North Carolina Cook Services Contract - Self-Employed

Description

How to fill out Cook Services Contract - Self-Employed?

Are you presently in a circumstance where you require documents for potential organization or specific purposes almost every workday.

There are numerous legal document templates accessible online, but finding ones you can rely on isn't easy.

US Legal Forms provides a vast array of form templates, such as the North Carolina Cook Services Contract - Self-Employed, which can be tailored to fulfill state and federal requirements.

Once you find the right form, click Purchase now.

Select the pricing plan you desire, complete the required information to create your account, and pay for the order with your PayPal or credit card. Choose a convenient document format and download your copy. Access all the document templates you have acquired in the My documents section. You can obtain an additional copy of the North Carolina Cook Services Contract - Self-Employed anytime, if needed. Simply navigate to the necessary form to download or print the document template. Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- Then, you can download the North Carolina Cook Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct area/region.

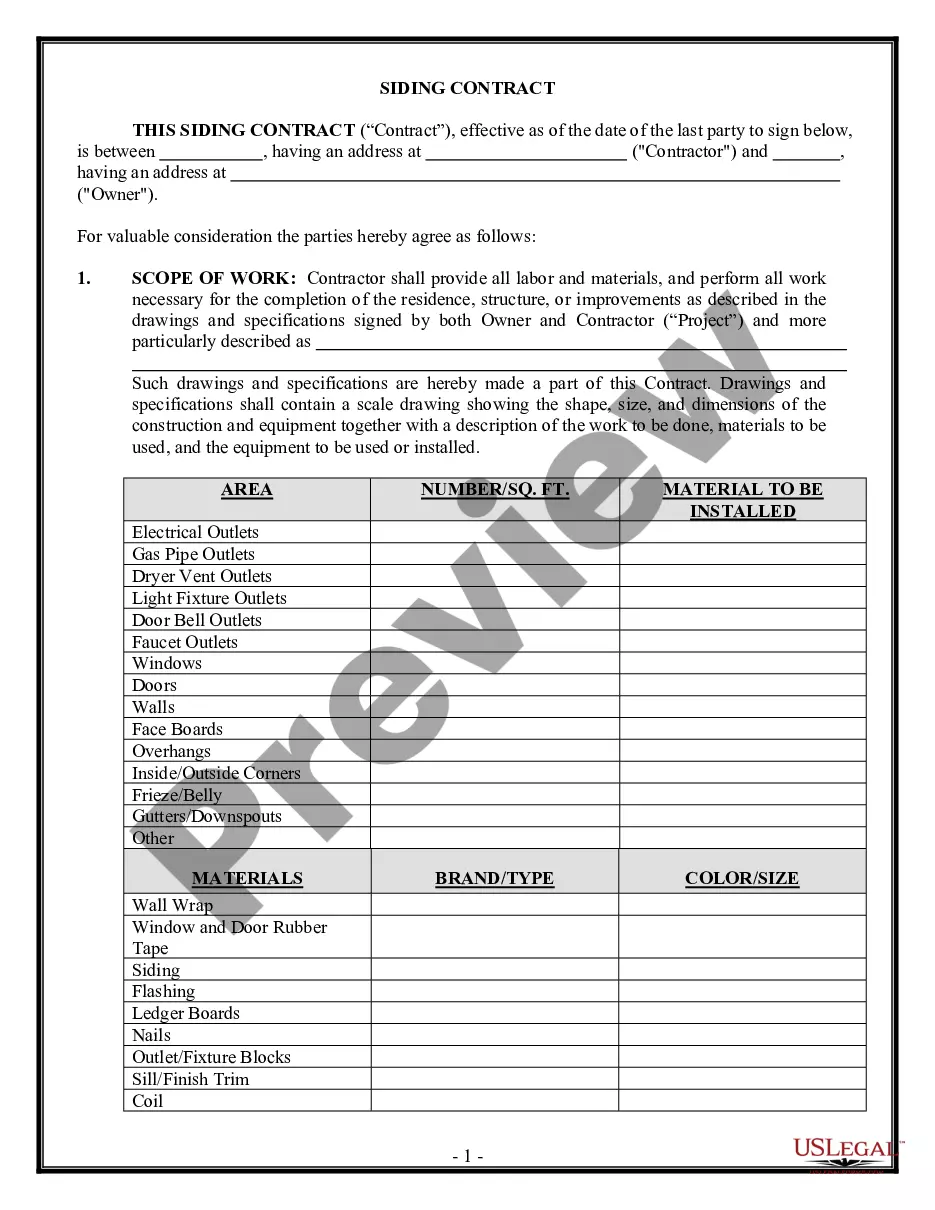

- Utilize the Preview button to review the form.

- Read the description to ensure you have chosen the correct template.

- If the form isn't what you're seeking, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

The time it takes to become a contractor in North Carolina varies based on your preparation and application process. Generally, it could take a few weeks to a few months, considering registration and licensing steps. With a well-prepared North Carolina Cook Services Contract - Self-Employed, you can hit the ground running once you receive approval.

In North Carolina, you may perform up to $30,000 worth of work without needing a contractor license, depending on the nature of the work. However, specific rules may apply to different trades and local regulations. Having a North Carolina Cook Services Contract - Self-Employed can help outline your projects and make compliance easier.

In North Carolina, whether you need a license as a contractor depends on the type of work you plan to perform. General contractors need to be licensed, while some trades may not require a license for smaller jobs. Regardless, having a North Carolina Cook Services Contract - Self-Employed is recommended to clarify your responsibilities and ensure a smooth workflow.

Yes, having a contract is vital if you are self-employed. A North Carolina Cook Services Contract - Self-Employed protects both you and your clients by defining the scope of work, payment terms, and responsibilities. This document helps prevent misunderstandings and provides a reference point in case of disputes.

To be an independent contractor in North Carolina, you must operate as a self-employed individual. This involves managing your own business practices, setting your rates, and handling your taxes. Additionally, you need to ensure you have a proper North Carolina Cook Services Contract - Self-Employed in place to outline your work terms clearly.

As a self-employed individual, you can typically deduct costs related to food and supplies needed for your work. This means that expenses incurred while fulfilling a North Carolina Cook Services Contract - Self-Employed may be eligible for a write-off. Be sure to keep detailed records of all your expenses to facilitate accurate tax filings.

A service contract in North Carolina is a legal agreement between a service provider and a client outlining the services to be provided. For example, a North Carolina Cook Services Contract - Self-Employed details the culinary services, payment, and duration. Having a service contract helps set clear expectations for both parties.

Yes, a self-employed person can and should have a contract. A well-drafted North Carolina Cook Services Contract - Self-Employed protects your interests, clearly defines service expectations, and establishes payment terms. This is crucial for maintaining professional relationships and ensuring clarity with your clients.

Typically, personal service contracts in North Carolina are considered taxable. This means that as a self-employed cook, you should ensure your North Carolina Cook Services Contract - Self-Employed includes provisions for handling any applicable sales tax. Keep informed about local tax laws to stay compliant.

To establish yourself as an independent contractor in North Carolina, you need to register your business and obtain any necessary licenses. Furthermore, it's vital to create a clear North Carolina Cook Services Contract - Self-Employed that outlines your terms, services, and payment structure to formalize your relationship with clients.