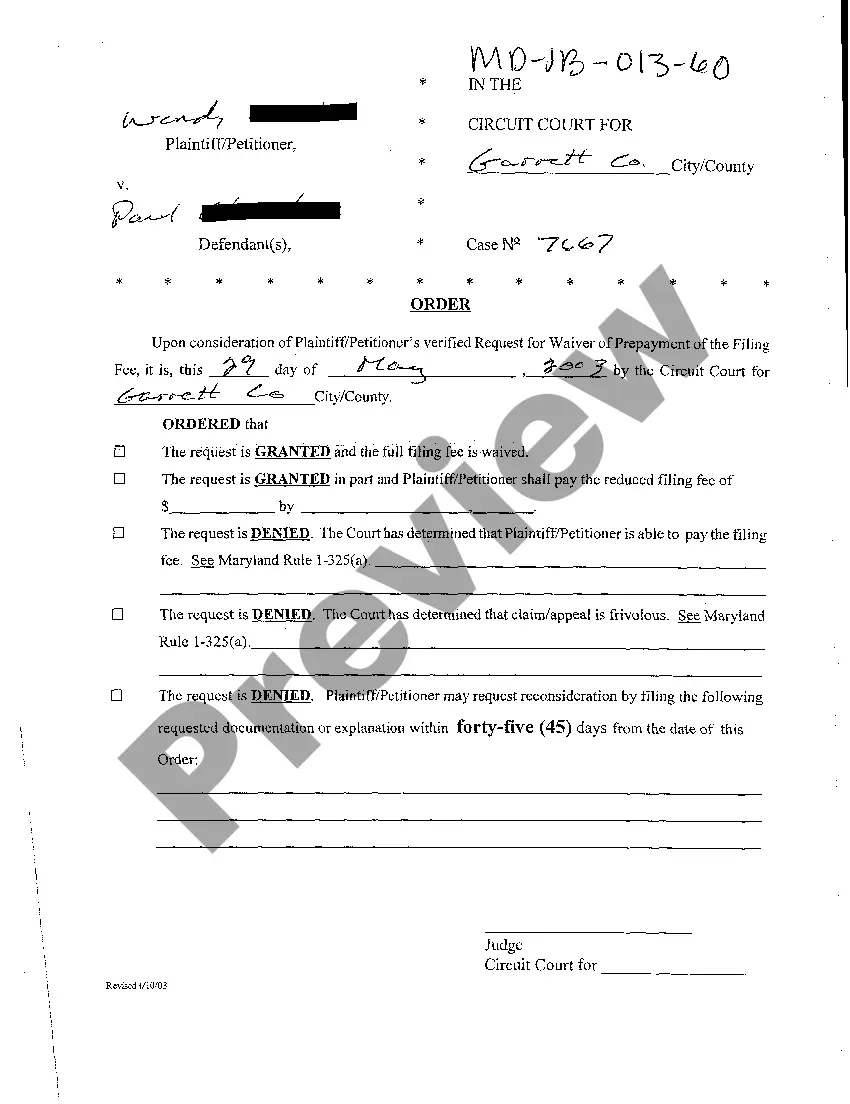

North Dakota Extended Date for Performance

Description

How to fill out Extended Date For Performance?

Selecting the appropriate legal document template can be quite challenging. Obviously, there are numerous templates accessible online, but how will you find the legal document you require.

Utilize the US Legal Forms website. The platform offers a vast collection of templates, including the North Dakota Extended Date for Performance, which you can use for both business and personal purposes.

All the documents are reviewed by professionals and comply with federal and state regulations.

Once you are confident that the document is suitable, click the Order Now button to procure the document. Select the pricing plan you want and provide the necessary information. Create your account and complete your order using your PayPal account or credit card. Choose the format and download the legal document template onto your device. Fill out, modify, print, and sign the acquired North Dakota Extended Date for Performance. US Legal Forms is the largest repository of legal documents where you can locate numerous document templates. Take advantage of the service to download professionally crafted documents that comply with state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the North Dakota Extended Date for Performance.

- Use your account to check the legal documents you may have ordered in the past.

- Go to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward steps for you to follow.

- First, ensure you have chosen the correct document for your area/county. You can preview the form by clicking the Preview button and reviewing the form description to confirm it meets your needs.

- If the document does not satisfy your requirements, use the Search field to find the appropriate form.

Form popularity

FAQ

North Dakota generally maintains lower tax rates compared to many other states, making it an appealing destination for residents and businesses alike. Low property taxes and favorable business taxes contribute to its reputation as a low tax state. If you are exploring the North Dakota Extended Date for Performance, understanding the tax landscape will help you take advantage of potential savings.

The extended filing date allows you to submit necessary documents beyond the regular due date, providing additional time for compliance. This is particularly important for businesses navigating complexities, such as those related to the North Dakota Extended Date for Performance. Utilizing platforms like US Legal Forms can simplify this process and ensure you meet all requirements.

North Dakota is not entirely tax-exempt, but it does provide various tax benefits and incentives to encourage growth. The state has a balanced tax system that supports both individuals and businesses. For those affected by the North Dakota Extended Date for Performance, knowing these tax structures can facilitate more informed decisions.

Yes, North Dakota offers an automatic extension for filing state income tax returns. This extension typically mirrors the federal deadline, allowing individuals and businesses additional time to prepare their returns. Understanding how the North Dakota Extended Date for Performance works can help you avoid penalties while ensuring you meet all necessary deadlines. For complete support and easy access to forms, USLegalForms can be a valuable resource.

A federal tax extension is indeed automatic, provided that the appropriate forms are filed on time. This means taxpayers do not need to provide a reason for the extension. However, it’s important to remember that while the North Dakota Extended Date for Performance may align with federal deadlines, state requirements can vary. To stay informed, USLegalForms can provide essential information to ensure you remain compliant with both federal and state regulations.

Yes, North Dakota does accept federal extensions for trusts. This means that if a trust has been granted a federal tax extension, it can generally benefit from the same additional time in North Dakota. This process can be important for trustees looking to meet obligations without rushing. To simplify this process, consider utilizing USLegalForms for guidance on the North Dakota Extended Date for Performance.

Yes, North Dakota accepts federal extensions for partnerships. When you file for a federal extension, you also receive extra time for your North Dakota taxes. Make sure you’re aware of the North Dakota Extended Date for Performance, as it can help you avoid penalties and streamline the filing process for your partnership.

Yes, Canadians may qualify for a refund of North Dakota taxes withheld on income earned in the state. They must file the appropriate forms and adhere to the North Dakota tax guidelines. Utilizing the North Dakota Extended Date for Performance can help Canadians navigate this process effectively and ensure they receive any refunds due.

North Dakota does allow taxpayers to request an automatic extension to file their taxes. However, it's important to note that this extension only extends the filing deadline, not the payment deadline. Understanding the North Dakota Extended Date for Performance can help you better manage your tax timeline and ensure timely payments.

Yes, if you earn income in North Dakota, you need to file state taxes. File your North Dakota tax return, even if you do not owe any taxes. Keep in mind that the North Dakota Extended Date for Performance may provide you more time to gather your documents and complete your return accurately.