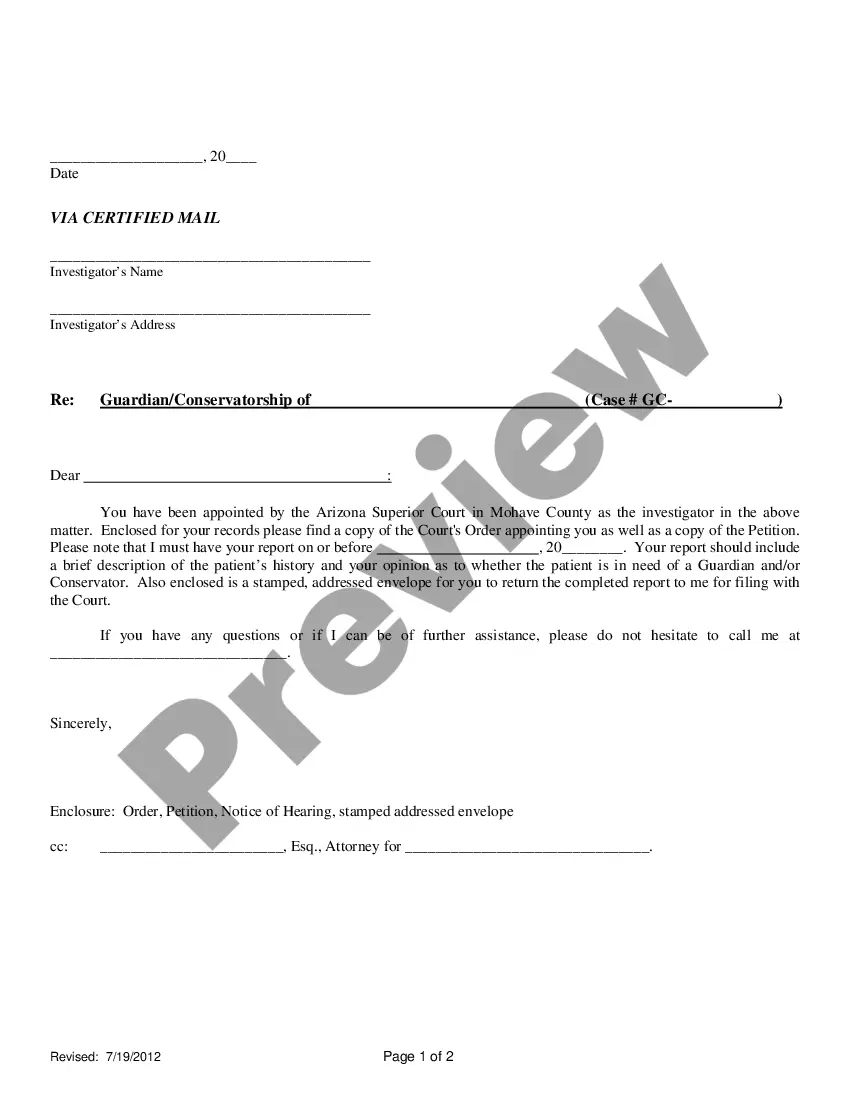

Life insurance proceeds can be paid directly to a funeral home, cemetery or other entity if the beneficiary executes an assignment of proceeds instrument. Funeral homes and cemeteries typically have their own assignment of proceeds forms. In order for us to honor an assignment of proceeds, the beneficiary's signature must be witnessed by a notary public affirming the identity of the person that signed the assignment. Additionally, all policy/certificate numbers subject to assignment must be written on the assignment and the specific maximum amount to be paid by assignment must be clearly stated.

