This office lease provision states that it is an unpermitted assignment for partners to have a change in their share of partnership ownership and thus a default under the lease. Generally, this type of change in ownership is couched in those provisions dealing with changes in share ownerships of corporations.

North Carolina Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership

Description

How to fill out Provision Dealing With Changes In Share Ownership Of Corporations And Changes In Share Ownership Of Partnership?

US Legal Forms - among the largest libraries of legitimate types in the States - delivers a wide range of legitimate document templates you are able to obtain or print out. Utilizing the web site, you will get a large number of types for business and person reasons, categorized by groups, states, or key phrases.You can get the latest versions of types such as the North Carolina Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership in seconds.

If you already possess a membership, log in and obtain North Carolina Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership from your US Legal Forms local library. The Down load key can look on each develop you view. You have accessibility to all earlier downloaded types within the My Forms tab of the profile.

If you wish to use US Legal Forms for the first time, listed below are basic directions to get you started out:

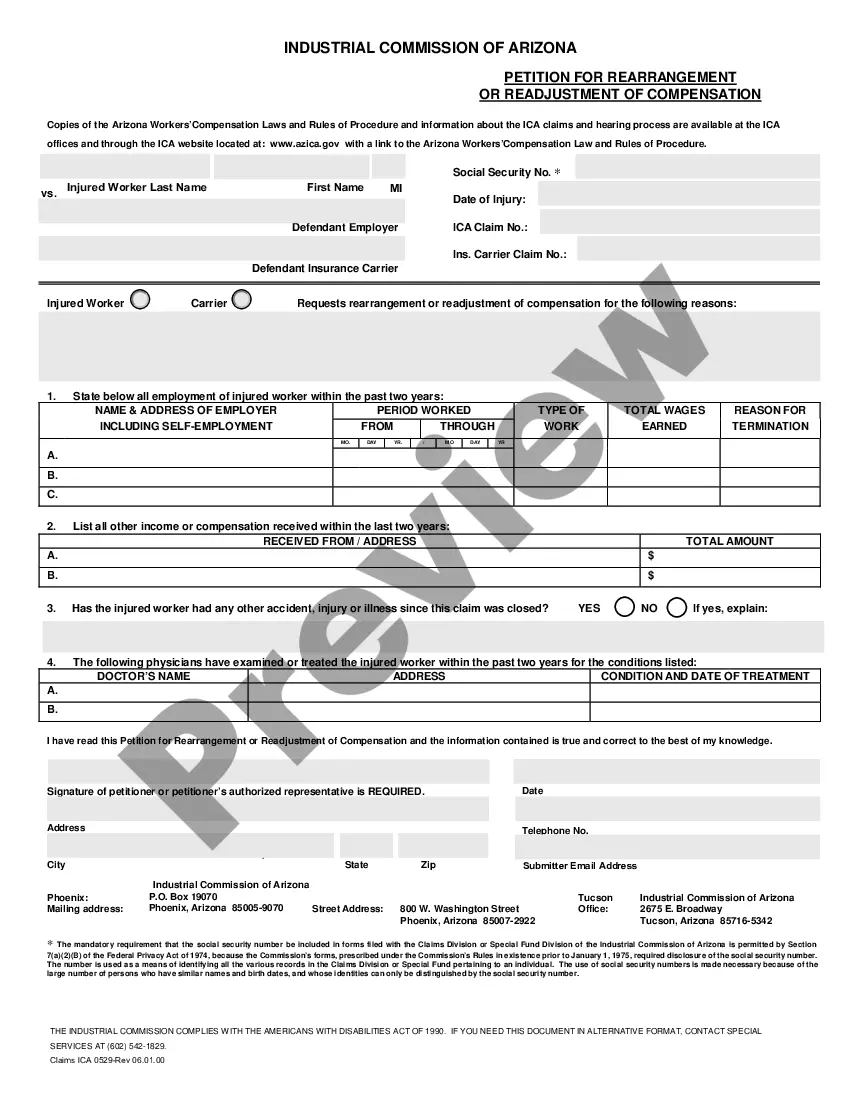

- Ensure you have chosen the right develop to your area/area. Click on the Review key to analyze the form`s content. Browse the develop outline to ensure that you have selected the correct develop.

- In case the develop doesn`t suit your specifications, utilize the Search discipline at the top of the display screen to discover the one that does.

- When you are happy with the form, confirm your selection by visiting the Acquire now key. Then, choose the prices program you prefer and supply your references to sign up for an profile.

- Process the purchase. Make use of charge card or PayPal profile to perform the purchase.

- Find the formatting and obtain the form on your own gadget.

- Make changes. Complete, modify and print out and signal the downloaded North Carolina Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership.

Each and every design you included in your account does not have an expiration time and is also the one you have permanently. So, in order to obtain or print out another duplicate, just go to the My Forms portion and click around the develop you want.

Gain access to the North Carolina Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership with US Legal Forms, the most substantial local library of legitimate document templates. Use a large number of expert and express-particular templates that satisfy your company or person demands and specifications.

Form popularity

FAQ

North Carolina and Foreign Partnerships are required to file a Cancelation of Limited Partnership, Limited Liability Partnership or Limited Liability Limited Partnership registration with the NC Department of the Secretary of State.

The following activities, among others, do not constitute transacting business by a foreign entity in North Carolina: Engaging in Litigation. Maintaining or defending any action or suit or any administrative or arbitration proceeding, or effecting the settlement thereof or the settlement of claims or disputes.

(e) If action is taken without a meeting by fewer than all shareholders entitled to vote on the action, the corporation shall give written notice to all shareholders who have not consented to the action and who, if the action had been taken at a meeting, would have been entitled to notice of the meeting with the same ...

§ 55-11-01. Merger. (a) One or more corporations may merge into another corporation if the board of directors of each corporation adopts and its shareholders (if required by G.S. 55-11-03) approve a plan of merger.

Action without meeting. (a) Unless the articles of incorporation or bylaws provide otherwise, action required or permitted by this Chapter to be taken at a board of directors' meeting may be taken without a meeting if the action is taken by all members of the board.

If you are a minority shareholder, you have the right to vote, dissent, and access key documents. These rights give you a say in the selection of corporate directors, the sale of assets outside normal operations, corporate mergers, and share exchanges.