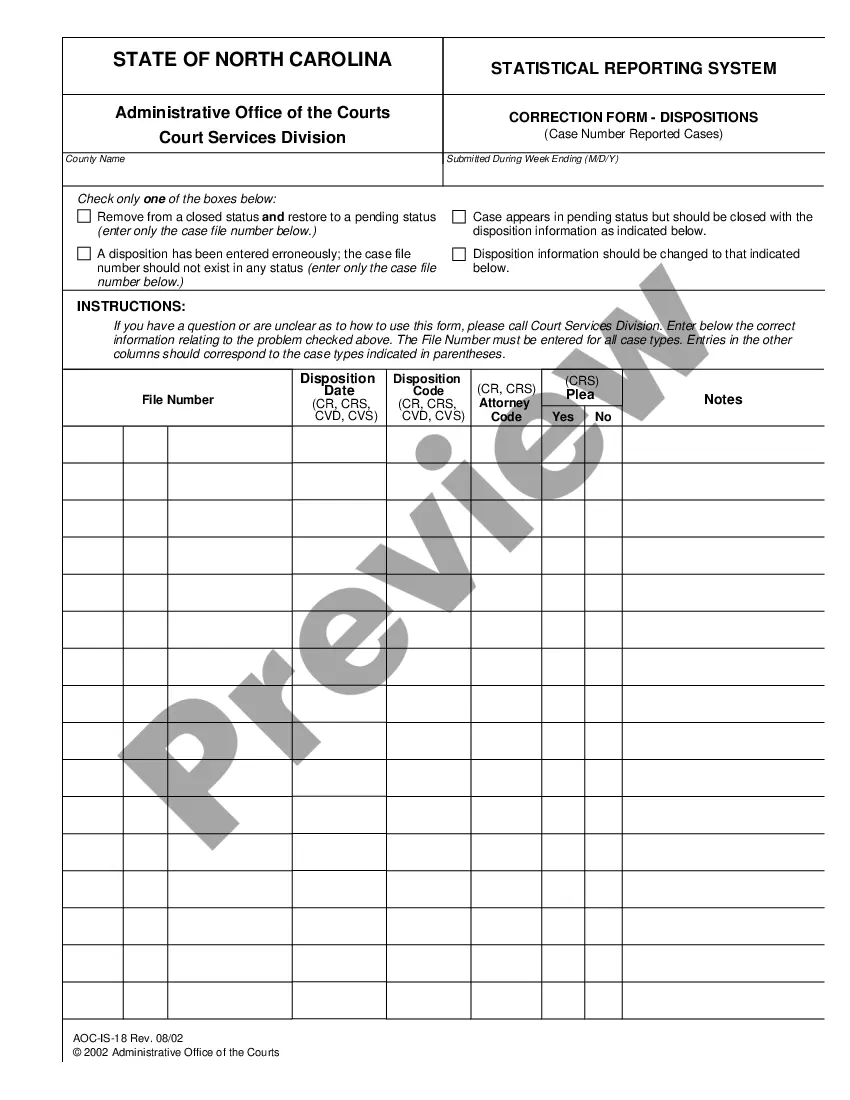

This is an official form from the North Carolina Court System, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

North Carolina Correction Form - Filings

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out North Carolina Correction Form - Filings?

Steer clear of expensive attorneys and locate the North Carolina Correction Form - Filings you require at an affordable rate on the US Legal Forms website.

Utilize our straightforward grouping feature to search for and retrieve legal and tax documents. Review their details and preview them prior to downloading.

Choose to receive the form in PDF or DOCX format. Click Download and locate your template in the My documents section. You can save the template to your device or print it. After downloading, you may fill out the North Carolina Correction Form - Filings manually or with the assistance of editing software. Print it out and reuse the template multiple times. Achieve more for less with US Legal Forms!

- Moreover, US Legal Forms offers users detailed guidance on how to access and complete every single form.

- US Legal Forms clients simply need to Log In and acquire the specific document they need from their My documents section.

- Those who have not yet subscribed must adhere to the following steps.

- Verify that the North Carolina Correction Form - Filings is permitted for use in your area.

- If accessible, browse the details and utilize the Preview feature before downloading the template.

- If you believe the form is appropriate, click Buy Now.

- If the form is incorrect, use the search tool to locate the correct one.

- Next, create your account and choose a subscription plan.

- Make payment via card or PayPal.

Form popularity

FAQ

How Do I Change My Registered Agent In North Carolina? You can easily change your registered agent service. Fill out the online form titled, Statement of Change of Registered Office and/or Registered Agent, and submit either by mail or in person. There is a $5 fee for changing your registered agent in North Carolina.

If you have a street address located in North Carolina (such as a home or office address), and are available during business hours, you can be your own Registered Agent. If you don't have a street address in North Carolina, you can use a friend or family member's address.

F0f0 If you have overpaid your tax liability for a previously filed period, complete Form E-588, Business Claim for Refund State and County Sales and Use Taxes. marked Amended Return in the coupon booklet or write Amended at the top of a Form E-500 to report corrections for that period.

The IRS might send you a notification to change an error on your tax return, or you might have discovered an error. If you or the IRS amended or changed one of your IRS Tax Return(s), the IRS will report this to the California Tax Agency. Therefore, you should file a California Tax Amendment within one year.

If you want to make changes after the original tax return has been filed, you must file an amended tax return using a special form called the 1040X, entering the corrected information and explaining why you are changing what was reported on your original return. You don't have to redo your entire return, either.

If sodon't be. Amending a return is not unusual and it doesn't raise any red flags with the IRS. In fact, the IRS doesn't want you to overpay or underpay your taxes because of mistakes you make on the original return you file.

Can I file my Amended Return electronically? If you need to amend your 2019 or 2020 Forms 1040 or 1040-SR you can now file the Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products.

Corporation. If you need to amend your North Carolina corporation's Articles of Incorporation, you will have to submit a completed Articles of Amendment Business Corporation to the Corporations Division of the Secretary of State. You can file by mail, online, or in person.

You can file your North Carolina LLC Articles of Organization by mail or online. The filing fee is $125 for both methods. If you form your LLC by mail, it will be approved in 10-15 days (this accounts for mail time). If you form your LLC online, it will be approved in 7-10 business days.