Wisconsin General Form of Amendment to Partnership Agreement

Description

How to fill out General Form Of Amendment To Partnership Agreement?

Selecting the appropriate legal document format may be a challenge. Clearly, there are numerous templates accessible online, but how do you find the legal form that you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Wisconsin General Form of Amendment to Partnership Agreement, which can be utilized for business and personal purposes. All the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Wisconsin General Form of Amendment to Partnership Agreement. Use your account to search through the legal forms you have acquired previously. Visit the My documents section of your account and download another copy of the document you need.

Select the file format and download the legal document format to your device. Complete, edit, and print and sign the downloaded Wisconsin General Form of Amendment to Partnership Agreement. US Legal Forms is the largest collection of legal forms where you can find numerous document templates. Utilize the service to obtain professionally-crafted documents that adhere to state requirements.

- First, ensure that you have selected the correct form for your state/area.

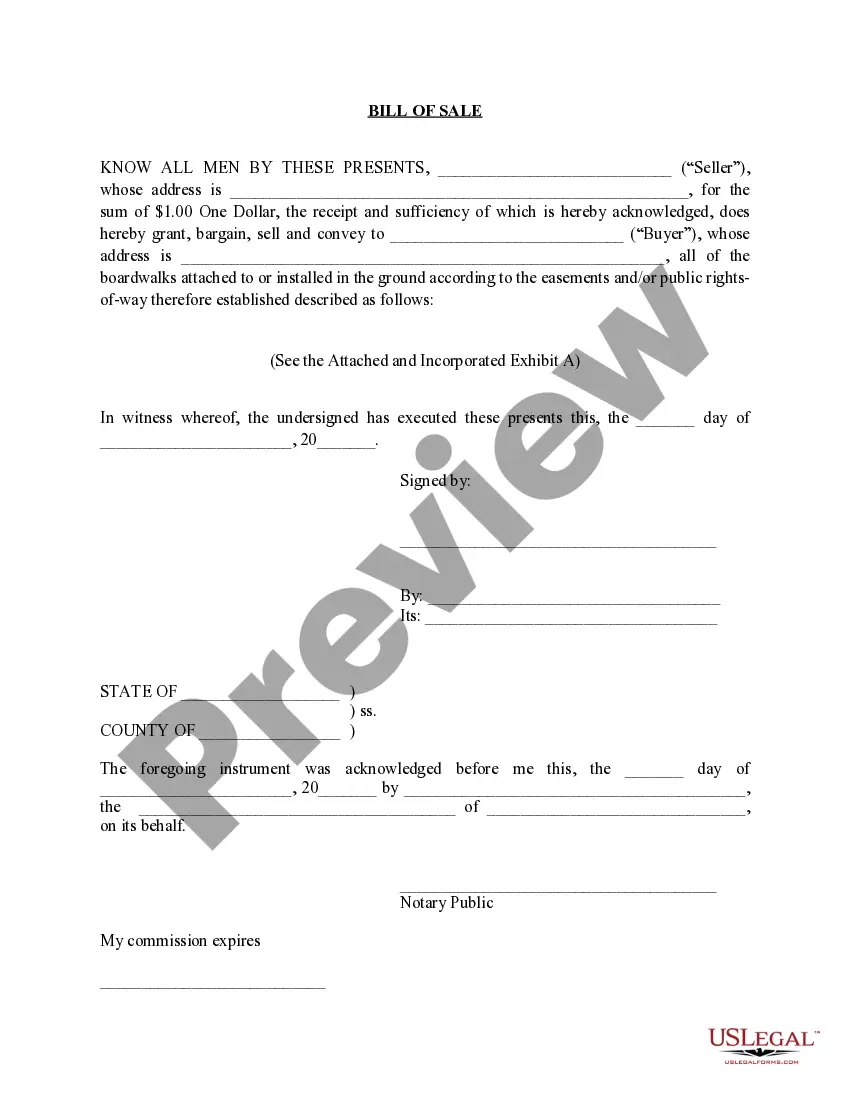

- You can view the form by using the Review button and reading the form description to confirm that it is the right one for you.

- If the form does not meet your requirements, utilize the Search field to find the correct form.

- Once you are confident that the form is suitable, select the Get now button to download the form.

- Choose the payment plan you desire and enter the necessary information.

- Create your account and complete your purchase using your PayPal account or Visa or MasterCard.

Form popularity

FAQ

Dissolving a partnership in Wisconsin requires a formal process, starting with the decision agreed upon by all partners. After reaching a consensus, you need to create a dissolution agreement and file it with the state. It may be beneficial to use the Wisconsin General Form of Amendment to Partnership Agreement to ensure that all procedural guidelines are met correctly.

Writing an amendment to an agreement involves clearly stating the original agreement and specifying the parts you wish to change. Be sure to use precise language and include the date of the original agreement. Utilizing the Wisconsin General Form of Amendment to Partnership Agreement can simplify this process and help ensure that all necessary details and signatures are correctly included.

To change the owner of your LLC in Wisconsin, you must update your operating agreement and file the necessary documents with the state. The transition requires informing the original and new owners about their roles. You can utilize the Wisconsin General Form of Amendment to Partnership Agreement if your LLC operates as a partnership, ensuring compliance and clarity during this process.

To amend a partnership agreement, you typically need to draft a document that outlines the specific changes. Make sure to include the original agreement date and identify all partners involved. Once you have created the amendments, the Wisconsin General Form of Amendment to Partnership Agreement serves as a structured way to finalize these changes with clarity and legal strength.

An amendment of a partnership refers to any change made to the original partnership agreement. This could involve altering terms related to profit sharing, ownership interests, or management responsibilities. To formalize these changes, you can use the Wisconsin General Form of Amendment to Partnership Agreement, ensuring that all partners initial and sign the document.

You can file Wisconsin Form 3 electronically or send it through the mail, depending on your preference and eligibility. Ensure that you follow the correct procedures outlined by the Wisconsin Department of Revenue. If any changes arise, making use of the Wisconsin General Form of Amendment to Partnership Agreement can keep your filings accurate and up to date.

You should mail Wisconsin Form 3 to the address designated for corporate income tax return submissions. Double-check the latest guidelines to ensure your form reaches the right location. If you are amending your partnership structure, using the Wisconsin General Form of Amendment to Partnership Agreement will ensure all documentation aligns with your tax submissions.

A general partnership typically files Form 1065 with the IRS. This form reports the partnership's income, deductions, and other important information. Additionally, if any changes are made, it's wise to consider the Wisconsin General Form of Amendment to Partnership Agreement to keep everything documented properly.

Yes, you can amend a partnership. To do this, you typically need to draft an amendment and have it signed by the partners. The Wisconsin General Form of Amendment to Partnership Agreement provides a structured way to make these necessary changes formally.

You should send Wisconsin tax forms to the Department of Revenue at the address specified for your type of return. It's crucial to follow the guidelines to avoid delays. If your partnership agreement has changed, referring to the Wisconsin General Form of Amendment to Partnership Agreement will help ensure all tax inquiries are aligned.