Wisconsin General Partnership Agreement - version 2

Description

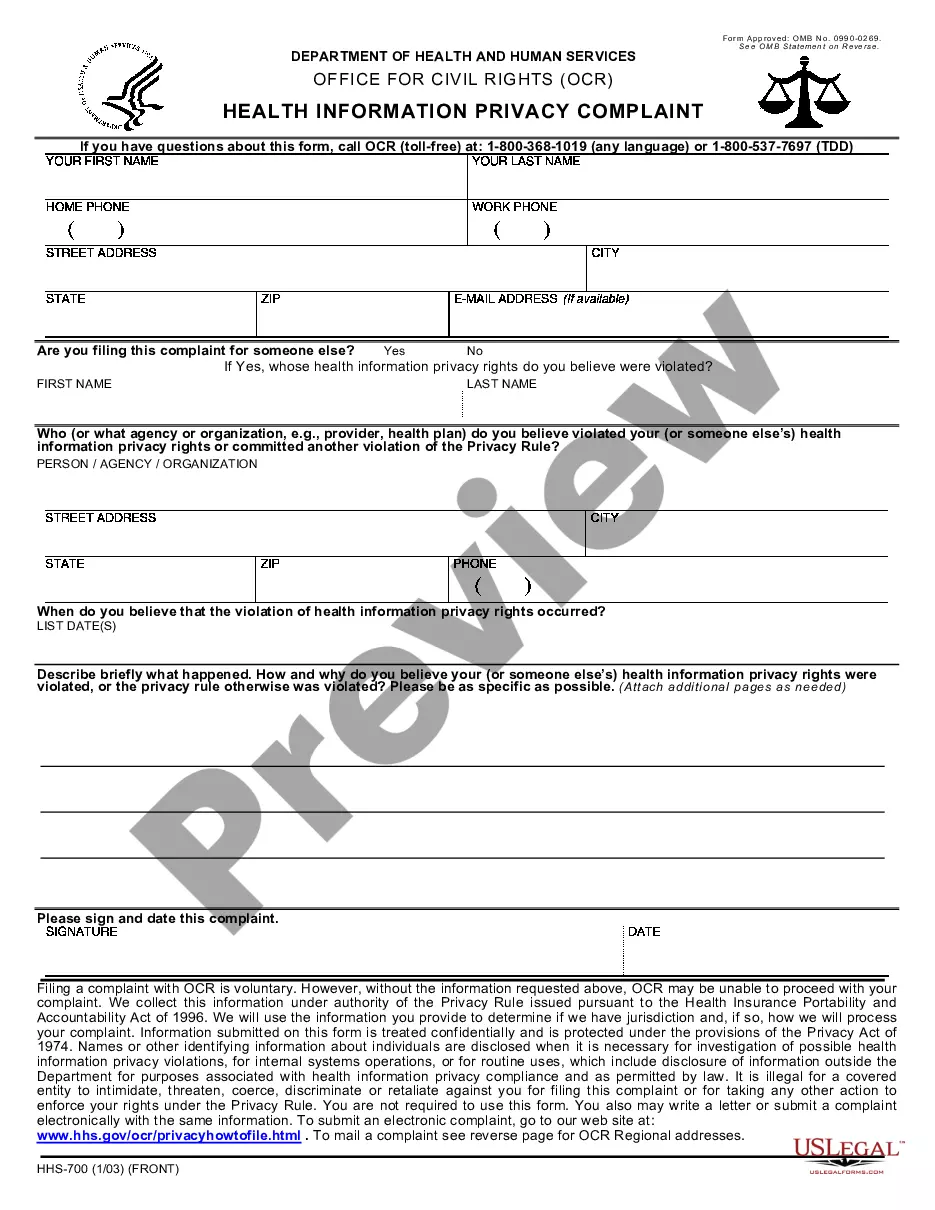

How to fill out General Partnership Agreement - Version 2?

