North Dakota Sample Letter regarding Authority to Cancel Deed of Trust

Description

How to fill out Sample Letter Regarding Authority To Cancel Deed Of Trust?

Are you presently within a placement that you will need papers for possibly company or personal reasons just about every time? There are tons of legitimate file layouts available on the Internet, but discovering types you can trust is not effortless. US Legal Forms provides thousands of form layouts, much like the North Dakota Sample Letter regarding Authority to Cancel Deed of Trust, that happen to be composed to satisfy state and federal needs.

In case you are previously acquainted with US Legal Forms internet site and also have your account, merely log in. Next, it is possible to obtain the North Dakota Sample Letter regarding Authority to Cancel Deed of Trust template.

If you do not have an profile and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the form you require and make sure it is to the appropriate town/county.

- Utilize the Review key to review the shape.

- Read the outline to actually have selected the proper form.

- If the form is not what you are trying to find, utilize the Search discipline to find the form that suits you and needs.

- If you discover the appropriate form, simply click Get now.

- Opt for the prices plan you desire, fill in the desired details to produce your account, and pay for the transaction utilizing your PayPal or bank card.

- Pick a hassle-free document file format and obtain your copy.

Locate each of the file layouts you might have purchased in the My Forms menus. You can get a further copy of North Dakota Sample Letter regarding Authority to Cancel Deed of Trust any time, if possible. Just go through the required form to obtain or print the file template.

Use US Legal Forms, probably the most extensive collection of legitimate kinds, to save time and avoid faults. The services provides expertly produced legitimate file layouts which you can use for an array of reasons. Make your account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

Six years after the Trust Deed starts, your credit rating will contain no mention of it. It's important to remember, if you have already missed payments or have been paying reduced amounts to your creditors then your credit rating may already have been adversely affected.

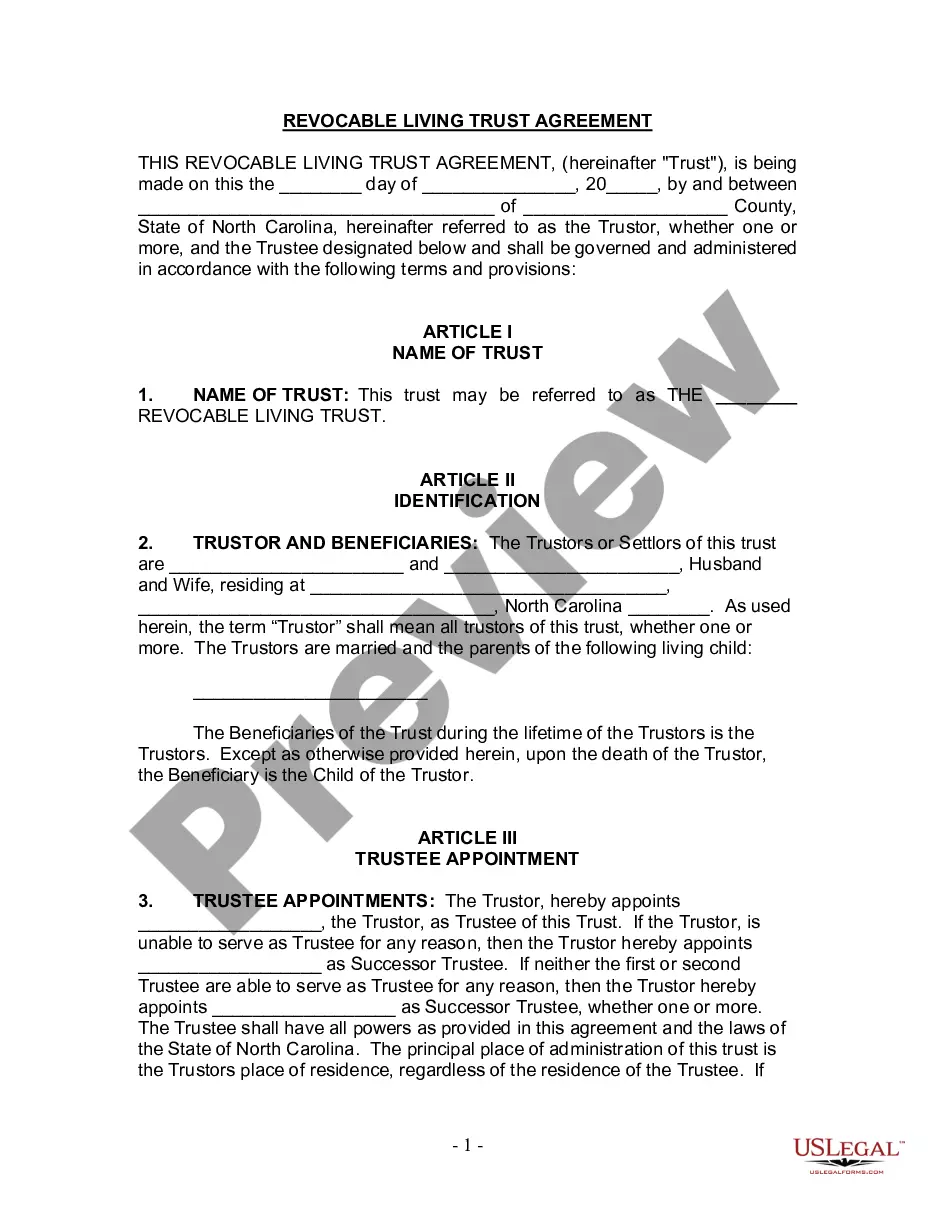

A Trust deed is a legal document that comprises and sets out the terms and conditions of creating and managing a trust. It involves the objective of the trust established , the names of the beneficiaries and the amount of lump sum income they will receive and even the method by which they will receive the payment.

Definitions. Trust: A legal document that spells out how a person's assets should be managed during their lifetime or after their death.

A deed of trust exists so that the lender has some recourse if you don't pay your loan as agreed. There are three parties involved in a deed of trust: the trustor, the beneficiary and the trustee. The three parties involved in a deed of trust for a real estate transaction are a: Trustor.