North Carolina Directors and officers liability insurance

Description

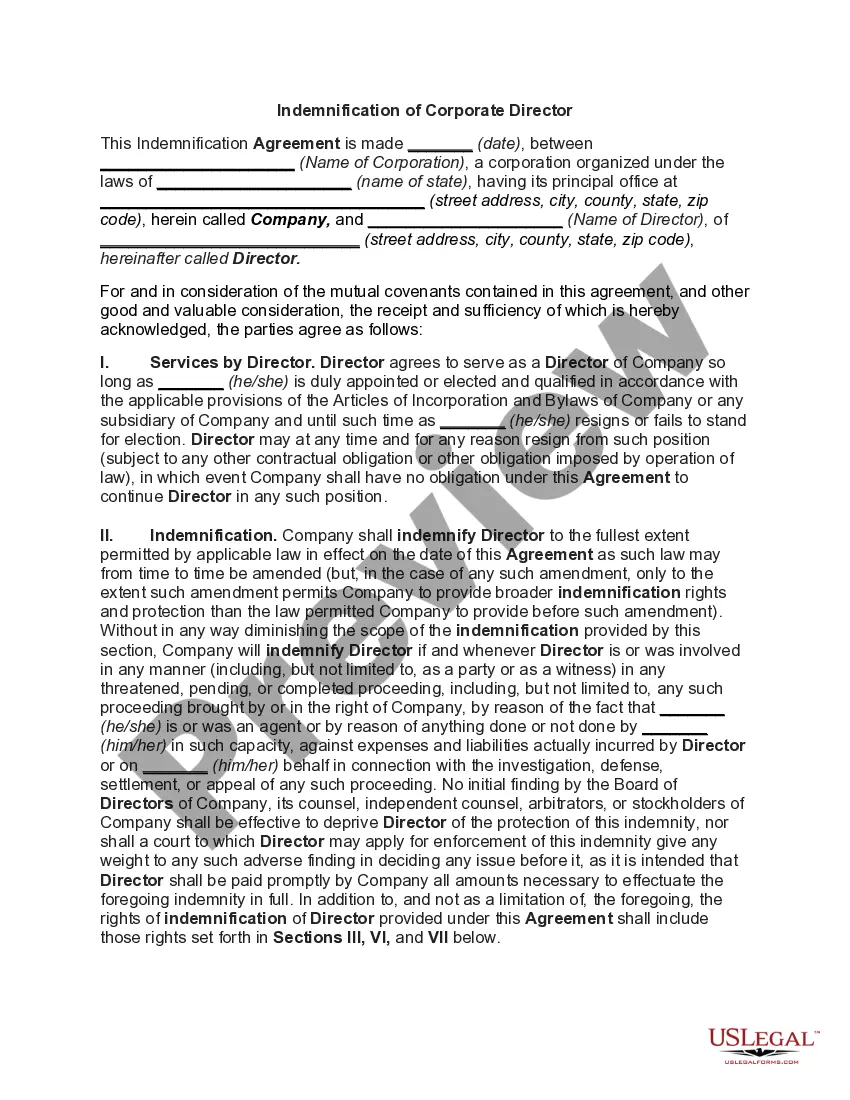

How to fill out Directors And Officers Liability Insurance?

If you need to complete, download, or print legitimate file themes, use US Legal Forms, the most important assortment of legitimate kinds, that can be found on the web. Make use of the site`s easy and convenient search to get the papers you want. A variety of themes for enterprise and personal uses are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to get the North Carolina Directors and officers liability insurance within a number of clicks.

If you are currently a US Legal Forms client, log in for your profile and click the Download key to get the North Carolina Directors and officers liability insurance. You may also access kinds you in the past delivered electronically in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, refer to the instructions under:

- Step 1. Make sure you have selected the form for your right area/land.

- Step 2. Take advantage of the Review choice to look over the form`s information. Do not forget about to learn the explanation.

- Step 3. If you are unhappy with all the type, use the Search discipline on top of the display screen to find other versions of the legitimate type design.

- Step 4. Once you have found the form you want, select the Purchase now key. Pick the rates program you prefer and put your credentials to register for an profile.

- Step 5. Method the financial transaction. You can utilize your Мisa or Ьastercard or PayPal profile to accomplish the financial transaction.

- Step 6. Select the format of the legitimate type and download it on your system.

- Step 7. Complete, revise and print or indicator the North Carolina Directors and officers liability insurance.

