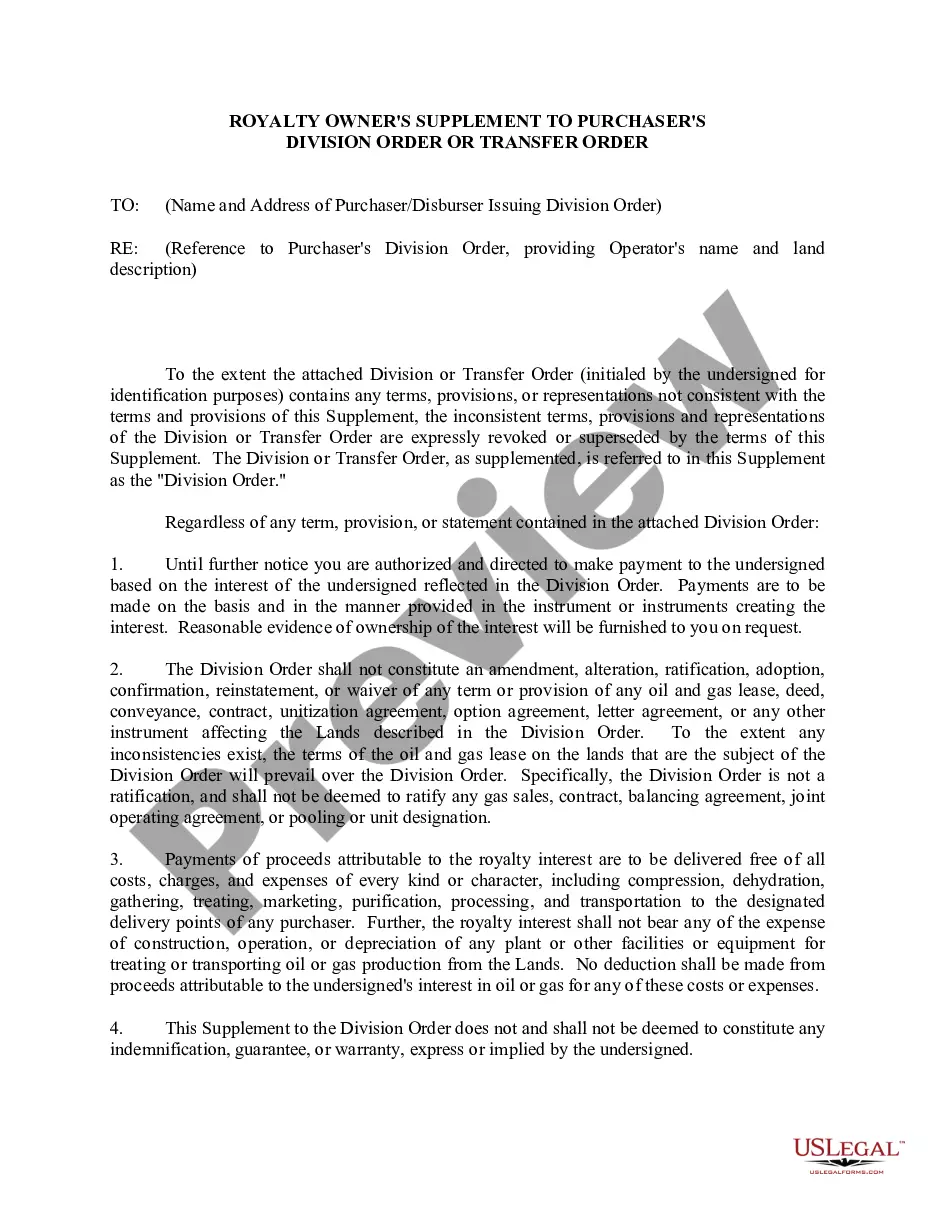

North Carolina Royalty Owner's Statement of Ownership

Description

How to fill out Royalty Owner's Statement Of Ownership?

You can commit several hours on the Internet searching for the authorized file template that meets the federal and state requirements you require. US Legal Forms provides thousands of authorized forms that happen to be analyzed by pros. You can easily down load or print the North Carolina Royalty Owner's Statement of Ownership from our service.

If you already possess a US Legal Forms profile, you are able to log in and click the Down load button. After that, you are able to complete, revise, print, or indication the North Carolina Royalty Owner's Statement of Ownership. Every authorized file template you acquire is your own for a long time. To get an additional copy of any bought develop, visit the My Forms tab and click the related button.

If you use the US Legal Forms web site for the first time, adhere to the simple instructions beneath:

- Very first, ensure that you have selected the correct file template for your area/city of your choosing. Read the develop information to make sure you have chosen the appropriate develop. If available, make use of the Review button to look throughout the file template also.

- If you would like discover an additional variation of the develop, make use of the Search industry to find the template that fits your needs and requirements.

- After you have identified the template you need, click Buy now to carry on.

- Find the rates prepare you need, type in your qualifications, and register for your account on US Legal Forms.

- Complete the financial transaction. You can use your bank card or PayPal profile to cover the authorized develop.

- Find the structure of the file and down load it in your gadget.

- Make alterations in your file if necessary. You can complete, revise and indication and print North Carolina Royalty Owner's Statement of Ownership.

Down load and print thousands of file themes using the US Legal Forms web site, that offers the most important collection of authorized forms. Use specialist and state-certain themes to tackle your company or individual requires.

Form popularity

FAQ

A stipulation of interest is a contract that consists of mutual conveyances, and therefore, it must conform to the requirements of both a contract and conveyance. Consequently, title to the property interest will be owned as set out in the stipulation, that is if it contains adequate granting language.

Whether you have an offer on the table or not, you may have good reasons to sell your mineral rights: To pursue other opportunities. If you have a nonproducing property, you might have to wait years for anything to happen ? and nothing may ever happen, even after multiple leases.

There are 6 types of mineral rights, including mineral interest (MI), royalty interest (RI), overriding royalty interest (ORRI), working Interest (WI), non-operated working interest, and net profits interest.

Mineral Rights Owner- If you are solely a mineral rights owner, you earn the royalties that come from extracting the minerals from the land in question. You do not have control over what occurs on the surface. As the mineral rights owner, you can sell, mine or produce the gas or oil below the surface.

Mineral rights are considered real estate and real property. There is zero drilling risk and drilling liabilities. There are zero environmental risks. The mineral owner owns the mineral rights with all depths and all natural resources in place.

What is Royalty Income? Royalty income is the amount received through a licensing or rights agreement for the use of copyrighted works, influencer endorsements, intellectual property like patents, or natural resources like oil and gas properties, often including an upfront payment and ongoing earnings and payments.

The ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate.

What Is Working Interest? Working interest is a term for a type of investment in oil and gas drilling operations in which the investor is directly liable for a portion of the ongoing costs associated with exploration, drilling, and production.

Also known as a mineral estate, mineral rights are just what their name implies: The right of the owner to utilize minerals found below the surface of property. Besides minerals, these rights can apply to oil and gas. Interestingly, mineral rights can be separate from actual land ownership.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.