Montana Aging of Accounts Receivable

Description

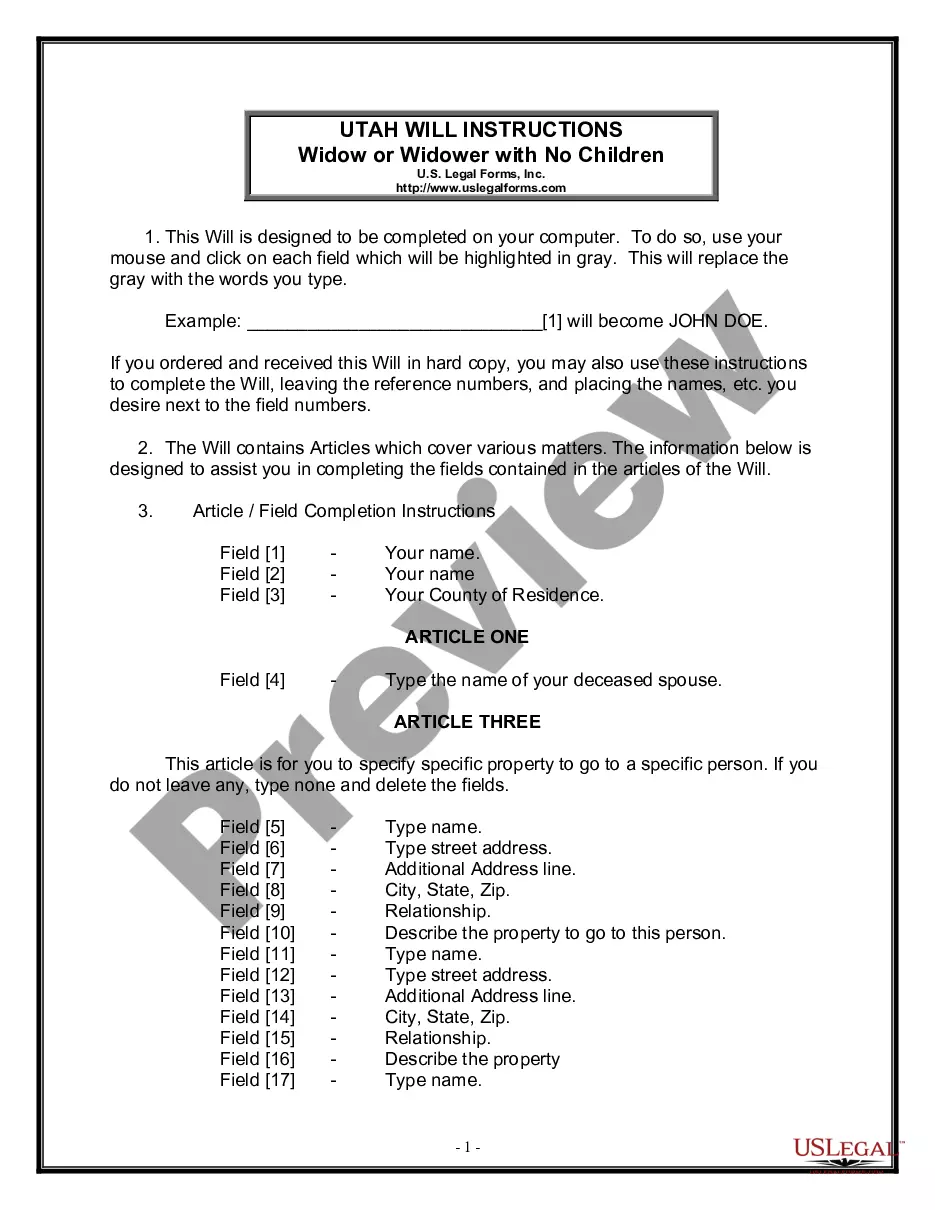

How to fill out Aging Of Accounts Receivable?

Are you presently in a location where you need documents for either business or particular tasks almost every workday.

There are numerous genuine document formats available online, but locating templates you can depend on isn't easy.

US Legal Forms offers a vast selection of document formats, such as the Montana Aging of Accounts Receivable, designed to fulfill federal and state requirements.

Select the pricing plan you want, complete the necessary information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

Choose a convenient document format and download your copy. Access all the document formats you have purchased in the My documents section. You can retrieve another copy of the Montana Aging of Accounts Receivable anytime if needed. Simply navigate through the necessary form to download or print the document template.

- If you are already familiar with the US Legal Forms site and possess your account, simply Log In.

- After that, you can easily download the Montana Aging of Accounts Receivable template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your specific city/state.

- Use the Preview button to review the form.

- Check the details to ensure you have selected the correct template.

- If the form isn't what you're looking for, use the Lookup field to find the document that meets your needs.

- Once you find the right form, click Acquire now.

Form popularity

FAQ

To calculate accounts receivable aging, take the total accounts receivable amount and segment it by age categories, usually based on the invoice date. From there, calculate the outstanding balance for each category to see which accounts are overdue. This process is crucial in analyzing your Montana Aging of Accounts Receivable and ensuring timely follow-ups with customers.

To perform aging of accounts receivable, list all outstanding invoices and group them by their due dates. This classification allows businesses to monitor overdue accounts promptly and take necessary actions for collections. Implementing this method simplifies the process of managing your Montana Aging of Accounts Receivable.

The aging method of accounts receivable involves categorizing invoices based on how long they have been outstanding, typically into time frames like 0-30 days, 31-60 days, and beyond. This approach helps businesses identify overdue accounts and assess the effectiveness of their collection process. Utilizing this method can optimize your Montana Aging of Accounts Receivable strategy.

To calculate the average age of accounts receivable, sum the total number of days an account remains outstanding and divide by the number of accounts. This gives you a clear picture of how long it typically takes to collect payments. Understanding the average age helps in managing your Montana Aging of Accounts Receivable effectively.

An AR Aging report outlines the outstanding invoices an organization has, categorized by how overdue they are. This report serves as a critical tool for businesses to analyze their receivables and understand payment timelines. By using an AR Aging report, you can bolster your strategies for managing the Montana Aging of Accounts Receivable.

To report accounts receivable aging in QuickBooks, you can use the Accounts Receivable Aging report feature found in the Reports section. This report allows you to view outstanding invoices categorized by their aging status. By effectively reporting these figures, you can maintain control over your Montana Aging of Accounts Receivable.

Running an accounts receivable aging report in SAP involves navigating through the Financial Accounting section and selecting the appropriate reporting option. By setting filters for aging periods, you can focus on particular debts. Keeping this report up-to-date is essential for monitoring the Montana Aging of Accounts Receivable effectively.

To run an accounts receivable aging report in SAP, access the relevant module and utilize transaction codes designed for generating such reports. You can customize the report to view particular customer accounts or specific time periods. Regularly reviewing this report can provide valuable insights for managing your Montana Aging of Accounts Receivable.

Recording aging accounts receivable involves updating your financial records to reflect the age of outstanding invoices. You classify these invoices into categories based on the time they have been outstanding. This process is crucial for maintaining accurate records and managing your Montana Aging of Accounts Receivable efficiently.

Extracting a debtors aging report from SAP requires you to access the Financial Accounting module. Here, you can utilize specific transaction codes to generate reports that summarize outstanding debts by age. This report assists in monitoring the Montana Aging of Accounts Receivable and enhances your credit management strategies.