Mississippi Sample Letter regarding Discharge of Debtor

Description

How to fill out Sample Letter Regarding Discharge Of Debtor?

Are you presently within a position that you require paperwork for both organization or personal purposes virtually every working day? There are a variety of legal papers themes available on the net, but finding kinds you can trust isn`t straightforward. US Legal Forms provides a large number of form themes, such as the Mississippi Sample Letter regarding Discharge of Debtor, that are written in order to meet state and federal needs.

When you are previously informed about US Legal Forms site and have a free account, basically log in. After that, you may download the Mississippi Sample Letter regarding Discharge of Debtor web template.

If you do not come with an profile and would like to begin using US Legal Forms, follow these steps:

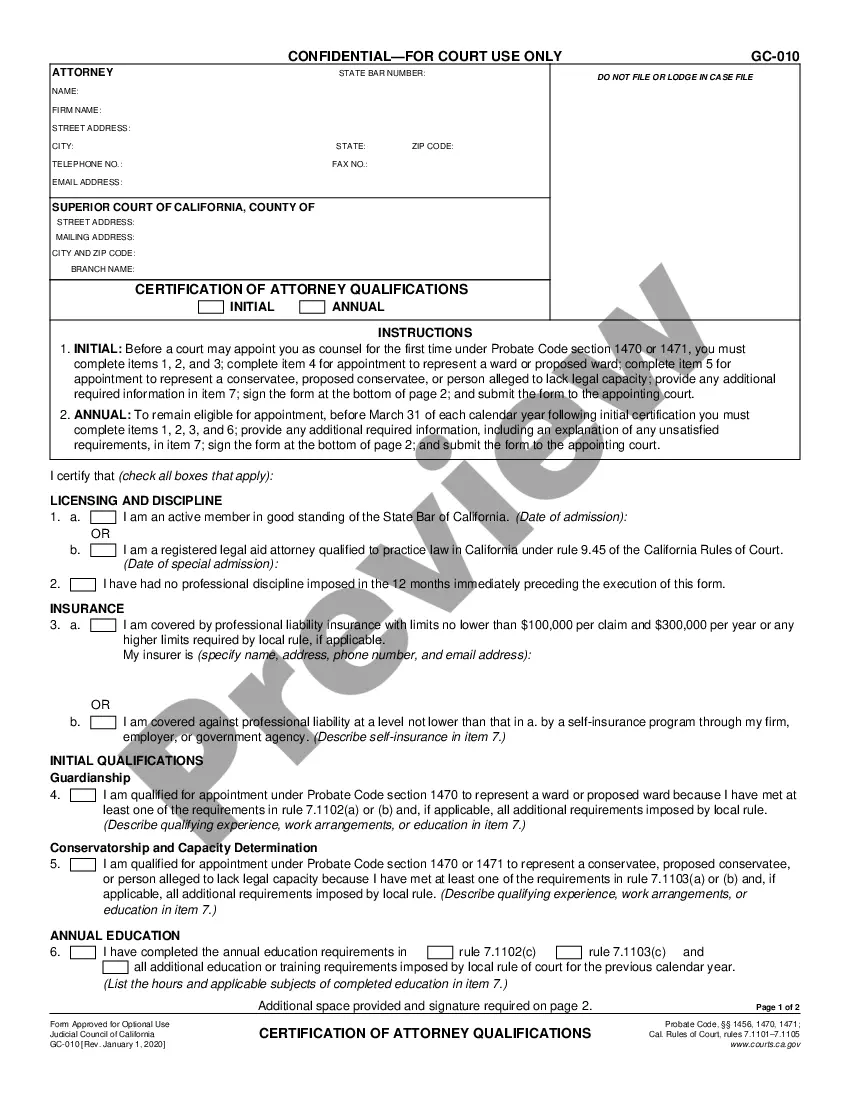

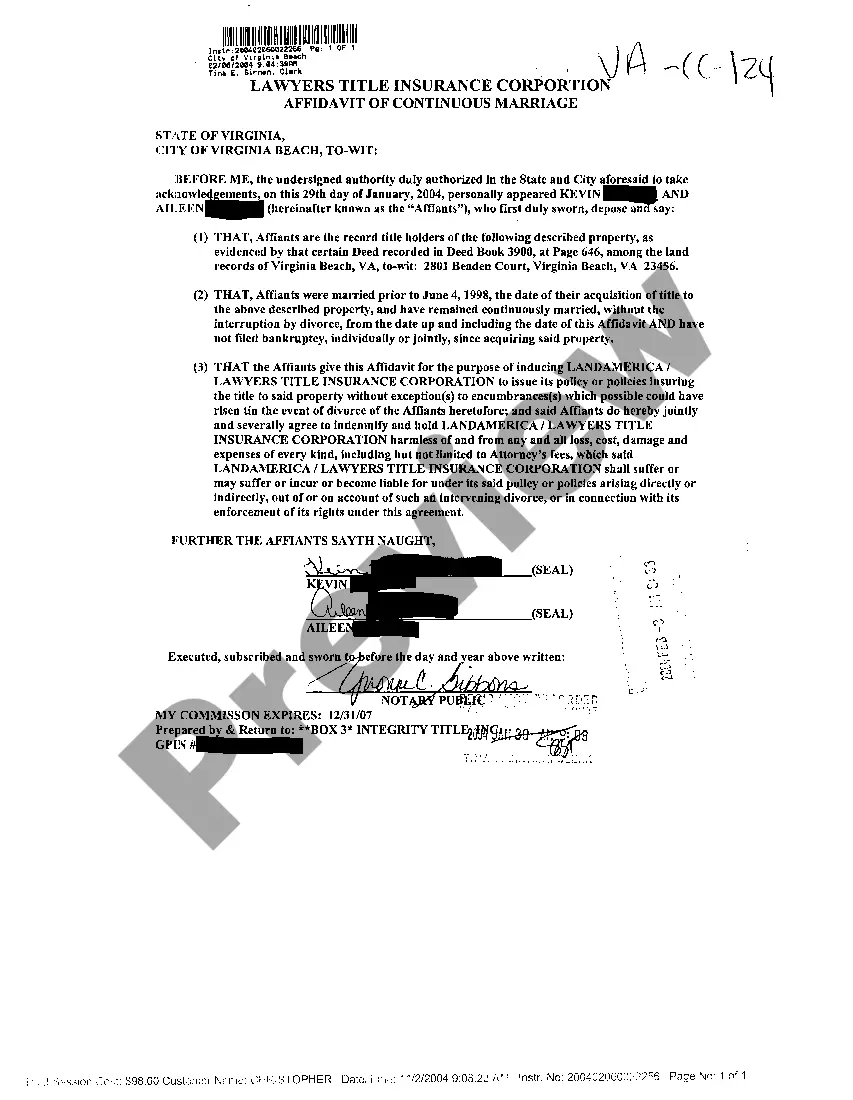

- Get the form you require and make sure it is for that proper city/area.

- Make use of the Review option to examine the form.

- See the outline to ensure that you have chosen the proper form.

- If the form isn`t what you`re seeking, utilize the Look for area to obtain the form that fits your needs and needs.

- When you get the proper form, simply click Acquire now.

- Opt for the costs program you need, fill out the necessary info to create your money, and buy the order utilizing your PayPal or Visa or Mastercard.

- Select a practical file format and download your copy.

Get each of the papers themes you possess bought in the My Forms food list. You can obtain a more copy of Mississippi Sample Letter regarding Discharge of Debtor whenever, if needed. Just select the essential form to download or print out the papers web template.

Use US Legal Forms, probably the most considerable selection of legal kinds, to save lots of time and steer clear of errors. The services provides expertly manufactured legal papers themes that can be used for a range of purposes. Make a free account on US Legal Forms and initiate producing your life easier.

