Alaska Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock

Description

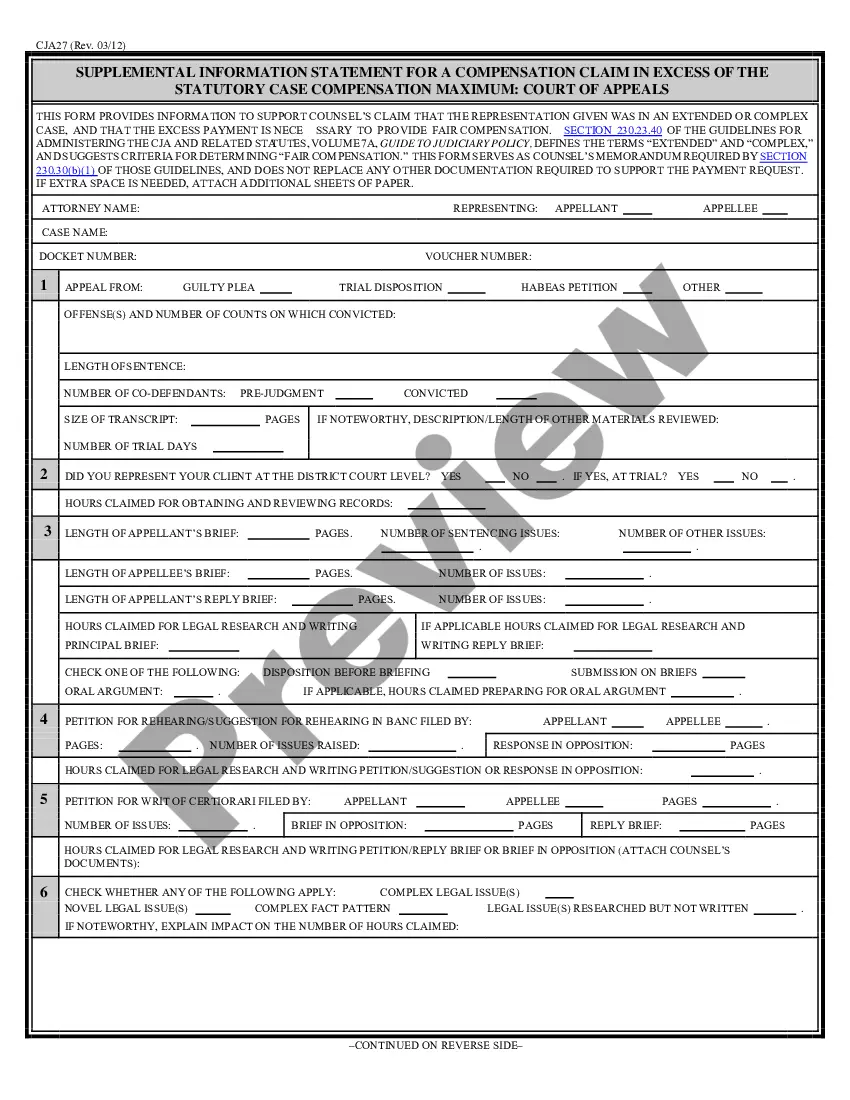

How to fill out Share Exchange Agreement Regarding Shareholders Issued Exchangeable Nonvoting Shares Of Capital Stock?

US Legal Forms - one of many biggest libraries of authorized kinds in America - provides a wide range of authorized papers templates you are able to down load or print out. Making use of the site, you can find a huge number of kinds for enterprise and individual uses, sorted by classes, says, or key phrases.You can find the most up-to-date models of kinds just like the Alaska Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock in seconds.

If you already possess a subscription, log in and down load Alaska Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock through the US Legal Forms catalogue. The Down load key will show up on every single kind you view. You have access to all earlier saved kinds within the My Forms tab of the account.

In order to use US Legal Forms for the first time, here are basic guidelines to help you get began:

- Make sure you have picked the proper kind for your personal town/county. Select the Review key to review the form`s information. Browse the kind information to ensure that you have selected the right kind.

- If the kind doesn`t satisfy your demands, use the Look for field towards the top of the screen to find the one who does.

- Should you be pleased with the shape, verify your choice by simply clicking the Buy now key. Then, select the costs program you want and provide your references to sign up for an account.

- Approach the purchase. Make use of credit card or PayPal account to finish the purchase.

- Pick the structure and down load the shape on your own device.

- Make changes. Load, modify and print out and indicator the saved Alaska Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock.

Every single design you put into your account lacks an expiry particular date and is the one you have for a long time. So, if you wish to down load or print out an additional copy, just visit the My Forms segment and click around the kind you want.

Get access to the Alaska Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock with US Legal Forms, one of the most substantial catalogue of authorized papers templates. Use a huge number of skilled and express-specific templates that satisfy your small business or individual requires and demands.

