Montana Letter to Confirm Accounts Receivable

Description

How to fill out Letter To Confirm Accounts Receivable?

Selecting the appropriate legal document format may be challenging.

Of course, there are numerous templates available online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Montana Letter to Confirm Accounts Receivable, which can be utilized for both business and personal purposes.

If the form does not meet your needs, use the Search field to find the appropriate form. Once you are confident that the form is suitable, click on the Get now button to download the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or Visa or MasterCard. Choose the file format and download the legal document to your system. Complete, revise, print, and sign the acquired Montana Letter to Confirm Accounts Receivable. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to obtain professionally crafted documents that adhere to state regulations.

- All of the forms are verified by professionals and comply with federal and state requirements.

- If you are already a registered user, Log In to your account and click the Obtain button to access the Montana Letter to Confirm Accounts Receivable.

- Use your account to browse through the legal documents you may have purchased before.

- Go to the My documents tab on your account to retrieve another copy of the document you need.

- If you're a new user of US Legal Forms, here are simple instructions you can follow.

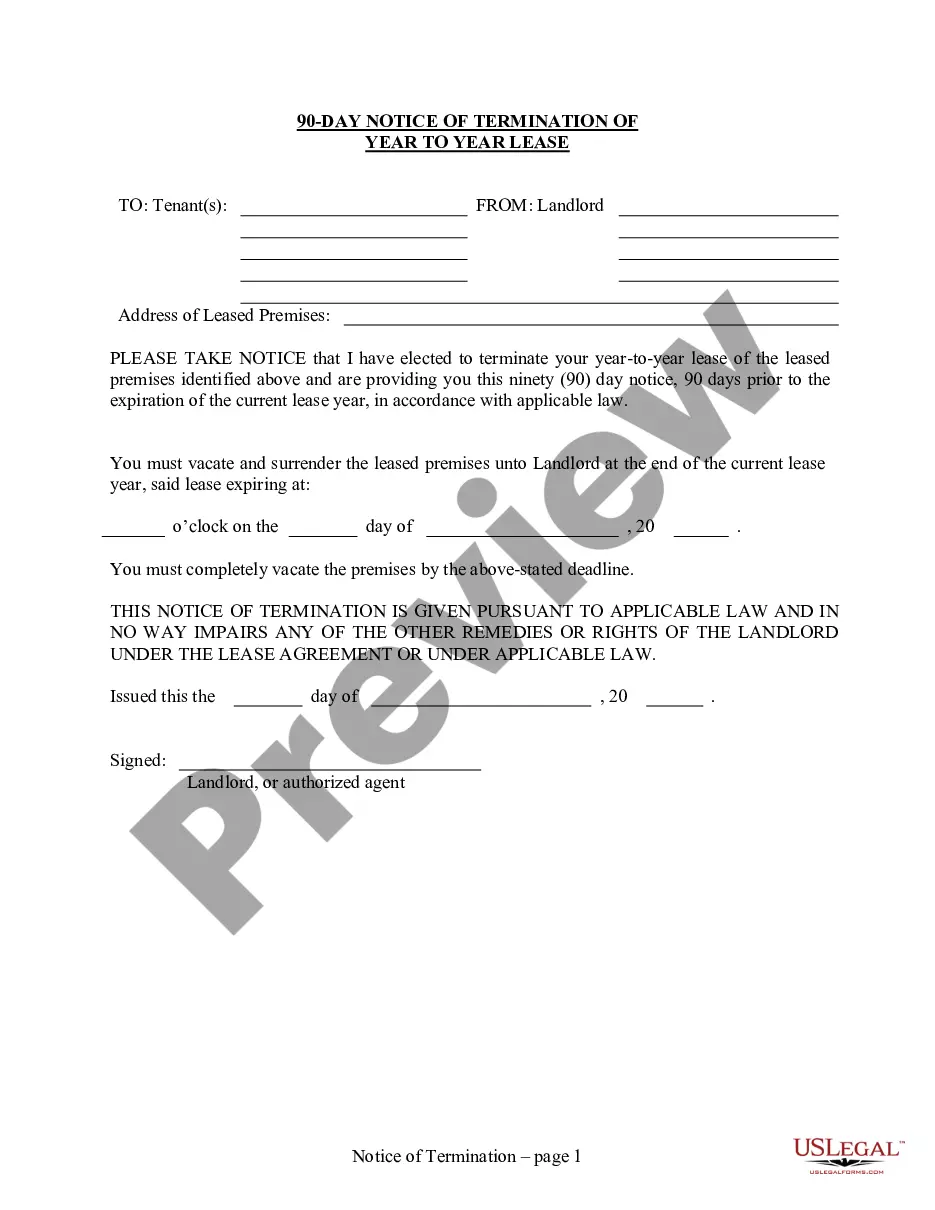

- First, ensure you have selected the correct form for your city/state. You can view the form using the Preview button and check the form description to confirm this is indeed the right one for you.

Form popularity

FAQ

To dissolve a corporation in Montana, you must file Articles of Dissolution with the Montana Secretary of State. This process includes settling any debts and notifying creditors. Make sure to keep records of your communications, including any Montana Letters to Confirm Accounts Receivable, as these may be relevant during the dissolution process.

No, an LLC cannot have two registered agents at the same time in Montana. However, you can designate multiple people within the company to receive documents. It's important to have a single registered agent listed to avoid confusion and ensure timely receipt of important communications.

To change your registered agent in Montana, you will need to file a form with the Montana Secretary of State. This form typically requires the name of your new agent and their consent to serve in this role. After submitting the form, update your records to reflect the change, ensuring smooth communication for any future Montana Letter to Confirm Accounts Receivable.

Yes, you can serve as your own registered agent in Montana. You must be a resident of Montana or a business entity authorized to conduct business in the state. As your own registered agent, you will be responsible for receiving legal documents, so it's important to ensure you are available during business hours to maintain compliance.

To obtain an Employer Identification Number (EIN) in Montana, start by visiting the IRS website. You can complete the application online, which is a quick process that typically takes around 10 minutes. Once you submit your application, you will receive your EIN immediately. This number is essential for your tax obligations and can be crucial when sending a Montana Letter to Confirm Accounts Receivable.

A due diligence notice is a communication sent to property owners to inform them of unclaimed property that may belong to them. This notice is typically sent prior to the property being deemed unclaimed by the state. Utilizing a Montana Letter to Confirm Accounts Receivable ensures that you have a reliable method to respond to such notices and reclaim any due property.

To inquire about unclaimed property in Montana, you can contact the state's unclaimed property division at their designated phone number. This office can provide guidance on the claims process and answer specific questions regarding your property. For a smoother process, consider using a Montana Letter to Confirm Accounts Receivable to gather the necessary documents before calling.

Yes, unclaimed property letters are legitimate notifications that inform individuals of potential funds owed to them. These letters often come from state authorities or verified sources looking to reunite owners with their assets. By responding promptly to a Montana Letter to Confirm Accounts Receivable, you can protect your interests and reclaim what is rightfully yours.

Claiming unclaimed property is legal and can be an important step in recovering owed funds. However, individuals must provide accurate information and act honestly to avoid potential issues. A Montana Letter to Confirm Accounts Receivable can assist in clearly establishing ownership and ensuring that you follow the proper claims process.

Montana has specific rules governing unclaimed property to protect consumers and ensure funds are returned to rightful owners. Typically, assets are considered unclaimed after a period of inactivity, which varies by property type. Individuals can utilize a Montana Letter to Confirm Accounts Receivable to verify their claim status and ensure compliance with these state regulations.