Form popularity

FAQ

From filing to discharge (wiping out debts), Chapter 7 bankruptcy cases typically take 4-6 months. As far as personal bankruptcies go, Chapter 7 is the fastest. By comparison, Chapter 13 can take up to five years because a repayment plan is involved.

In Chapter 13 bankruptcy, a hardship discharge is a court-authorized elimination of debt when a debtor is prevented from completing the repayment plan due to financial hardship that arose while their case is open.

Generally, a discharge removes the debtors' personal liability for debts owed before the debtors' bankruptcy case was filed. Also, if this case began under a different chapter of the Bankruptcy Code and was later converted to chapter 7, debts owed before the conversion are discharged.

What happens when a creditor files an objection? A creditor's objection does not automatically prevent a discharge of debt. The debtor gets a chance to file an answer to the objection, and the court may hold a hearing to decide the issue. This is called an adversary proceeding, and it works much like any other lawsuit.

Courts can issue a discharge ruling when the debtor meets the discharge requirements under Chapter 7 or Chapter 11 of federal bankruptcy law, or the ruling is based on a debt canceling. A canceling of debt happens when the lender agrees that the rest of the debt is forgiven.

People who file for personal bankruptcy get a discharge ? a court order that says they don't have to repay certain debts. Bankruptcy is generally considered your last option because of its long-term negative impact on your credit.

May the debtor pay a discharged debt after the bankruptcy case has been concluded? A debtor who has received a discharge may voluntarily repay any discharged debt. A debtor may repay a discharged debt even though it can no longer be legally enforced.

The Process of a Debt Discharge The bankruptcy court will look at your plan and decide whether it is fair and in ance with the law. You will also need to work with a trustee who will distribute these payments to the creditors. The trustee will pay creditors ing to priority.