Maryland Warranty Deed from Husband to Himself and Wife

Description

Key Concepts & Definitions

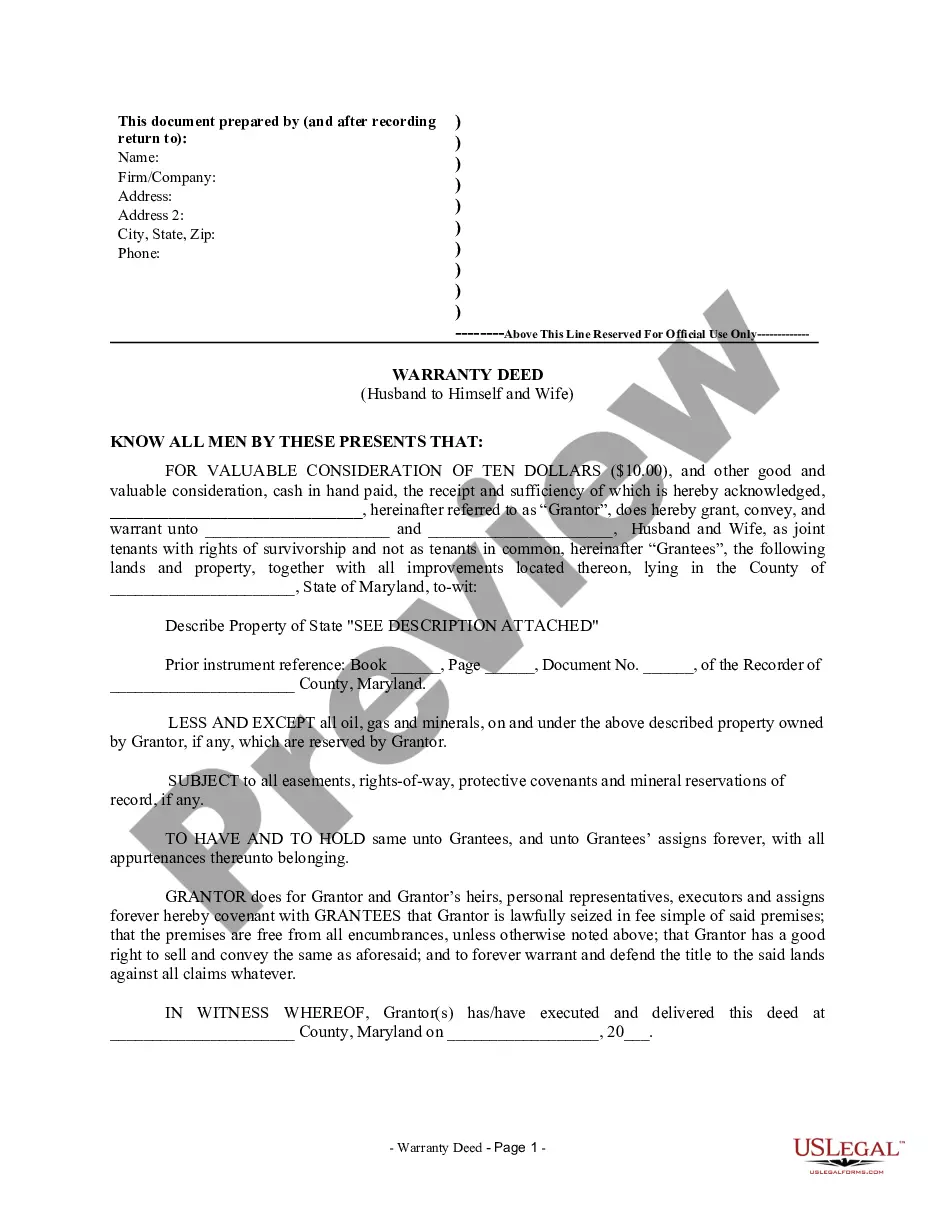

Warranty Deed: A legal document used in real estate that provides the grantee (buyer) with the greatest level of protection, asserting that the grantor (seller) holds clear title to a property and has a right to sell it. Warranty Deed from Husband to Himself and Wife: A specific type of deed where a married individual (husband) transfers property title not only to his spouse but also retains ownership, ensuring both are recognized as legal owners.

Step-by-Step Guide

- Determine the Need: Evaluate why a warranty deed is needed from husband to both himself and his wife. Common reasons include estate planning or property ownership structuring.

- Prepare the Deed: Engage a real estate attorney to draft the deed correctly. It must clearly state that the property is being transferred from the husband to the joint ownership of both spouses.

