Montana Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

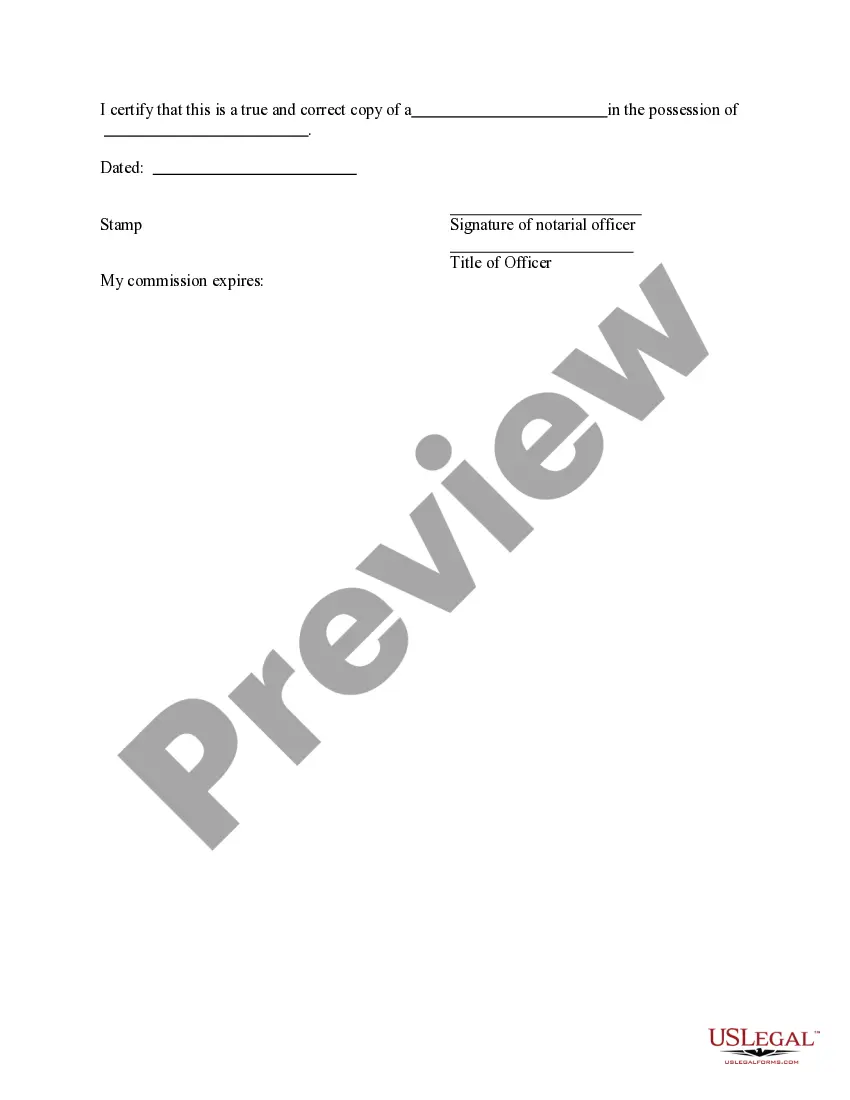

How to fill out Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

It is possible to invest time on-line searching for the legitimate record template that meets the federal and state demands you require. US Legal Forms provides 1000s of legitimate varieties that are analyzed by professionals. It is simple to download or print the Montana Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust from our support.

If you have a US Legal Forms account, you may log in and click on the Obtain button. Next, you may total, revise, print, or signal the Montana Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust. Every single legitimate record template you purchase is yours permanently. To get yet another backup of the bought develop, check out the My Forms tab and click on the corresponding button.

If you use the US Legal Forms internet site the very first time, adhere to the simple recommendations below:

- First, make certain you have selected the correct record template for that region/metropolis of your choice. Look at the develop description to make sure you have selected the correct develop. If offered, take advantage of the Preview button to look with the record template too.

- If you wish to locate yet another variation from the develop, take advantage of the Search industry to find the template that suits you and demands.

- Once you have found the template you want, just click Purchase now to move forward.

- Choose the pricing strategy you want, type in your accreditations, and sign up for a merchant account on US Legal Forms.

- Comprehensive the purchase. You can use your bank card or PayPal account to purchase the legitimate develop.

- Choose the file format from the record and download it to the device.

- Make modifications to the record if needed. It is possible to total, revise and signal and print Montana Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust.

Obtain and print 1000s of record web templates utilizing the US Legal Forms Internet site, that provides the most important selection of legitimate varieties. Use skilled and status-specific web templates to handle your small business or person requires.

Form popularity

FAQ

Who Gets What in Montana? If you die with:here's what happens:children but no spousechildren inherit everythingspouse but no descendants or parentsspouse inherits everythingspouse and descendants from you and that spouse, and the spouse has no other descendantsspouse inherits everything5 more rows

Montana intestate succession laws divide the deceased's property based on family relationships. For example, if you have: A surviving spouse and do not have surviving descendants or parents: your spouse gets everything. Children but do not have a surviving spouse: your children receive everything.

Key Takeaways. Disclaim, in a legal sense, refers to the renunciation of an interest in inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

A disclaimer is the act by which a person refuses to accept an estate which has been conveyed or an interest which has been bequeathed to him or her. Such disclaimer can be made at any time before the beneficiary has derived benefits from the assets. It requires no particular form and may even be evidenced by conduct.

A disclaimer of interest is, essentially, a written statement to the probate court where someone who stands to inherit property or assets states that they do not wish to exercise that inheritance. They ?disclaim? any right to receive the interest that they otherwise would.

A disclaimer is when the recipient (called the ?donee?) refuses a bequest, for example, the donee refuses an inheritance left in a will or trust, refuses the proceeds from an account labeled as pay-on-death account when the original owner dies, or refuses the surviving interest in jointly owned property when one joint ...

If there are no eligible next of kin based on the provincial law, the proceeds will become the government's property ? otherwise known as escheat. It is also possible for a beneficiary to waive their right to inherit or disclaim an inheritance.