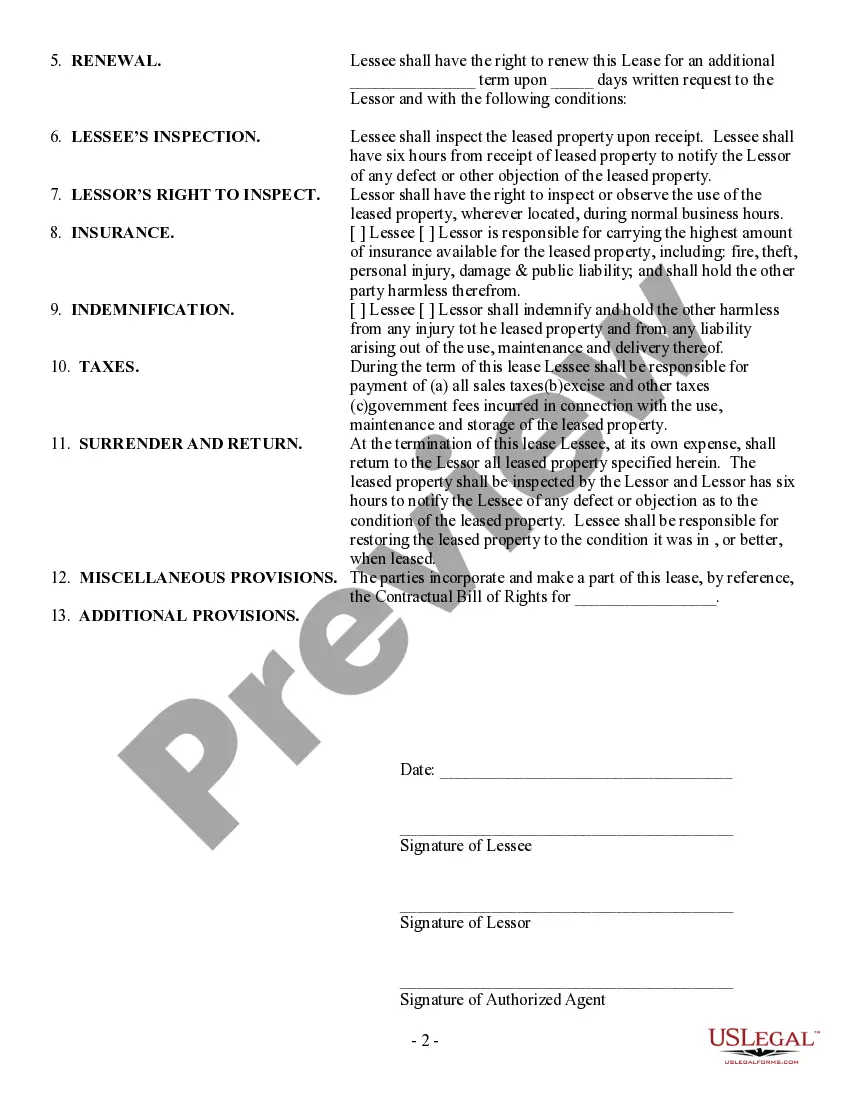

North Carolina Simple Equipment Lease

Description

How to fill out Simple Equipment Lease?

It is feasible to spend numerous hours online searching for the legal document template that complies with the federal and state specifications you require.

US Legal Forms provides a vast collection of legal forms that are assessed by professionals.

You can acquire or print the North Carolina Simple Equipment Lease through my service.

Review the form outline to confirm you have chosen the right one. If available, utilize the Review button to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can complete, alter, print, or sign the North Carolina Simple Equipment Lease.

- Every legal document template you buy is yours permanently.

- To get another copy of a purchased template, visit the My documents tab and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- Initially, ensure you have selected the correct document template for your state/area that you choose.

Form popularity

FAQ

Yes, rental equipment in North Carolina is subject to sales tax. If you’re using a North Carolina Simple Equipment Lease, you will need to account for this tax on your rental payments. Be mindful that sales tax affects your overall budget for equipment rental. Consulting with tax professionals can help clarify any uncertainties you might have.

Yes, leased equipment in North Carolina is subject to taxation. When you engage in a North Carolina Simple Equipment Lease, ensure you understand the associated tax implications. Sales tax applies to the lease payments, making it crucial to factor this expense into your overall costs. Knowledge of these tax responsibilities will help you avoid any compliance issues.

In North Carolina, there is no statutory requirement to record leases, including the North Carolina Simple Equipment Lease. However, recording often provides protection for both parties and can clarify leasing terms. It may also help in establishing priority rights if there are any disputes. We recommend evaluating this option to safeguard your interests.

For tax purposes, leased equipment in North Carolina is treated similarly to purchased equipment. The North Carolina Simple Equipment Lease may subject you to sales tax, depending on the lease structure. Typically, the lessor is responsible for collecting tax on the lease payments. Staying informed about the tax implications will ensure compliance and avoid surprises.

Setting up an equipment lease starts with identifying the equipment you need and understanding the lease terms. Gather necessary information, such as the lease duration, payment amount, and any additional fees. Our platform offers the North Carolina Simple Equipment Lease template, making it easy for you to create a comprehensive and legally binding lease agreement that meets your needs.

Leasing equipment to your LLC requires that you draft a lease agreement that specifies your LLC as the lessee. Provide clear details, such as rental terms, payment schedule, and rights to use the equipment. Utilizing the North Carolina Simple Equipment Lease can simplify the process and help you adhere to legal requirements. This makes leasing efficient and straightforward.

Creating a rental agreement for equipment involves outlining the terms and conditions clearly. Start by specifying the equipment's details, rental duration, payment structures, and responsibilities of both parties. You can easily draft an effective agreement using the North Carolina Simple Equipment Lease template available on our platform. This ensures you cover all necessary legal aspects.

To lease equipment in North Carolina, a decent credit score generally helps secure favorable terms. Typically, a score of 650 or higher increases your chances of approval. However, if your score is lower, alternative options may still be available. Consider using the North Carolina Simple Equipment Lease to understand your financing options fully.

A lease with an option to buy can be a good idea for many tenants in North Carolina, especially for those uncertain about making a long-term commitment. This option allows for flexibility and the chance to evaluate the property without immediately purchasing it. However, it is essential to review the terms carefully, as they can vary widely. Preparing your agreement using the North Carolina Simple Equipment Lease from US Legal Forms ensures clarity and protection.

A lease with an option to buy in North Carolina allows a tenant to rent a property with the possibility of purchasing it before the lease expires. This arrangement provides tenants time to decide while securing the property they wish to buy. It can be beneficial for those who want to test the property before committing. For seamless documentation, consider using the North Carolina Simple Equipment Lease available on US Legal Forms.