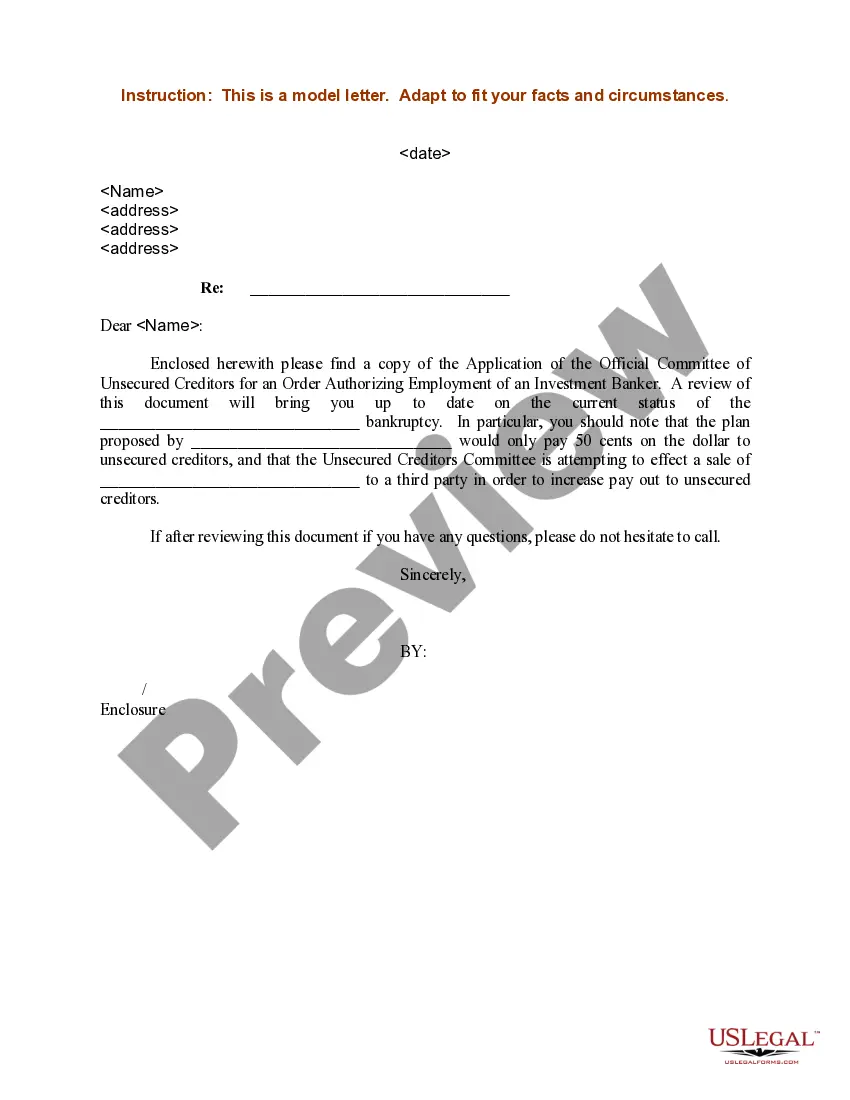

Montana Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker

Description

How to fill out Sample Letter For Application Of Unsecured Creditors For An Order Authorizing Employment Of Investment Banker?

Have you been inside a situation in which you need paperwork for possibly enterprise or person reasons just about every day? There are plenty of authorized record web templates available on the net, but discovering kinds you can trust is not straightforward. US Legal Forms offers thousands of form web templates, like the Montana Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker, that happen to be written to meet federal and state requirements.

If you are previously informed about US Legal Forms internet site and possess your account, simply log in. Following that, you may down load the Montana Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker format.

Unless you offer an accounts and would like to begin to use US Legal Forms, adopt these measures:

- Get the form you require and ensure it is for the appropriate city/state.

- Make use of the Review button to review the form.

- Read the outline to ensure that you have chosen the right form.

- If the form is not what you`re trying to find, take advantage of the Look for field to get the form that fits your needs and requirements.

- Whenever you find the appropriate form, just click Get now.

- Choose the costs program you want, submit the desired information and facts to generate your account, and buy your order utilizing your PayPal or bank card.

- Pick a practical data file format and down load your backup.

Find all the record web templates you have bought in the My Forms food list. You can aquire a further backup of Montana Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker whenever, if necessary. Just click the needed form to down load or printing the record format.

Use US Legal Forms, probably the most comprehensive variety of authorized types, to save some time and stay away from mistakes. The services offers expertly manufactured authorized record web templates that can be used for a selection of reasons. Produce your account on US Legal Forms and begin making your daily life a little easier.

Form popularity

FAQ

In the event of the bankruptcy of the debtor, the unsecured creditors usually obtain a pari passu distribution out of the assets of the insolvent company on a liquidation in ance with the size of their debt after the secured creditors have enforced their security and the preferential creditors have exhausted ...

Unsecured creditors can include suppliers, customers, HMRC and contractors. They rank after secured and preferential creditors in an insolvency situation. Preferential creditors are generally employees of the company, entitled to arrears of wages and other employment costs up to certain limits.

Also known as general creditor and general unsecured creditor. A creditor holding an unsecured claim, or having no liens against a debtor's property. Unsecured creditors have no rights against specific property of the debtor. Also, they generally have no right to receive postpetition interest in a bankruptcy case.

Creditors' Rights for Unsecured Claims As an unsecured creditor, you can file a proof of claim, attend the first meeting of creditors, and file objections to the discharge. You can review the bankruptcy papers that were filed to determine whether there are any inaccuracies.

Understanding Unsecured Debt A loan is unsecured if it is not backed by any underlying assets. Examples of unsecured debt include credit cards, medical bills, utility bills, and other instances in which credit was given without any collateral requirement.

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged).

An unsecured loan is not protected by any collateral. If you default on the loan, the lender can't automatically take your property. The most common types of unsecured loan are credit cards, student loans, and personal loans.

A creditor who has no security over any of the debtor's assets for the debt due to it. Unsecured creditors in a corporate insolvency process most commonly include trade creditors, the Redundancy Payments Service and HMRC.