Each and every legitimate file design you get is yours eternally. You might have acces to each type you delivered electronically with your acccount. Go through the My Forms portion and choose a type to print or download yet again.

Be competitive and download, and print the North Carolina Directors and officers liability insurance with US Legal Forms. There are many professional and state-certain kinds you can use for your personal enterprise or personal demands.

Form popularity

FAQ

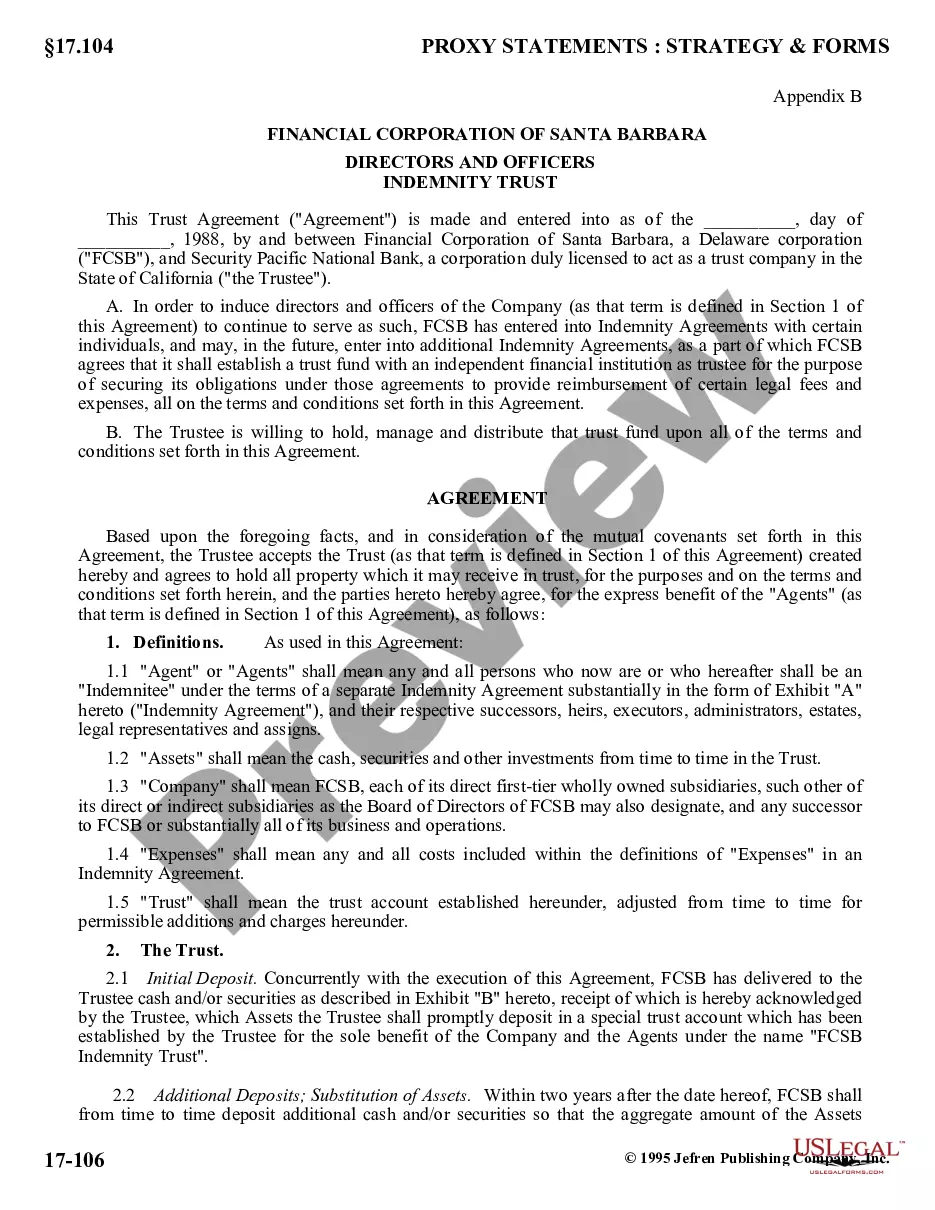

However, D&O is a product designed to protect the personal assets of company directors and officers in the event they were sued while acting in their capacity as a director or officer. Management liability protects the company as well as its directors and officers against legal liabilities and statutory obligations.

Side A coverage safeguards the personal assets of directors and officers when indemnification is not available, while Side B and C coverage provide reimbursement to the company and protection against claims related to securities violations or corporate liability.

