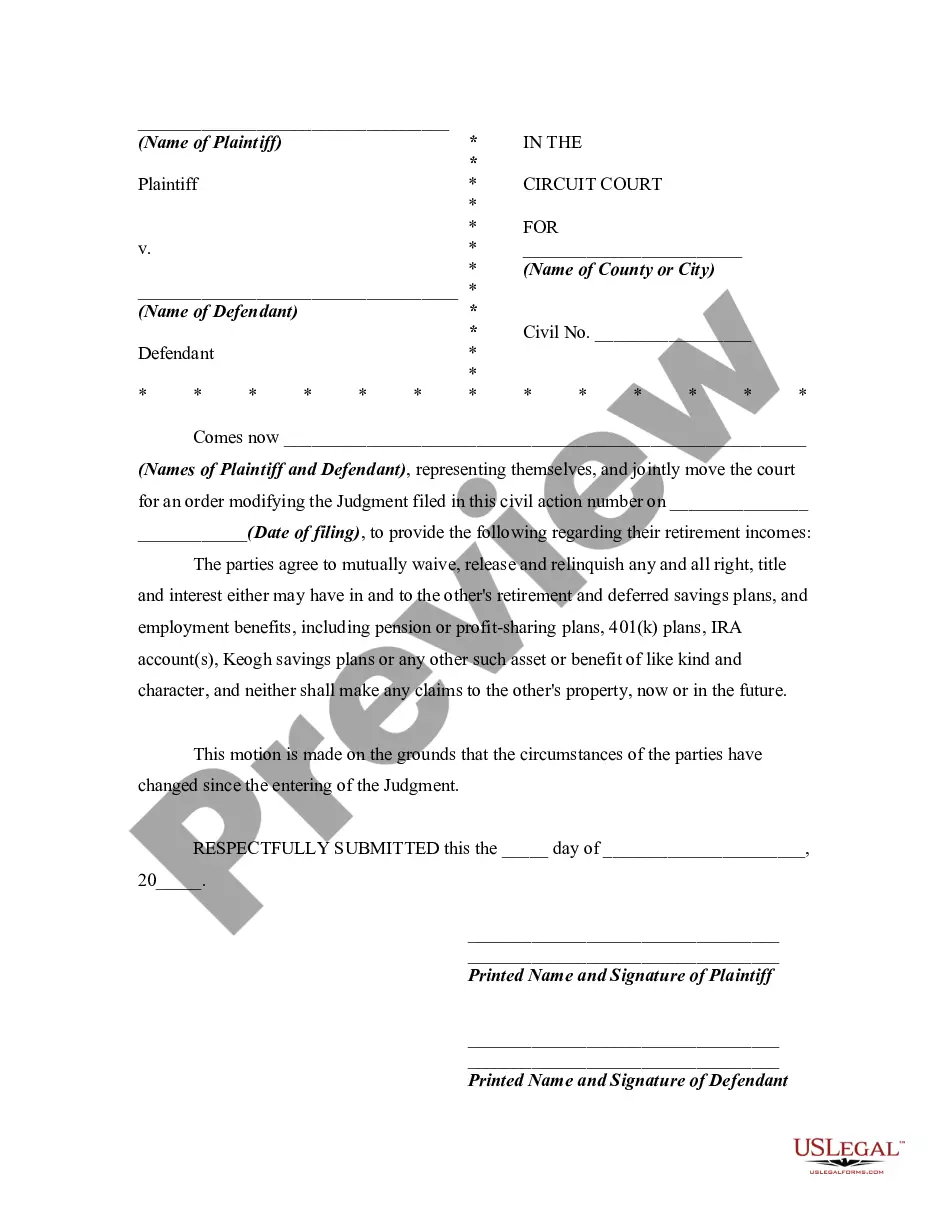

This motion seeks an order modifying a previous divorce judgment and thereby allowing both former spouses to keep all of their future retirement income.

Maryland Joint Motion for Order Changing Divorce Judgment Regarding Retirement Income to Provide that Each Spouse Keeps all of His / Her Retirement Income

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Joint Motion For Order Changing Divorce Judgment Regarding Retirement Income To Provide That Each Spouse Keeps All Of His / Her Retirement Income?

You are invited to the premier legal document repository, US Legal Forms. Here you can acquire any template such as the Maryland Joint Motion for Order Changing Divorce Judgment Regarding Retirement Income to Ensure that Each Spouse Retains all of Their Retirement Income forms and download them (as many as you desire/need). Prepare official documents in a matter of hours, rather than days or weeks, without having to pay a fortune on an attorney. Obtain your state-specific example with just a few clicks and feel assured with the understanding that it was created by our experienced lawyers.

If you’re an existing subscriber, simply Log In to your account and then click Download next to the Maryland Joint Motion for Order Changing Divorce Judgment Regarding Retirement Income to Ensure that Each Spouse Retains all of Their Retirement Income you wish to obtain. Because US Legal Forms is online-based, you’ll usually have access to your downloaded documents, no matter what device you’re using. Locate them in the My documents section.

If you do not have an account yet, what are you waiting for? Follow our instructions below to get started.

Once you’ve finalized the Maryland Joint Motion for Order Changing Divorce Judgment Regarding Retirement Income to Ensure that Each Spouse Retains all of Their Retirement Income, send it to your attorney for review. It’s an additional step but a crucial one to ensure you’re fully protected. Register with US Legal Forms now and access thousands of reusable templates.

- If this is a state-specific document, verify its validity in the state where you reside.

- Review the description (if available) to ensure it’s the correct template.

- Utilize more resources with the Preview feature.

- If the document fulfills all your criteria, click Buy Now.

- To create your account, choose a pricing plan.

- Use a credit card or PayPal account to sign up.

- Save the document in your preferred format (Word or PDF).

- Print the document and complete it with your or your business’s information.

Form popularity

FAQ

After the divorce is over, your spouse will not have the ability to come back and try to get more of your pension plan for herself. All contributions and the value of the plan after your divorce has concluded will be a part of your separate estate and your spouse would have no ability to claim that value as her own.

If you have submitted a QDRO to your retirement plan and decide you have changed your mind, it is impossible to reverse once it has been received and processed.Otherwise, you will need to renegotiate with your ex-spouse in order to get the QDRO amended.

Any funds contributed to the 401(k) account during the marriage are marital property and subject to division during the divorce, unless there is a valid prenuptial agreement in place.For example, if your spouse also has a retirement account worth a similar amount, you may each decide to keep your own accounts.

Protecting Your Pension Assets in a Divorce According to most state laws, pension assets that were in the plan during the marriage are considered joint or marital property. So the court would typically split distributions of these assets in half.

There are two ways to divide plan assets using a QDRO. The first awards a separate interest in the account balance. The second allows a divorcing spouse to share in the payment of the benefits. Once both parties agree to the terms, the account owner gives the document to the plan administrator.

Hire an experienced divorce attorney. Ideally, this person will emphasize mediation or collaborative divorce over litigation. Open accounts in your name only. Sort out mortgage and rent payments. Be prepared to share retirement accounts.

If you and your spouse agree that you should give up a portion of your 401(k), you'll need a qualified domestic relations order (QDRO). This is a court order that gives your spouse the right to a portion of the funds in your 401(k). Usually you split your 401(k) into two new accounts.

If you were married to your ex for at least 10 years, you might be eligible to get a portion of their Social Security benefits.If you are entitled to your own benefits as well, you are usually allowed to receive the larger of either your benefit or your share of your ex-spouse's payments.

A general rule of thumb when it comes to splitting pensions in divorce is that a spouse will receive half of what was earned during the marriage, though it depends on each state's laws governing this subject.