North Dakota Sample Letter for Land Deed of Trust

Description

How to fill out Sample Letter For Land Deed Of Trust?

Finding the right legal record template can be a battle. Needless to say, there are plenty of layouts available online, but how will you find the legal develop you require? Make use of the US Legal Forms internet site. The services gives a large number of layouts, like the North Dakota Sample Letter for Land Deed of Trust, which can be used for company and personal needs. All of the forms are inspected by professionals and satisfy state and federal needs.

Should you be currently registered, log in for your bank account and then click the Obtain switch to get the North Dakota Sample Letter for Land Deed of Trust. Utilize your bank account to appear throughout the legal forms you may have acquired formerly. Go to the My Forms tab of your own bank account and get yet another backup of the record you require.

Should you be a fresh customer of US Legal Forms, listed here are simple guidelines for you to comply with:

- Initially, ensure you have chosen the appropriate develop for your personal area/region. You can check out the form making use of the Preview switch and browse the form information to make certain it is the right one for you.

- When the develop fails to satisfy your needs, take advantage of the Seach area to find the proper develop.

- Once you are certain that the form is proper, click on the Get now switch to get the develop.

- Pick the rates plan you would like and enter the needed information. Make your bank account and buy the transaction utilizing your PayPal bank account or credit card.

- Pick the data file file format and acquire the legal record template for your product.

- Total, revise and printing and signal the obtained North Dakota Sample Letter for Land Deed of Trust.

US Legal Forms will be the most significant local library of legal forms in which you can discover a variety of record layouts. Make use of the service to acquire appropriately-made paperwork that comply with condition needs.

Form popularity

FAQ

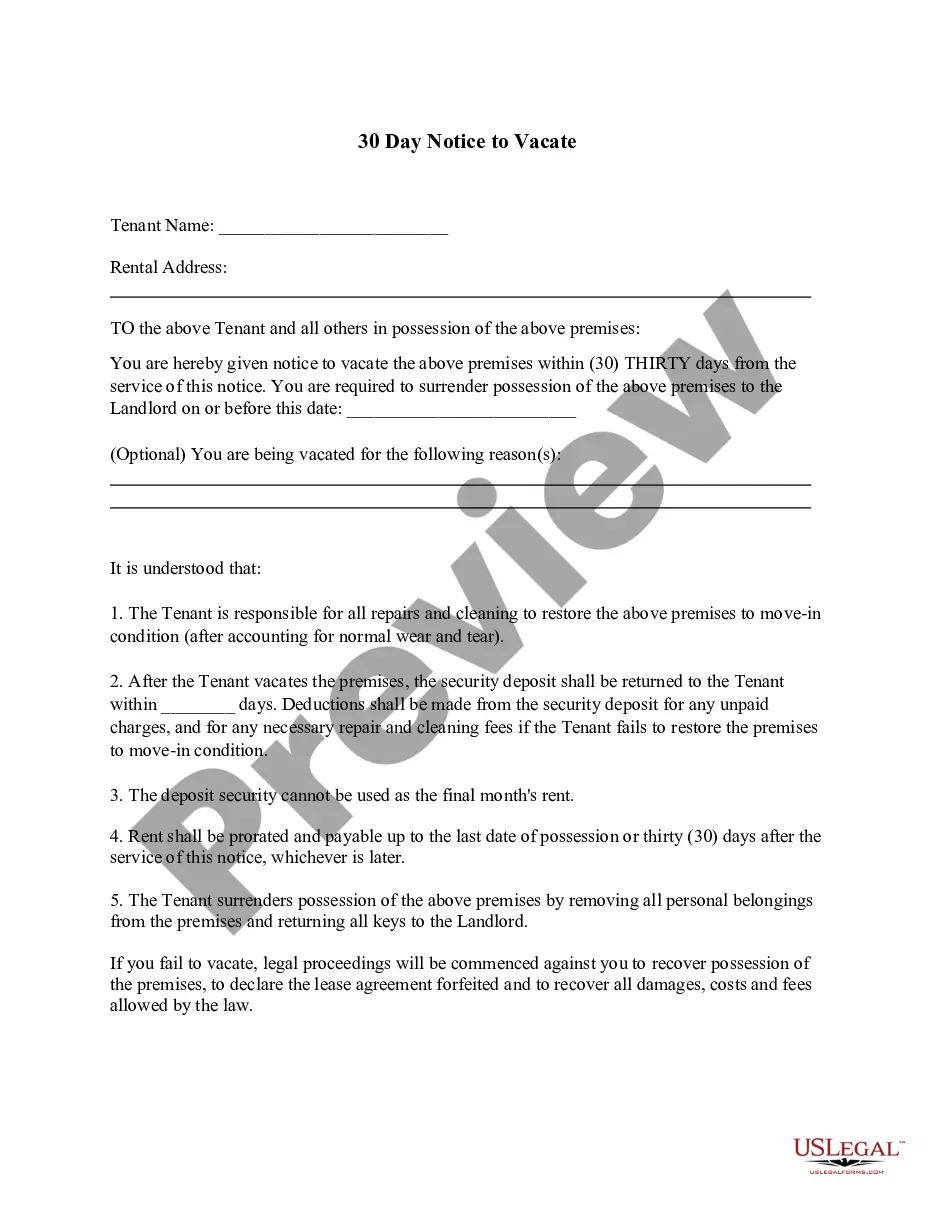

A fictitious/master deed of trust is a blank, unsigned long form deed of trust with a cover sheet attached, requesting recording for reference purposes only. By referencing the recorded instrument information on the fictitious DOT, all rights and obligations of the parties are preserved.

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

There are two basic types of Deeds of Trust, the Long Form and the Short Form. The Long Form, which could be 20-30 pages long, is the one used by institutional lenders. The Short Form is the one that is most usually prepared by your Escrow Officer.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

A "Short Form Deed of Trust" is a document that is used to secure a promissory note by using real estate as collateral. When filing a Deed of Trust, it places a lien against the property.

Notes: Not all states recognize a Trust Deed. Use a Mortgage Deed if you live in: Connecticut, Delaware, Florida, Indiana, Iowa, Kansas, Louisiana, New Jersey, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, or Wisconsin.

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.