D&O insurance typically covers legal fees, settlements, and financial losses when the insured is held liable. Common allegations covered include breaches of fiduciary duty, failure to comply with regulations, lack of corporate governance, creditor claims, and reporting errors.

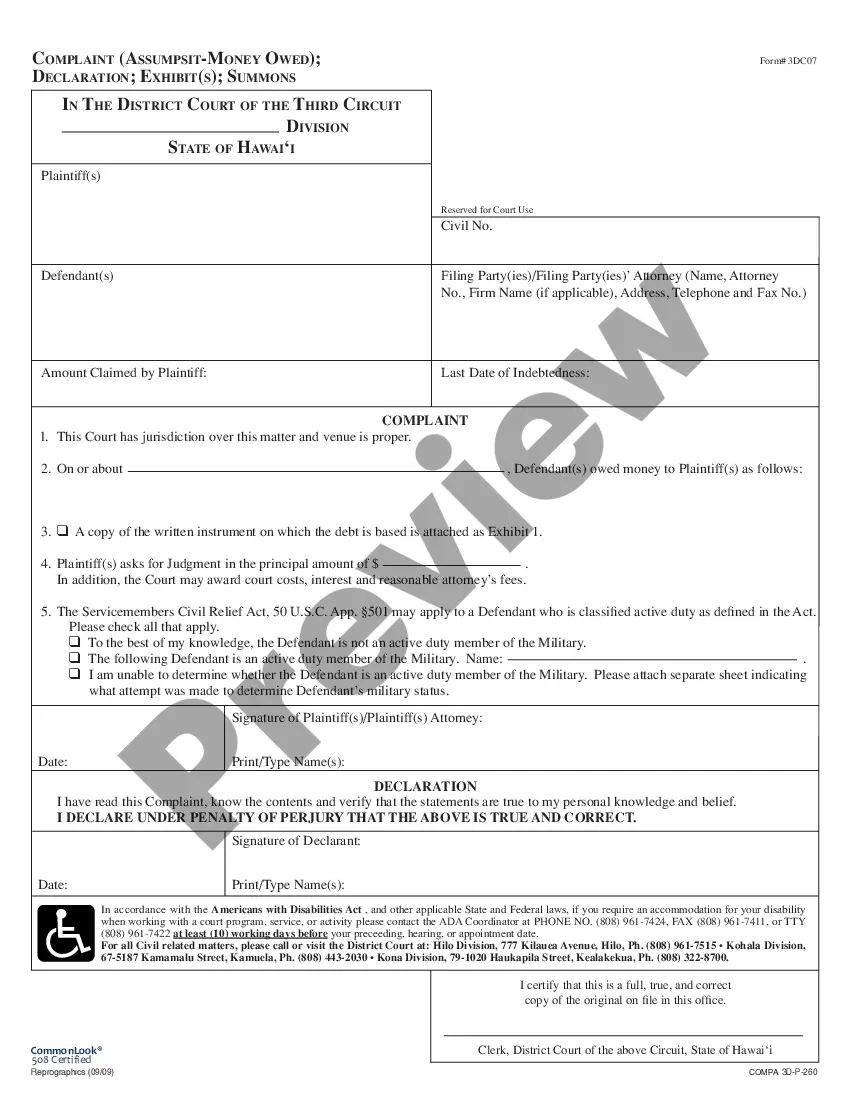

A director's obligation includes acting in good faith with corporate information and reporting which the board deems correct. Failure to do this will mean the director is liable for losses due to non-compliance. Directors are at risk if they fail to oversee the compliance program or act passively.

Directors & officers insurance (D&O) is liability insurance that covers the directors and officers of the company against lawsuits alleging a breach of fiduciary duty. A company pays for this coverage so executives can serve confidently as leaders of their organization without fear of personal financial loss.

Liability under federal securities laws In publicly traded corporations, officers and directors are also subject to liability for violations of the extensive anti-fraud and disclosure requirements of the federal securities laws ? particularly the Securities Act of 1933 and the Securities Exchange Act of 1934.

Directors and officers (D&O) liability insurance protects the personal assets of corporate directors and officers, and their spouses, in the event they are personally sued by employees, vendors, competitors, investors, customers, or other parties, for actual or alleged wrongful acts in managing a company.

Further, officers and directors who participate in or authorize the commission of wrongful acts that are prohibited by statute, even if the acts are done on behalf of the corporation, may be held personally liable. Officers and directors may also be liable to the corporation or its shareholders.