Assignment of Life Insurance Proceeds to Funeral Director

Description

Key Concepts & Definitions

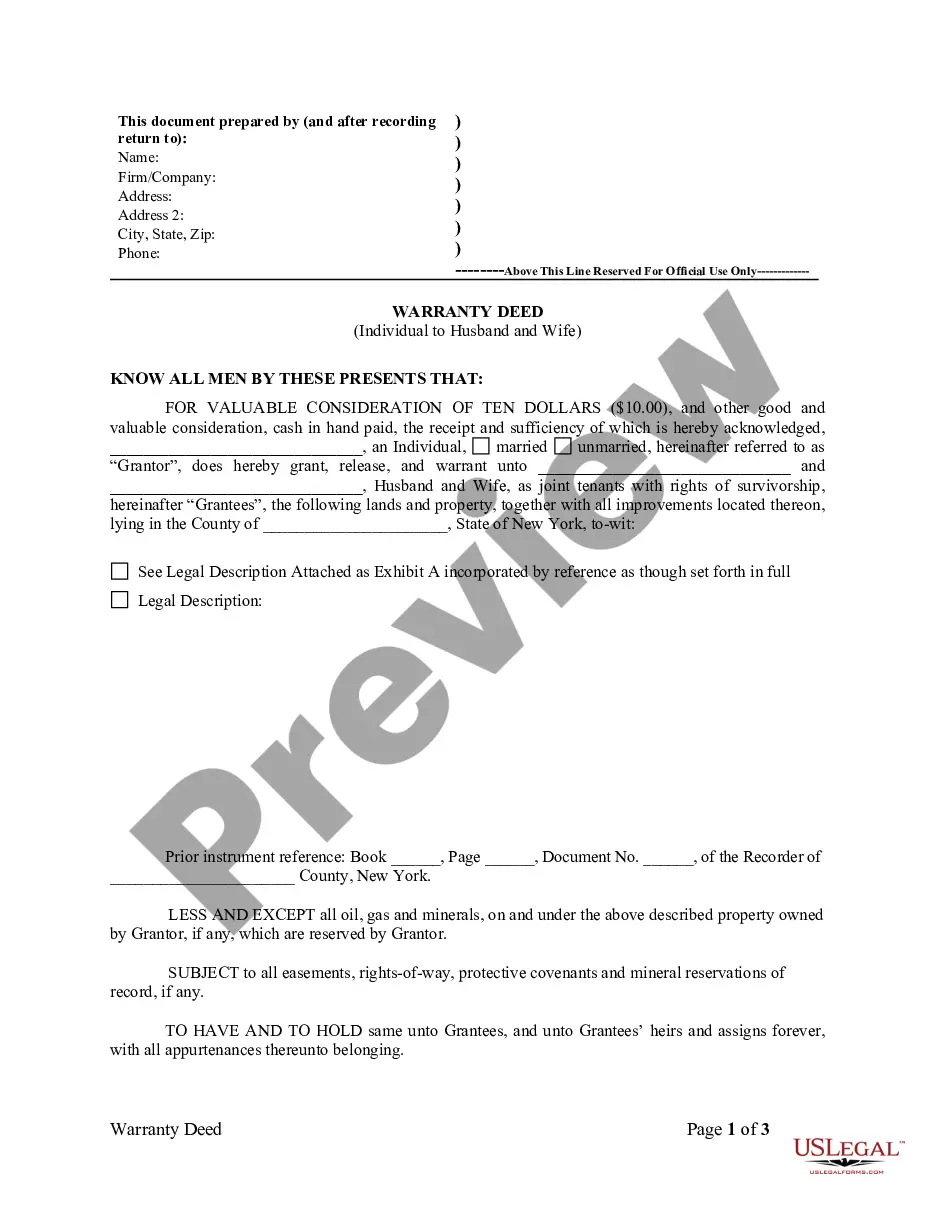

Assignment of Life Insurance Proceeds to Funeral: This is a legal process where the policyholder authorizes their life insurance company to directly pay a portion or the entirety of the policy's proceeds to a funeral service provider. This arrangement is often established to ensure funeral expenses are covered without burdening the family financially or administratively.

Step-by-Step Guide

- Review Your Insurance Policy: Ensure that your life insurance policy allows for the assignment of proceeds to a funeral provider.

- Select a Funeral Home: Choose a funeral home that accepts direct payment through life insurance proceeds.