US Legal Forms - one of the most prominent repositories of legal documents in the United States - offers a variety of legal form templates that you can download or print. By using the website, you can access thousands of forms for business and personal use, categorized by type, state, or keywords.

You can find the latest types of forms like the Wisconsin General Partnership Agreement - version 2 in just a few minutes.

If you already possess a membership, Log In and download the Wisconsin General Partnership Agreement - version 2 from the US Legal Forms catalog. The Download button will appear on every form you view. You can access all previously saved forms from the My documents tab in your account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the saved Wisconsin General Partnership Agreement - version 2. Each template you added to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Wisconsin General Partnership Agreement - version 2 with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your area/county.

- Click the Preview button to review the form's details.

- Check the form description to confirm that you have chosen the right form.

- If the form doesn't meet your needs, use the Search box at the top of the page to find one that does.

- If you are satisfied with the form, affirm your choice by clicking the Acquire now button.

- Then, choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Filling out a partnership agreement for a Wisconsin General Partnership Agreement - version 2 involves several key steps. First, outline the partnership's structure, including details such as partner roles and responsibilities. Next, involve all partners in discussing and agreeing on important clauses, like dissolution procedures and dispute resolutions. Finally, use a reliable platform like USLegalForms to help you customize and finalize your agreement efficiently.

To fill out a partnership form for a Wisconsin General Partnership Agreement - version 2, start by gathering essential information about each partner. Include names, addresses, and contributions that each partner will make to the partnership. Make sure to clearly define the purpose of the partnership and specify how profits and losses will be shared. Finally, review all sections for accuracy before submitting the form.

Filing a partnership return, specifically under the guidelines of a Wisconsin General Partnership Agreement - version 2, requires you to fill out Form 1065 for federal taxes. Then, you'll need to check the state requirements and file the corresponding Wisconsin forms. You can use the US Legal Forms platform to find templates and guidance, simplifying the preparation process. Keep all relevant financial documents on hand to accurately report your income and deductions.

To file Wisconsin tax forms, you can submit your documents to the Wisconsin Department of Revenue. It's important to ensure that your filing aligns with the specifics of your Wisconsin General Partnership Agreement - version 2. You can file online using the state's e-filing system or send your forms through mail. Remember, timely filing helps you avoid any penalties or fines.

In Wisconsin, all partnerships must file an annual partnership return, regardless of profit or loss. This includes partnerships formed under a Wisconsin General Partnership Agreement - version 2. Partners will then report their respective shares of income and deductions on their individual tax returns, facilitating transparency and compliance.

To form a partnership in Wisconsin, start by choosing a business name and ensuring it complies with state regulations. Then, draft a comprehensive Wisconsin General Partnership Agreement - version 2 to outline the details of your partnership. Lastly, you can choose to register your partnership with state authorities, ensuring your business is recognized and protected.

A partnership does not require an LLC, as partnerships can operate as standalone entities. However, forming an LLC can provide personal liability protection, which a Wisconsin General Partnership Agreement - version 2 alone does not offer. Weigh the benefits of each structure based on your business needs and risk tolerance.

To start a partnership in Wisconsin, first gather your partners and discuss the business structure, roles, and goals. Next, create a Wisconsin General Partnership Agreement - version 2 to ensure clarity on various aspects of the partnership. Finally, you may consider registering your partnership with the appropriate state authorities for formal recognition.

Although Wisconsin does not legally require a partnership agreement, having one is advantageous. A Wisconsin General Partnership Agreement - version 2 clarifies each partner's roles, reducing potential conflicts and safeguarding your business interests. In essence, it serves as a roadmap for successful collaboration.

To form a partnership in Wisconsin, you need at least two parties willing to collaborate in business. While a formal written agreement is not mandatory, drafting a Wisconsin General Partnership Agreement - version 2 is highly recommended to outline the rights, responsibilities, and profit distribution among partners. This helps prevent misunderstandings and ensures a smoother collaboration.