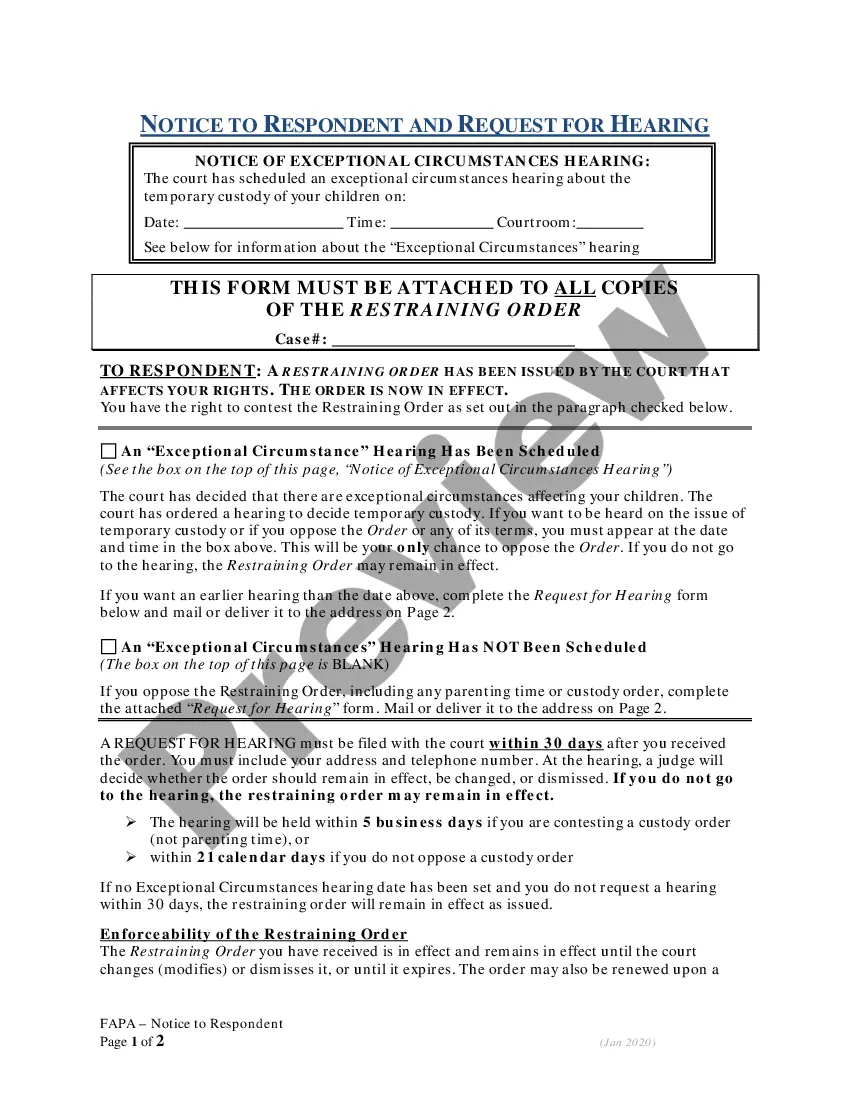

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept of an estate which has been conveyed to him. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montana Disclaimer by Beneficiary of all Rights in Trust

Description

How to fill out Disclaimer By Beneficiary Of All Rights In Trust?

US Legal Forms - among the largest collections of legal documents in the United States - provides a variety of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords. You can find the latest forms such as the Montana Disclaimer by Beneficiary of all Rights in Trust in just minutes.

If you hold a membership, Log In to download Montana Disclaimer by Beneficiary of all Rights in Trust from the US Legal Forms library. The Download option will appear for each form you view. You can access all previously saved forms in the My documents section of your account.

Complete the transaction by processing payment. Use a credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the saved Montana Disclaimer by Beneficiary of all Rights in Trust. Each template added to your account has no expiration date and belongs to you permanently. So, if you need to download or print another copy, simply visit the My documents section and click on the form you need. Access the Montana Disclaimer by Beneficiary of all Rights in Trust with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- First, ensure you've selected the correct form for your city/state.

- Click the Preview button to review the content of the form.

- Check the form summary to confirm that you've chosen the right document.

- If the form doesn't meet your requirements, use the Search feature at the top of the screen to find one that does.

- Once you're satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the pricing plan you wish and provide your details to create an account.

Form popularity

FAQ

Yes, a trust beneficiary can disclaim their interest in a trust. This means they voluntarily choose not to accept their rights to the assets. In a Montana Disclaimer by Beneficiary of all Rights in Trust, disclaiming can have various tax advantages, but it must be done correctly to avoid negative consequences. Make sure to consult legal resources to understand the implications before taking action.

The trustee of a trust is the person or entity appointed to manage the trust's assets and carry out the instructions specified in the trust document. In the realm of a Montana Disclaimer by Beneficiary of all Rights in Trust, this individual acts as the fiduciary, ensuring that the beneficiaries' interests are protected. It's crucial for the trustee to understand their legal obligations and make decisions that align with the trust's goals.

While disclaimer trusts can offer benefits, they also have potential drawbacks. Some common problems include tax implications and the complexity of the disclaimer process itself. Additionally, a Montana Disclaimer by Beneficiary of all Rights in Trust may lead to misunderstandings among beneficiaries regarding their rights and responsibilities. Consulting with a legal professional can clarify these complexities and help navigate challenges.

The trustee of the disclaimer trust is the individual or institution responsible for managing the trust assets according to the trust's terms. In the context of a Montana Disclaimer by Beneficiary of all Rights in Trust, the trustee carries out duties such as distributing assets and ensuring compliance with legal obligations. It's important to select a trustworthy and competent person or entity for this role, as they will have significant influence over the trust's administration.

Montana's intestacy laws govern the distribution of assets when someone passes away without a will. Generally, assets will be distributed to the deceased's closest relatives, such as spouses and children. Understanding these laws reinforces the importance of using tools like a Montana Disclaimer by Beneficiary of all Rights in Trust to ensure your legacy aligns with your wishes, rather than default state rules dictated by intestacy.

In Montana, a trust operates by designating a trustee to manage assets on behalf of beneficiaries. The settlor, who creates the trust, controls how and when assets are distributed, which can enhance financial planning. By utilizing a Montana Disclaimer by Beneficiary of all Rights in Trust, beneficiaries can choose to decline their inheritance, allowing assets to be redirected according to the trust's terms.

The downside of a trust can include setup and ongoing maintenance costs. Establishing a trust often requires legal fees, and managing it may require additional administrative work. Moreover, a Montana Disclaimer by Beneficiary of all Rights in Trust can complicate the distribution process if not clearly defined, potentially causing disputes among beneficiaries.

Yes, you can write your own will in Montana, as long as it meets the state’s legal requirements. However, it is wise to consider consulting with an attorney or using a reliable platform, like US Legal Forms, to ensure your will is properly structured and includes essential elements, such as a Montana Disclaimer by Beneficiary of all Rights in Trust.

An example of a trust clause could be the distribution directive, which specifies how assets are to be allocated among beneficiaries. It can address various conditions, such as age milestones or specific events. Including a Montana Disclaimer by Beneficiary of all Rights in Trust in such clauses adds an additional layer of flexibility for the beneficiaries.

A disclaimer by beneficiary of a trust occurs when a beneficiary chooses to refuse their interest in the trust. This can be useful for tax planning or to prevent disputes among family members. It is essential to understand the implications of executing a Montana Disclaimer by Beneficiary of all Rights in Trust to ensure effective estate management.