Form popularity

FAQ

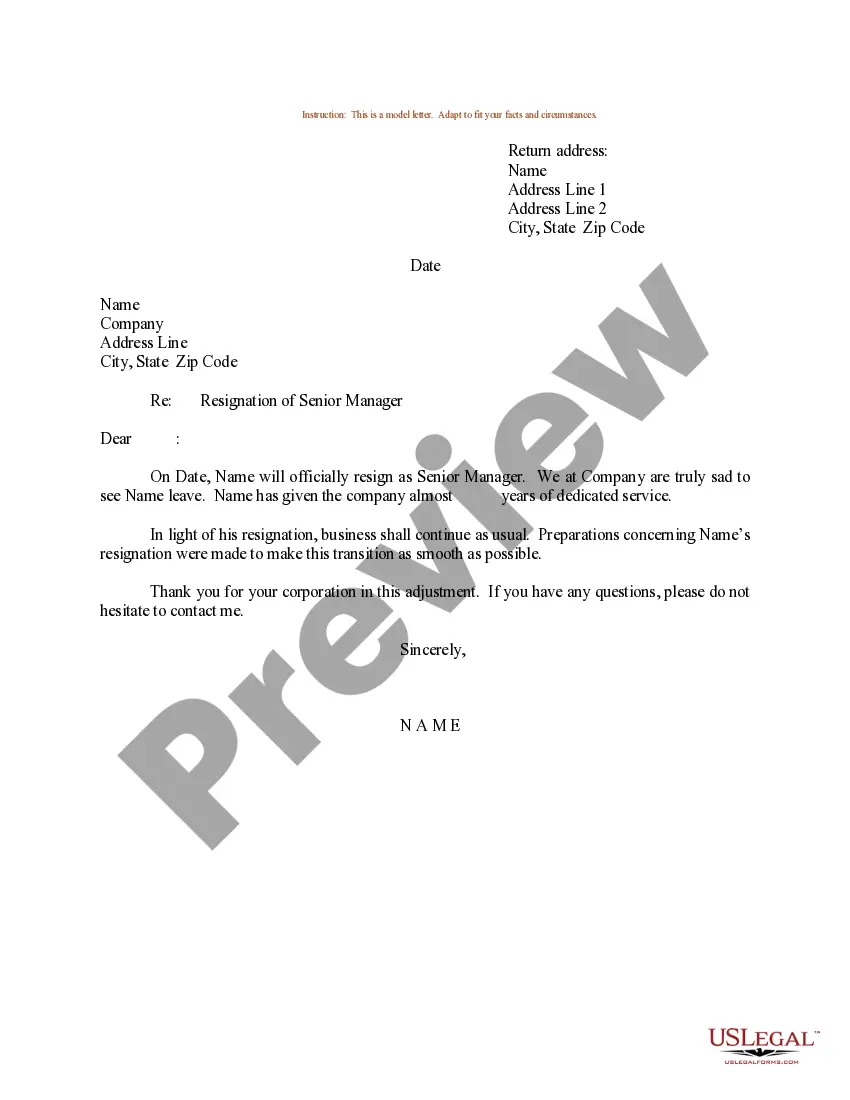

Purpose of shareholder agreement 1.2 The Shareholders are entering into this Shareholder Agreement to provide for the management and control of the affairs of the Corporation, including management of the business, division of profits, disposition of shares, and distribution of assets on liquidation.

A good shareholders agreement should set out the decisions a shareholder-director may and may not make without agreement from others. These are known as reserved matters. Disclosure of decision making is also important. A shareholder-director may be able to make decisions that aren't reported to other shareholders.

