, sorted by categories, states, or keywords.

You can access the latest versions of forms like the North Dakota Debt Adjustment Agreement with Creditor in just seconds.

Review the form summary to ensure you have chosen the appropriate form.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you currently hold a membership, Log In to obtain the North Dakota Debt Adjustment Agreement with Creditor from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure to have selected the right form for your city/region.

- Click the Review button to examine the form's details.

Form popularity

FAQ

In North Dakota, a judgment typically lasts for ten years, though it can be renewed if necessary. During this period, creditors may take certain actions to collect the debt. Understanding how judgments work is vital, especially if you are exploring options like a North Dakota Debt Adjustment Agreement with Creditor to resolve your financial challenges.

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

10 Tips for Negotiating with CreditorsIs Negotiation the Right Move For You? It's important to think carefully about negotiation.Know Your Terms.Keep Your Story Straight.Ask Questions, and Don't Tolerate Bullying.Take Notes.Read and Save Your Mail.Talk to Creditors, Not Collection Agencies.Get It in Writing.More items...?

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed. The strategy works best for debts that are already delinquent.

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

Debt settlement is an agreement made between a creditor and a consumer in which the total debt balance owed is reduced and/or fees are waived, and the reduced debt amount is paid in a lump sum instead of revolving monthly.

A creditor agreement is a contract concluded between the debtor and all the creditors. This agreement pays for some part or a percentage of each debt, and the debtor receives a final discharge for the remaining amount due. The debtor can make a new start and the creditors receive their payments immediately.