North Carolina Catering Services Contract - Self-Employed Independent Contractor

Description

How to fill out Catering Services Contract - Self-Employed Independent Contractor?

If you need to collect, retrieve, or produce official document templates, utilize US Legal Forms, the biggest collection of lawful forms, accessible online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction.

Step 6. Obtain the file format of the legal form and download it onto your device.

- Utilize US Legal Forms to find the North Carolina Catering Services Contract - Self-Employed Independent Contractor in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to retrieve the North Carolina Catering Services Contract - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are accessing US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm you have selected the form for the correct city/state.

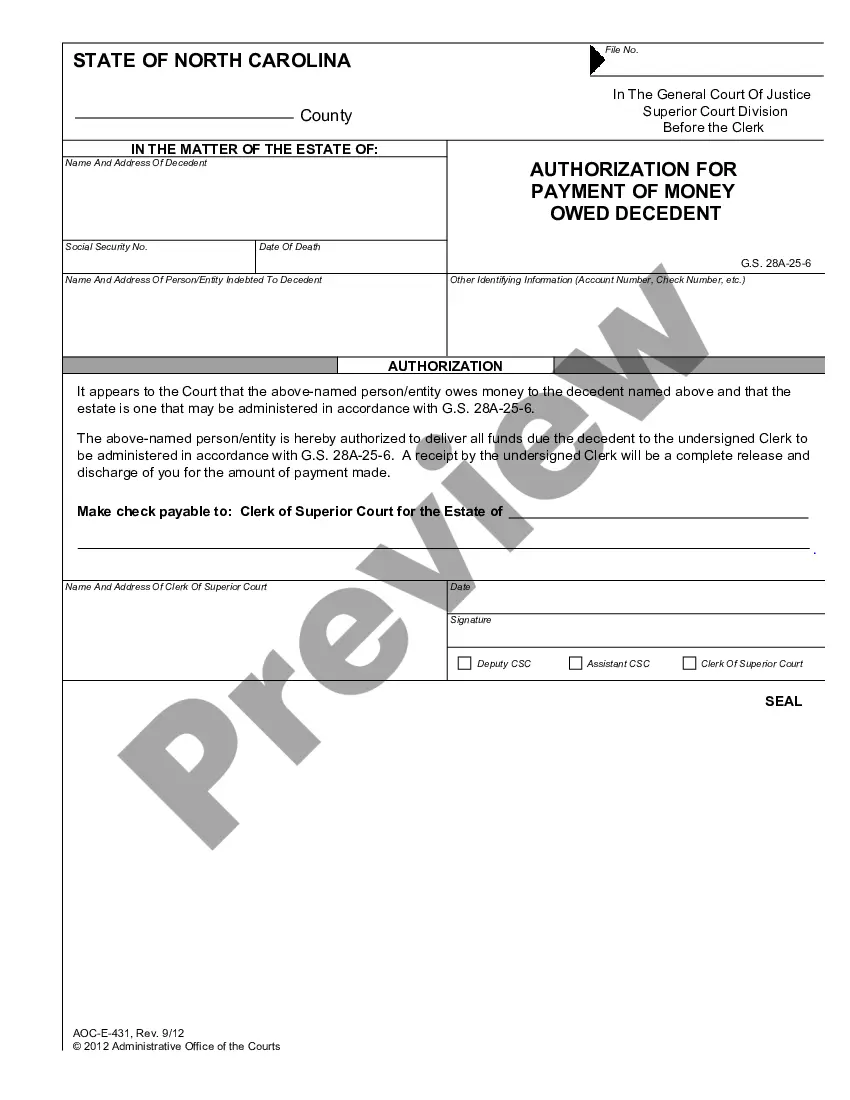

- Step 2. Use the Preview option to review the form's details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to find other variations in the legal form design.

- Step 4. Once you have identified the form you want, click the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

Form popularity

FAQ

To write an independent contractor agreement, begin by defining the services you will provide and outlining payment rates. It’s vital to include clauses specific to the North Carolina Catering Services Contract - Self-Employed Independent Contractor, ensuring all legal aspects are covered. Use clear and concise language to prevent misunderstandings and promote clarity. Once both parties agree on the terms, sign the document to formalize the agreement.

Writing a catering agreement begins with specifying the details of the event, including the date, location, and number of guests. Incorporate terms relevant to the North Carolina Catering Services Contract - Self-Employed Independent Contractor, such as the menu options and payment schedules. Don't forget to detail cancellation policies and other essential clauses to protect both parties. Review and discuss the agreement with your client to address any questions or concerns.

Filling out an independent contractor agreement involves clearly stating the scope of work, payment terms, and deadlines. Be sure to outline any specifics about the North Carolina Catering Services Contract - Self-Employed Independent Contractor, such as liability and tax responsibilities. This ensures that both parties have a thorough understanding of their obligations. Once completed, both you and the client should sign the agreement to make it legally binding.

To fill out an independent contractor form, start by entering your personal details, such as your name, address, and contact information. Next, specify the services you are offering, including those related to the North Carolina Catering Services Contract - Self-Employed Independent Contractor. It's crucial to include any applicable payment terms, deadlines, and any required signatures. Finally, review the form to ensure all information is accurate before submitting it.

Yes, you can create your own legally binding contract. To do this, ensure your contract includes essential elements like an offer, acceptance, and consideration. Clarity is crucial, so express terms in straightforward language. To help create a valid North Carolina Catering Services Contract - Self-Employed Independent Contractor, explore customizable templates available on platforms like uslegalforms.

The new federal rule for independent contractors outlines criteria for classifying workers effectively. This rule emphasizes the importance of the degree of control and independence in the contractor relationship. It's essential to understand how this affects your status and obligations under the law. For guidance, consider reviewing a North Carolina Catering Services Contract - Self-Employed Independent Contractor to ensure you comply with current regulations.

Creating an independent contractor contract involves outlining the project details that both you and your client agree upon. Begin with basic information, such as contact details and project timelines. Next, state the payment structure and any provisions regarding modifications or cancellations. Utilizing resources like uslegalforms, which provide templates for a North Carolina Catering Services Contract - Self-Employed Independent Contractor, can simplify the process.

To write a contract as a self-employed independent contractor, start by clearly defining the scope of work you will perform. Include important details such as payment terms, deadlines, and confidentiality agreements. You should also ensure both parties agree on rights and responsibilities. Using a North Carolina Catering Services Contract - Self-Employed Independent Contractor template can guide you in creating a professional agreement.

In North Carolina, several services are exempt from sales tax, including certain personal services and freelance work. As a Self-Employed Independent Contractor, understanding what falls outside of taxable categories, especially in your North Carolina Catering Services Contract, is crucial. Services such as educational classes or services performed for nonprofit organizations may not be taxable. However, it's important to confirm with a tax advisor to ensure you meet all requirements.

Maintenance contracts in North Carolina typically fall under sales tax regulations, meaning they can be taxable. This is relevant for self-employed independent contractors working under a North Carolina Catering Services Contract, especially if your services include maintenance. To avoid issues, familiarize yourself with what services trigger sales tax, and consult with a tax expert if you are uncertain about your obligations.