North Dakota Reduce Capital - Resolution Form - Corporate Resolutions

Description

How to fill out Reduce Capital - Resolution Form - Corporate Resolutions?

Have you experienced the scenario where you require documents for both organizational or individual tasks nearly every workday.

There are numerous authentic document templates accessible online, but finding ones you can rely on isn't simple.

US Legal Forms provides thousands of form templates, such as the North Dakota Reduction Capital - Resolution Form - Corporate Resolutions, which are designed to comply with state and federal requirements.

Choose a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the North Dakota Reduction Capital - Resolution Form - Corporate Resolutions at any time, if necessary. Click on the desired form to download or print the document template.

Utilize US Legal Forms, the most comprehensive collection of lawful forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the North Dakota Reduction Capital - Resolution Form - Corporate Resolutions template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it fits the correct city/state.

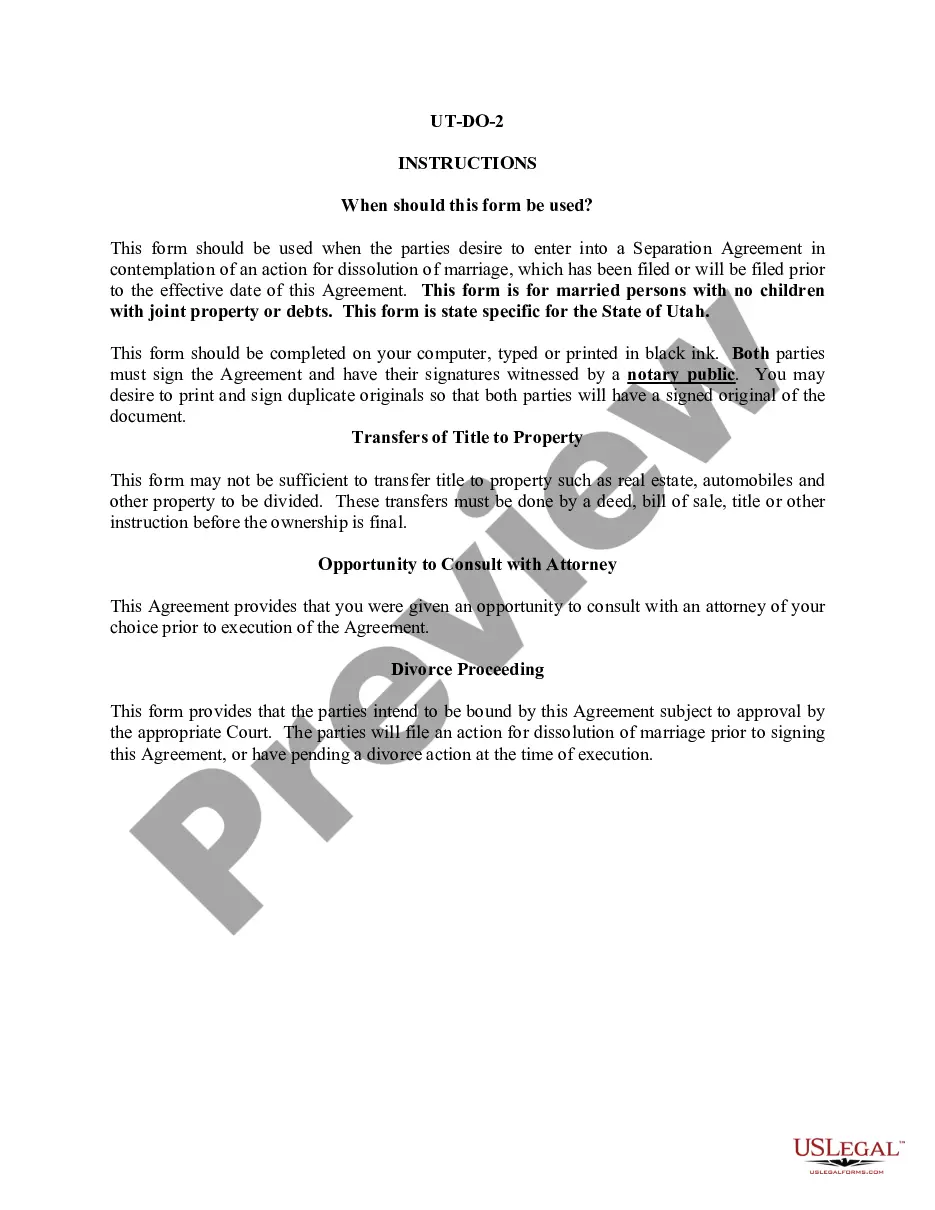

- Use the Review button to examine the document.

- Read the description to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, utilize the Search field to locate the form that matches your needs and requirements.

- Once you find the appropriate form, click on Buy now.

- Select the pricing plan you prefer, complete the information required to create your account, and make your purchase using your PayPal or credit card.

Form popularity

FAQ

The current corporate tax rate varies based on legislative changes but follows the brackets set by the state. Businesses should review the latest tax information from state resources regularly. Utilizing the North Dakota Reduce Capital - Resolution Form - Corporate Resolutions can also assist in crafting strategies that accommodate any adjustments in corporate tax rates.

The corporate tax rate in North Dakota ranges depending on net income levels, with the higher rates applying to larger income ranges. It’s essential for businesses to stay informed about these rates, which can impact financial planning. Tools like the North Dakota Reduce Capital - Resolution Form - Corporate Resolutions can help navigate tax obligations effectively.

Yes, you can carry forward a net operating loss in North Dakota for up to 20 years. This capability allows businesses some flexibility in managing losses. To simplify the process and ensure compliance, businesses can make use of the North Dakota Reduce Capital - Resolution Form - Corporate Resolutions when preparing their tax documentation.

Nevada is known as one of the US states that have no corporate tax. This offers certain businesses a competitive edge. However, companies should also consider corporate resolutions. The North Dakota Reduce Capital - Resolution Form - Corporate Resolutions can help in ensuring compliance with North Dakota regulations, even if expanding to states with favorable tax structures.

The sales factor weighting election allows businesses to alter how they allocate sales across different states for tax purposes. This can be beneficial for corporations engaging in multi-state operations. Utilizing the North Dakota Reduce Capital - Resolution Form - Corporate Resolutions can assist in achieving the right structure for tax efficiency.

The state tax rate in North Dakota varies based on the type of income generated. Generally, it combines various taxes, including corporate and individual taxes. Companies can benefit from understanding these rates further by utilizing resources like the North Dakota Reduce Capital - Resolution Form - Corporate Resolutions, which offers clarity in corporate financial obligations.

The corporate income tax in North Dakota is structured with two brackets. A small rate applies to income under a certain threshold, while income exceeding that threshold is taxed at a higher rate. For businesses looking to streamline their compliance, the North Dakota Reduce Capital - Resolution Form - Corporate Resolutions can help in managing corporate governance efficiently.