North Dakota Corporation - Resolution

Description

How to fill out Corporation - Resolution?

If you want to obtain, acquire, or print authentic document templates, use US Legal Forms, the largest selection of lawful forms accessible on the web.

Utilize the site's straightforward and user-friendly search feature to locate the documents you require. Numerous templates for business and individual purposes are organized by categories and states, or keywords.

Employ US Legal Forms to discover the North Dakota Corporation - Resolution in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you saved in your account.

Click on the My documents section and select a form to print or download again. Stay competitive and acquire and print the North Dakota Corporation - Resolution with US Legal Forms. There are millions of professional and state-specific templates available for your business or individual needs.

- If you are already a US Legal Forms customer, Log In to your account and click on the Obtain button to find the North Dakota Corporation - Resolution.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have selected the form for the correct region/country.

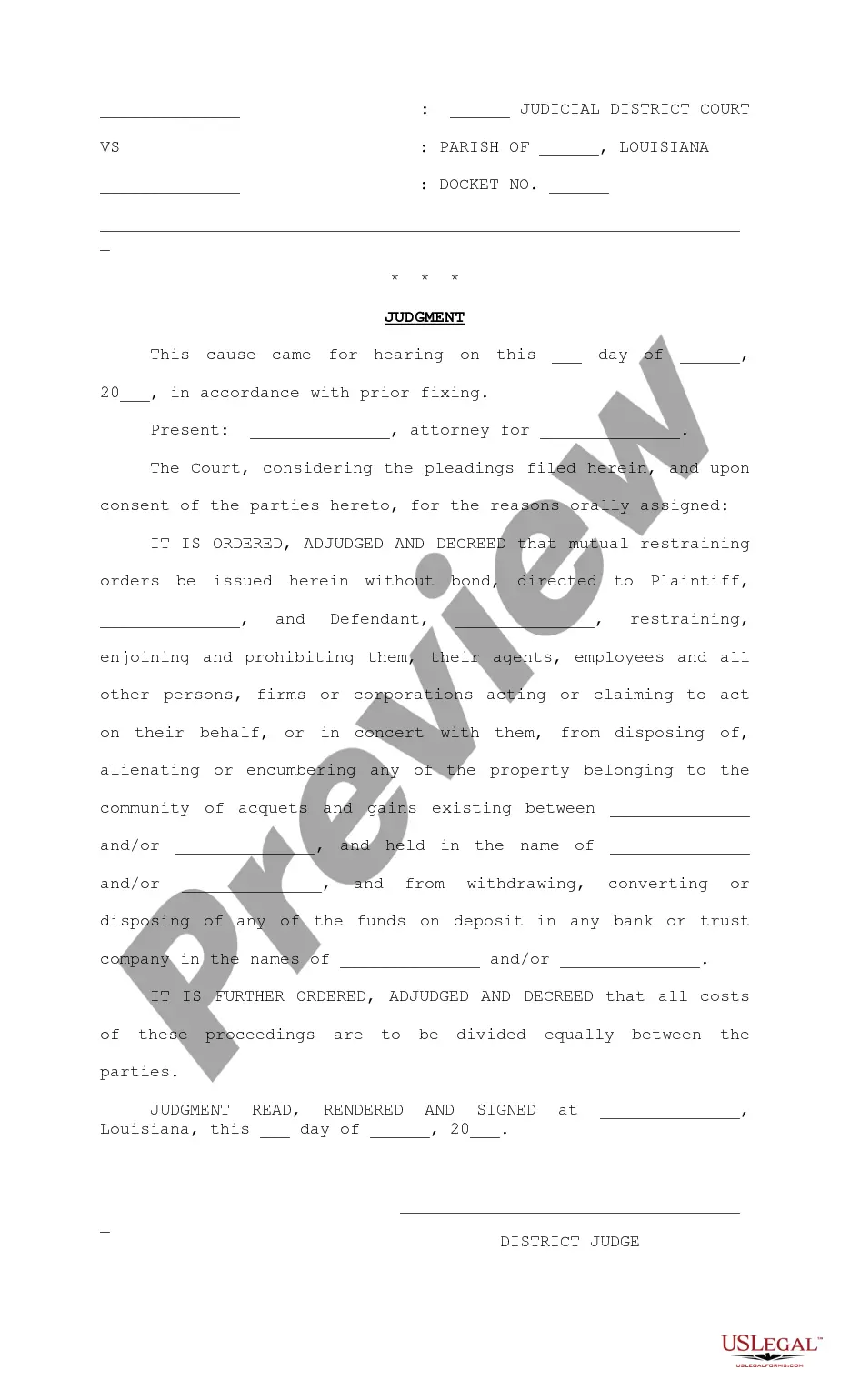

- Step 2. Use the Preview option to review the content of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other templates in the legal form design.

- Step 4. Once you have located the form you need, select the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Download the format of the legal form and save it to your device.

- Step 7. Fill out, modify, and print or sign the North Dakota Corporation - Resolution.

Form popularity

FAQ

To check if a business name is trademarked, you can search the United States Patent and Trademark Office (USPTO) database. This online resource allows you to view trademarks registered at the federal level. Additionally, consider checking state trademark databases for broader protection. Ensuring your North Dakota Corporation - Resolution avoids trademark conflicts strengthens your business's legal foundation.

To obtain a copy of your Articles of Organization in North Dakota, you can contact the Secretary of State's office or visit their website. You may request copies online, via email, or by mail. Having this document is crucial when establishing your North Dakota Corporation - Resolution, as it contains important information about your business structure.

You can check if a business name is taken in North Dakota by utilizing the Secretary of State's website for business entity searches. This online tool provides real-time updates on all registered businesses, giving you a clear picture of name availability. Securing a unique name is essential for your North Dakota Corporation - Resolution and your overall branding strategy.