- Complete an Assignment Form: Fill out the necessary forms provided by the insurance company to authorize the assignment. This typically requires policy information, funeral service details, and signatures from all parties.

- Submit Form to Insurance Company: Send the completed form to your insurance provider, preferably before the services are needed.

- Confirmation and Payment: The insurance company will process the assignment and, upon the policyholder's death, will pay the agreed amount directly to the funeral service provider.

Risk Analysis

- Liquidation Delay: There might be a delay in the insurance company's payment processing, which could affect funeral arrangements.

- Financial Limitation: The amount assigned might not cover all funeral expenses, leading to out-of-pocket costs for the family.

- Policy Restrictions: Some policies may have restrictions or conditions on such assignments that could complicate the process.

Key Takeaways

Assigning life insurance proceeds to funeral homes simplifies the payment process for funeral expenses and ensures the deceased's wishes are fulfilled without financial stress on the family. It's essential to understand the policy's terms and coordinate with the funeral home and insurance company to handle this smoothly.

Best Practices

- Early Coordination: Arrange the assignment well in advance to avoid delays and complications during a difficult time.

- Clear Communication: Maintain open communication lines among all parties involvedfamily, insurance provider, and funeral home.

- Document Verification: Ensure all forms and documentation are correctly filled out and verified to prevent issues during the claims process.

FAQ

- Q: Can any life insurance policy be assigned to cover funeral expenses?

A: Not all policies permit assignment to funeral homes. It's important to check with your insurance provider. - Q: Are there any tax implications for assigning life insurance proceeds to a funeral home?

A: Generally, life insurance proceeds are tax-free, but it's best to consult with a tax advisor to understand any specific implications.

How to fill out Assignment Of Life Insurance Proceeds To Funeral Director?

Aren't you tired of choosing from countless templates every time you require to create a Assignment of Life Insurance Proceeds to Funeral Director? US Legal Forms eliminates the lost time numerous Americans spend searching the internet for suitable tax and legal forms. Our skilled crew of attorneys is constantly upgrading the state-specific Forms collection, to ensure that it always has the proper documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have an active subscription should complete easy steps before having the capability to get access to their Assignment of Life Insurance Proceeds to Funeral Director:

- Utilize the Preview function and read the form description (if available) to ensure that it is the correct document for what you’re looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the right template to your state and situation.

- Utilize the Search field at the top of the site if you need to look for another document.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your file in a needed format to complete, create a hard copy, and sign the document.

After you have followed the step-by-step instructions above, you'll always be able to log in and download whatever document you need for whatever state you want it in. With US Legal Forms, completing Assignment of Life Insurance Proceeds to Funeral Director templates or any other official paperwork is not hard. Get started now, and don't forget to double-check your examples with certified attorneys!

Form popularity

FAQ

Make Sure the Policy is Assignable.Funeral homes generally accept a life insurance policy in lieu of payment for a funeral, though it's best not to assume that they will. Remember, if they do accept a policy as payment, it must be assignable. Retirement benefits and 401(k) benefits are not assignable.

With life insurance, your family is required to pay the funeral home upfront at the time of the funeral.It's important to note that some life insurance policies offer burial insurance (called a final expense plan). This additional purchase offers funds to help your beneficiary pay for funeral expenses.

