North Carolina Equipment Lease - General

Description

How to fill out Equipment Lease - General?

You can dedicate multiple hours online searching for the legal document template that satisfies the federal and state requirements you need.

US Legal Forms provides a vast selection of legal forms that have been reviewed by professionals.

It is straightforward to obtain or create the North Carolina Equipment Lease - General from my service.

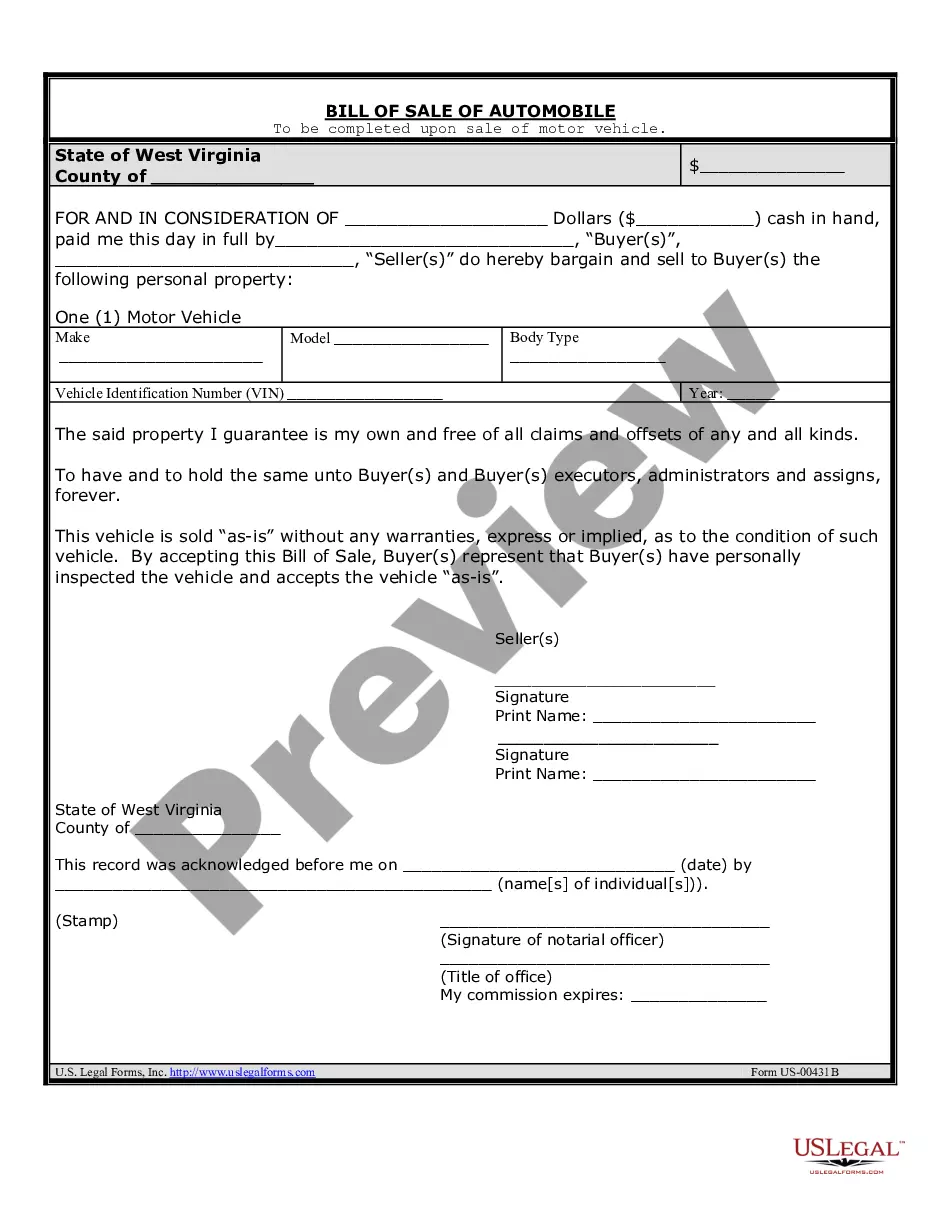

If available, utilize the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you may Log In and click the Download button.

- Following that, you can complete, edit, print, or sign the North Carolina Equipment Lease - General.

- Every legal document template you acquire is yours indefinitely.

- To obtain an additional copy of the downloaded form, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the state/city of your choice.

- Refer to the form description to confirm you have selected the proper form.

Form popularity

FAQ

Yes, you can write up your own lease agreement, but it is crucial to ensure that it complies with local laws and regulations. Crafting a lease for a North Carolina Equipment Lease - General requires attention to detail and an understanding of certain legal requirements. Using platforms like USLegalForms can simplify this process, providing templates and guidance to help you create a lease that meets your needs while minimizing legal risks.

To write up a commercial lease, start by clearly defining the parties involved, the property address, and the terms of the lease, including rental amount and duration. It's also important to include clauses related to repairs, maintenance, and the responsibilities of each party. If you're considering a North Carolina Equipment Lease - General, you may want to use resources like USLegalForms to assist you in drafting a comprehensive and legally binding document. This helps ensure that you cover all necessary details and protect your interests.

Yes, equipment rental in North Carolina generally incurs sales tax. As you engage in a North Carolina Equipment Lease - General, it is vital to account for these taxes as part of your overall budgeting. The North Carolina Department of Revenue specifies which equipment rentals are taxable, ensuring you do not overlook any costs. Utilizing resources like uslegalforms can help clarify these tax issues.

In North Carolina, certain items are exempt from sales tax. Items such as food for human consumption, prescription medications, and specific types of farming equipment may not incur tax liabilities. However, when you are involved with a North Carolina Equipment Lease - General, you should verify what specific items are included to avoid surprise taxes. A clear understanding will help you make informed decisions.

Leased equipment is often treated differently from owned equipment for tax purposes in North Carolina. When you enter into a North Carolina Equipment Lease - General, the lease payments may be considered taxable income for the lessor. On the lessee side, any rental expenses related to business use may also be deducted, creating complexity. Therefore, understanding the tax implications thoroughly is crucial.

In North Carolina, renting equipment typically falls under taxable transactions. Generally, you must collect sales tax on the rental of tangible personal property, which includes equipment. Therefore, when you enter a North Carolina Equipment Lease - General, it is important to understand that this may incur additional tax obligations. Always consult a tax professional to ensure compliance.

A contract in North Carolina is legally binding when it includes an offer, acceptance, consideration, and mutual intent to enter into an agreement. Specifically for a North Carolina Equipment Lease - General, having both parties sign a written document can solidify this intent. Clarity in terms helps prevent disputes. Engaging a service like USLegalForms can assist you in crafting a robust agreement that meets all legal requirements.

To create a legally binding rental agreement in North Carolina, both parties must agree to the terms and provide their signatures. The agreement should clearly outline the responsibilities, rights, and terms associated with the North Carolina Equipment Lease - General. Consider including pertinent details like property description, rental amount, and duration. Using a reputable platform like USLegalForms can streamline this process and ensure compliance with local laws.

In North Carolina, breaking a lease may be justified under specific circumstances such as a significant breach by the landlord, uninhabitable living conditions, or military service. If a tenant faces serious issues like health violations or a lack of essential repairs, they might have grounds to terminate the North Carolina Equipment Lease - General. Documenting these issues helps protect your rights. Always consult a legal expert to understand your options.

In North Carolina, leases for a term of three years or more should be recorded to enforce the lease terms against third parties. Additionally, certain leases that may involve significant assets or high values may also benefit from recording. The North Carolina Equipment Lease - General can help clarify these requirements, ensuring proper compliance.