To check if a business name is already taken, you can search your state’s business registry, which is often managed by the Secretary of State. This will help you identify any existing businesses using the name you're interested in. Remember to also consider conducting a trademark search to ensure your North Dakota Corporation - Resolution complies with intellectual property laws.

The IRS does not directly provide a business name availability search, as they focus on identifying tax filings rather than name conflicts. However, you can check if an Employer Identification Number (EIN) is already associated with your desired name by reviewing existing registrations through the IRS website. For a thorough check on business identities, consider the North Dakota Corporation - Resolution for ensuring that your name remains distinctive.

To determine if a business name is available in North Dakota, you can visit the North Dakota Secretary of State's website. They have a business entity search tool that allows you to check for name availability easily. If your desired name is unique and not confusingly similar to existing businesses, you may proceed with the formation of your North Dakota Corporation - Resolution.

To dissolve a corporation in North Dakota, you must file Articles of Dissolution with the Secretary of State. This process involves clearing any outstanding debts and liabilities prior to dissolution. Additionally, completing this task effectively contributes to a smooth North Dakota Corporation - Resolution experience. Consider consulting with uslegalforms to streamline the dissolution process and avoid complications.

Several states follow federal extensions, including North Dakota, which simplifies the tax filing process for businesses. However, each state may have its specific rules and conditions that need consideration. Staying informed can help you successfully manage your North Dakota Corporation - Resolution. Always verify state-specific requirements to avoid any potential pitfalls.

North Dakota does grant an automatic extension for corporate tax filings, typically aligning with the federal timeline. This extension provides corporations with additional time to prepare accurate tax returns. Thus, it is essential for businesses to stay compliant while managing their North Dakota Corporation - Resolution. Consider utilizing platforms like uslegalforms for a seamless filing experience.

Yes, North Dakota has a Pass-Through Entity (PTE) election available for certain corporations. This election allows S corporations and partnerships to file taxes at the entity level, simplifying the tax reporting process for owners. Understanding this option can ease your North Dakota Corporation - Resolution journey. Consulting with a tax professional ensures you take full advantage of available tax benefits.