1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

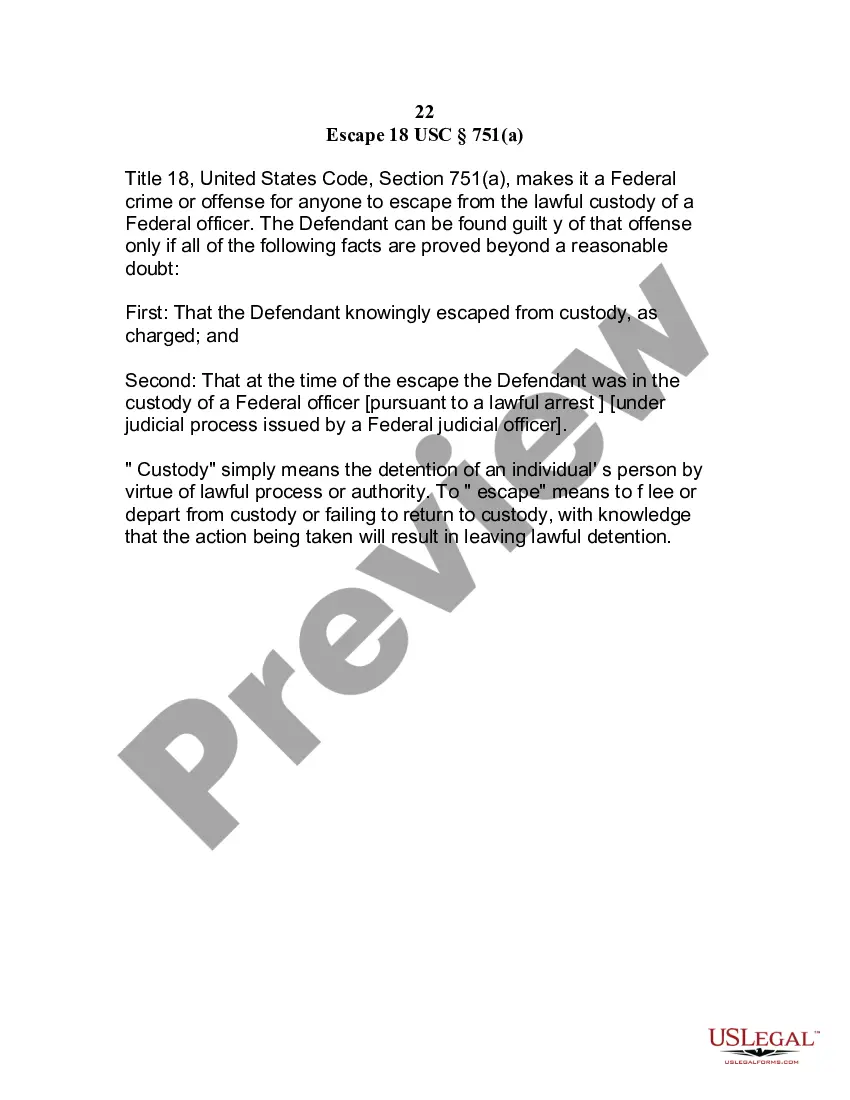

Technically, a share for share exchange is treated as a 'reorganisation' for tax purposes. The selling shareholders are therefore treated as not making a disposal of their old shares but as having acquired their new shares in the acquiring company at the same time and for the same amount as their old shares.

A shareholders agreement is a binding contract between the shareholders of a company, which governs the relationship between the shareholders and specifies who controls the company, how the company will be owned and managed, how shareholders' rights may be protected and how shareholders can exit the company.

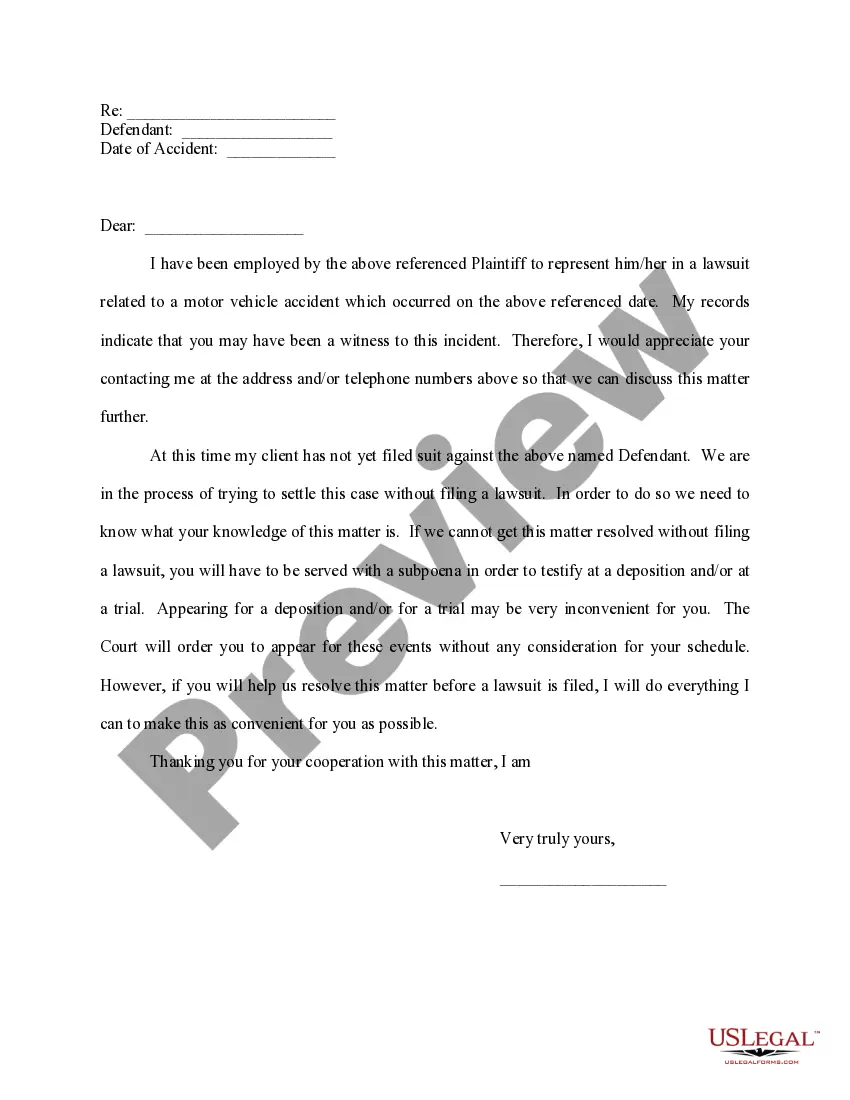

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

A shareholders agreement will almost always contain clauses which regulate the company's directors and management structure. Generally, this will include clauses relating to decision making, the rights of shareholders to appoint or remove directors and the powers of the managing director.