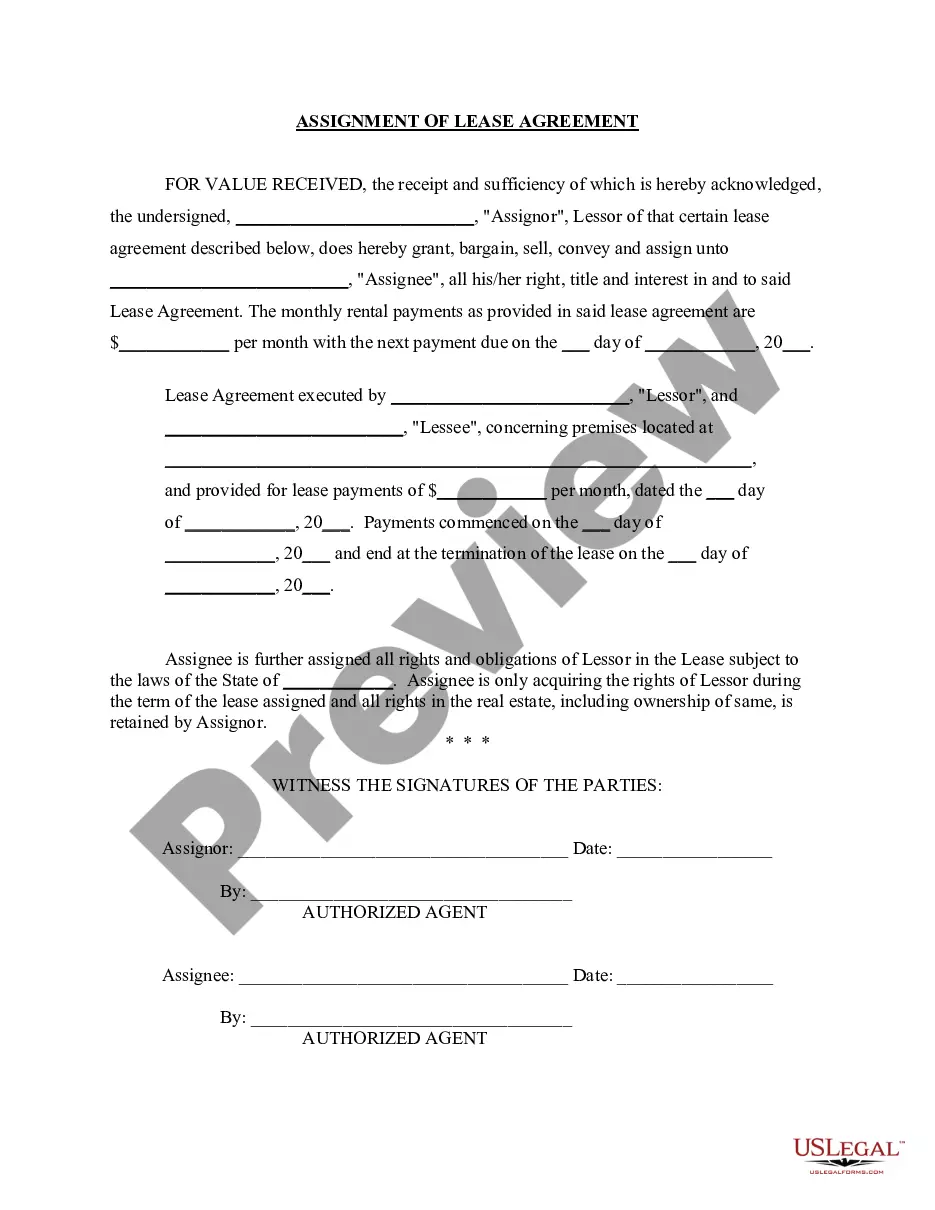

Beneficiary Assignment A beneficiary of a life insurance policy can fill out an assignment form at the funeral home, which will allow payment of the settlement to go directly to the funeral home. Again, any money left over is given back to the beneficiaries named once the funeral expenses are settled.

A Funeral Assignment is an agreement that is signed by a beneficiary of a life insurance policy. The beneficiary assigns all or a portion of the life insurance benefits at the Funeral Home which allows payment for funeral expenses to be made directly to the funeral home.

If the deceased person had a life insurance policy with a named beneficiary, it is not part of the estate. The proceeds pass directly to the beneficiary. The beneficiary has no obligation to pay for the funeral using the life insurance proceeds.

A beneficiary of a life insurance policy can fill out an assignment form at the funeral home, which will allow payment of the settlement to go directly to the funeral home. Again, any money left over is given back to the beneficiaries named once the funeral expenses are settled.

Pre-Paying With Life InsuranceYou can't pre-pay for your funeral with a life insurance policy that is still in place.The death benefit and earmark can be used to cover funeral services. The family simply makes the funeral home the beneficiary of the policy.