Connecticut Exclusive Advertising and Consulting Agreement

Description

How to fill out Exclusive Advertising And Consulting Agreement?

If you need to thorough, acquire, or printing sanctioned documents templates, utilize US Legal Forms, the largest collection of sanctioned forms, available on the web.

Take advantage of the site's straightforward and convenient search to find the documents you require. Various templates for commercial and personal uses are arranged by categories and states, or keywords.

Utilize US Legal Forms to obtain the Connecticut Exclusive Marketing and Consulting Agreement with just a couple of clicks.

Each legal document template you acquire is yours indefinitely. You have access to every form you have saved in your account. Select the My documents section and choose a form to print or download again.

Stay competitive and acquire, and print the Connecticut Exclusive Marketing and Consulting Agreement with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your commercial or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click the Acquire option to locate the Connecticut Exclusive Marketing and Consulting Agreement.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct town/county.

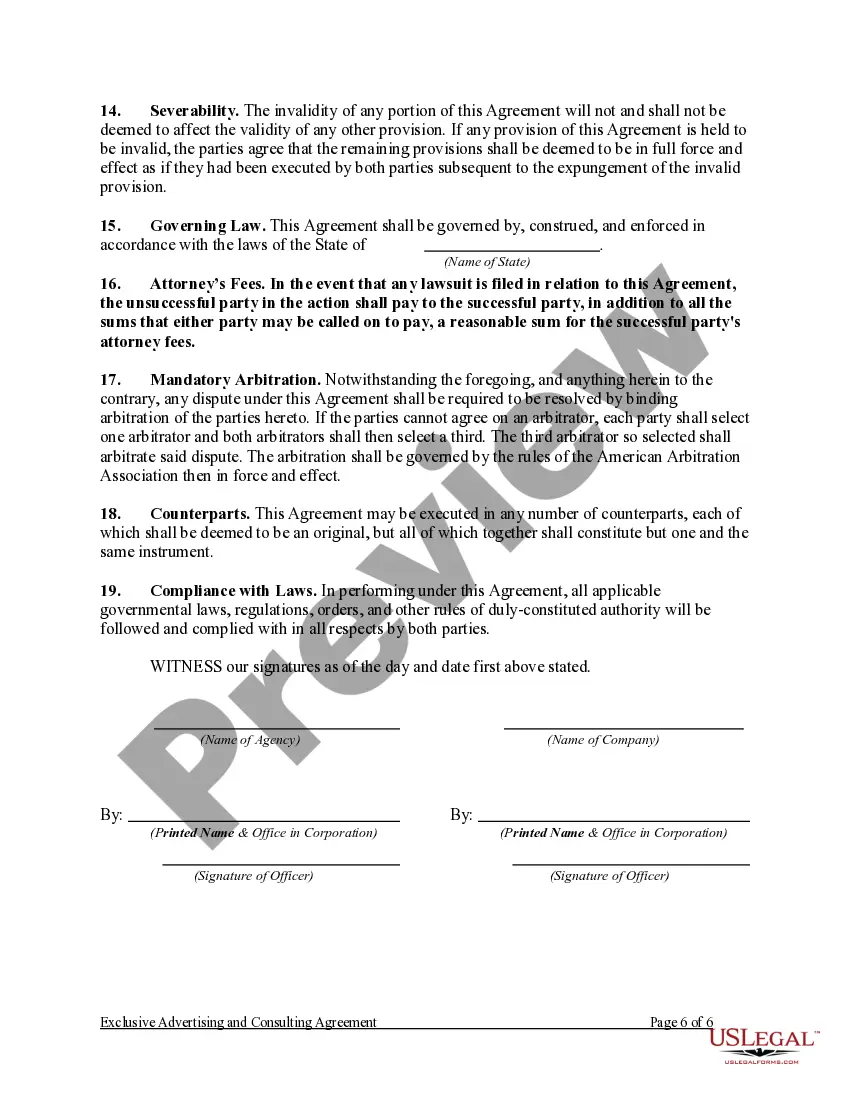

- Step 2. Utilize the Review option to view the form’s content. Always remember to read the details.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, select the Purchase now option. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Connecticut Exclusive Marketing and Consulting Agreement.

Form popularity

FAQ

In a consulting agreement, look for well-defined roles and responsibilities that clarify what each party is expected to do. Ensure there are specific payment terms and conditions for additional costs, if any. Additionally, consider including dispute resolution procedures to handle any issues efficiently, especially within the framework of a Connecticut Exclusive Advertising and Consulting Agreement.

Writing a consulting contract agreement requires a clear structure, starting with an introduction that defines the parties involved. Follow this with detailed sections covering the scope of work, payment methods, and confidentiality agreements. Utilizing a platform like uslegalforms can streamline this process, ensuring your Connecticut Exclusive Advertising and Consulting Agreement adheres to legal standards.

To review a consultancy agreement, examine each section of the contract, paying close attention to the responsibilities and deliverables outlined. Look for any vague terms that may lead to misunderstandings. Ultimately, ensure the agreement reflects your expectations and complies with the standards for a Connecticut Exclusive Advertising and Consulting Agreement.

When selecting a consultant, focus on their expertise in the relevant field and their past project successes. Assess their communication skills to ensure they can articulate ideas clearly and listen to your needs. A good consultant should also align with your business goals, especially in the context of a Connecticut Exclusive Advertising and Consulting Agreement.

A Connecticut Exclusive Advertising and Consulting Agreement should include essential elements, such as defined services, payment terms, and the duration of the agreement. Additionally, it is crucial to outline confidentiality clauses and termination conditions. This clarity helps protect both parties and provides a solid foundation for effective collaboration.

Professional services, including consulting and advising, are generally not taxable in Connecticut. However, overlaps with taxable services, such as certain advertising activities, should be clearly outlined. Understanding the implications of the Connecticut Exclusive Advertising and Consulting Agreement can help separate taxable from non-taxable services, ensuring compliance while maximizing benefits.

The exclusivity clause in a consulting agreement typically prevents the consultant from providing similar services to competitors in the same market sphere. This clause is designed to protect the interests of the client and foster trust. When drafting a Connecticut Exclusive Advertising and Consulting Agreement, consider including an exclusivity clause to safeguard your business interests and enhance competitive advantage.

In Connecticut, certain services including typical consulting and professional services may not be subject to tax. However, it’s crucial to understand how these services relate to advertising and consulting agreements. Carefully reviewing the details of your Connecticut Exclusive Advertising and Consulting Agreement can help identify non-taxable services and ensure you stay compliant.

Digital services are often taxable in Connecticut, depending on the nature of the service. If you provide services classified as digital advertising or marketing, these may fall under taxable categories. When developing your Connecticut Exclusive Advertising and Consulting Agreement, it's beneficial to specify the types of digital services offered to accurately address tax implications.

Yes, income generated from advertising is typically taxable at both the federal and state levels. This income must be reported on your tax returns, and it's crucial to keep thorough records of all advertising activities. For businesses operating under a Connecticut Exclusive Advertising and Consulting Agreement, it’s advisable to consult with a tax professional to ensure proper reporting of your advertising income.