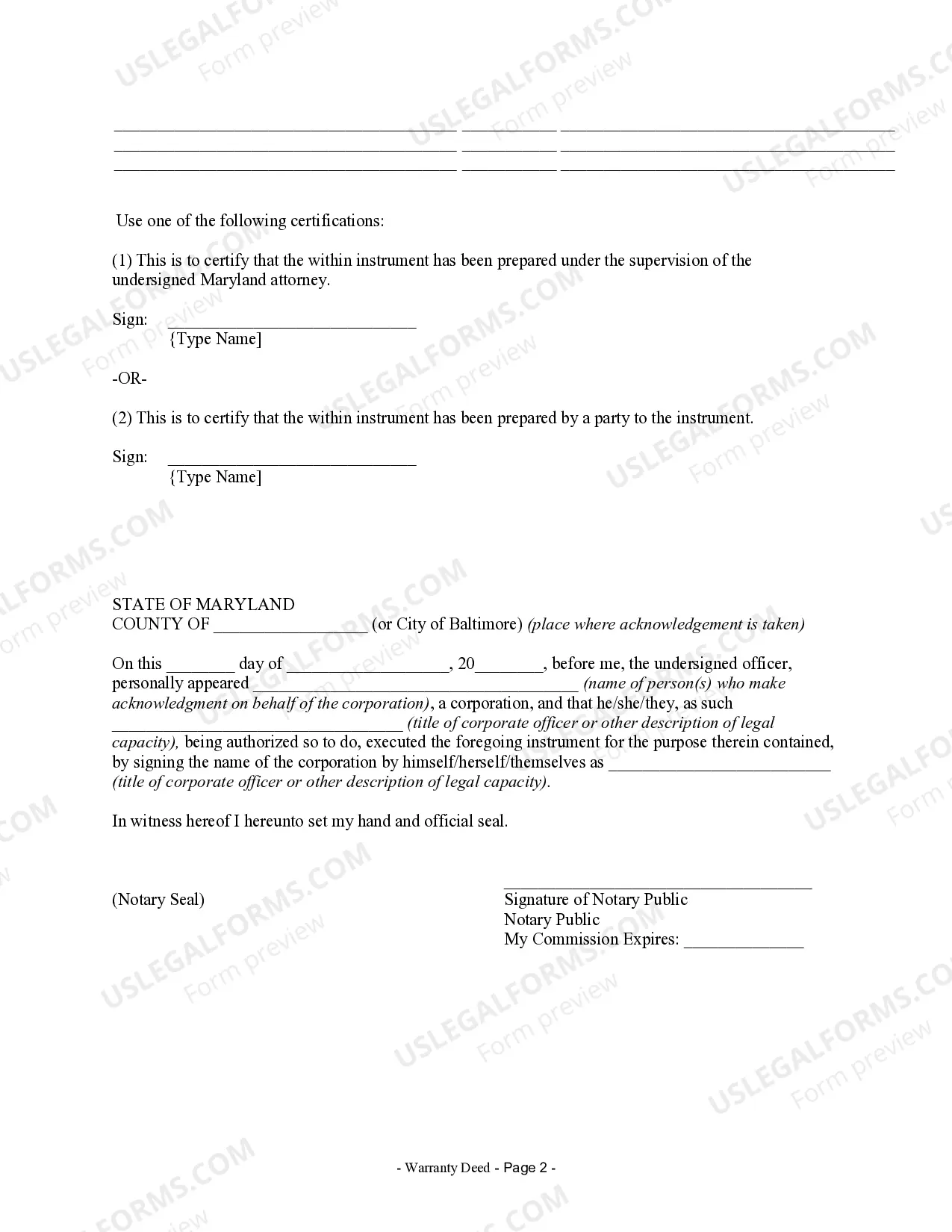

- Signatures: Both husband and wife must sign the deed in front of a notary to make the transfer official and legally binding.

- Record the Deed: File the signed deed with the local county clerk's office to make the transaction part of the public record, which helps in protecting both parties' ownership rights.

Risk Analysis

- Legal Risks: Incorrectly drafting or failing to properly record a warranty deed can lead to disputes over property ownership or issues in the chain of title.

- Financial Risks: There might be tax implications when transferring property ownership that could financially affect the parties involved.

- Relationship Risks: Changes in marital status or disputes might complicate the property ownership structured under such a deed.

Key Takeaways

- Ensure Legal Accuracy: Always involve a legal professional when creating or modifying deeds.

- Record Everything: Promptly recording deeds avoids future legal complications.

- Understand the Implications: Be aware of all implications, including potential tax liabilities, when transferring property ownership.

How to fill out Maryland Warranty Deed From Husband To Himself And Wife?

You are welcome to the most significant legal files library, US Legal Forms. Here you can get any example such as Maryland Warranty Deed from Husband to Himself and Wife templates and download them (as many of them as you wish/require). Prepare official files within a couple of hours, rather than days or weeks, without spending an arm and a leg on an lawyer. Get the state-specific sample in clicks and feel assured knowing that it was drafted by our qualified lawyers.

If you’re already a subscribed user, just log in to your account and then click Download near the Maryland Warranty Deed from Husband to Himself and Wife you need. Due to the fact US Legal Forms is online solution, you’ll generally have access to your saved templates, no matter the device you’re utilizing. See them within the My Forms tab.

If you don't have an account yet, what exactly are you awaiting? Check our guidelines listed below to start:

- If this is a state-specific form, check out its validity in the state where you live.

- See the description (if accessible) to understand if it’s the right example.

- See more content with the Preview feature.

- If the example matches all of your needs, just click Buy Now.

- To make an account, pick a pricing plan.

- Use a card or PayPal account to subscribe.

- Save the document in the format you require (Word or PDF).

- Print the file and fill it out with your/your business’s information.

After you’ve completed the Maryland Warranty Deed from Husband to Himself and Wife, send away it to your lawyer for confirmation. It’s an extra step but a necessary one for being sure you’re completely covered. Become a member of US Legal Forms now and access a large number of reusable samples.

Form popularity

FAQ

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

You usually do this by filing a quitclaim deed, in which your ex-spouse gives up all rights to the property. Your ex should sign the quitclaim deed in front of a notary. One this document is notarized, you file it with the county. This publicly removes the former partner's name from the property deed and the mortgage.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

One of the simplest ways to add your wife to the home title is by using an interspousal deed. You can transfer the property from your sole and separate property to mutual tenancy, such as joint tenants with right of survivorship, with your wife.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.

A quitclaim deed will remove the out-spouse (or departing spouse) from the title to the property, effectively relinquishing their equity or ownership in the home. The execution of a quitclaim deed is typically a requirement of a divorce settlement in order to complete the division of assets.