Montana Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property

Description

How to fill out Renunciation And Disclaimer Of Right To Inheritance Or To Inherit Property From Deceased - Specific Property?

Choosing the right lawful file template can be a battle. Of course, there are a variety of layouts available online, but how do you obtain the lawful develop you want? Utilize the US Legal Forms website. The support delivers 1000s of layouts, such as the Montana Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property, that you can use for enterprise and personal requirements. Each of the types are checked by specialists and meet federal and state requirements.

If you are already listed, log in for your bank account and then click the Acquire button to obtain the Montana Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property. Make use of bank account to check throughout the lawful types you possess purchased earlier. Visit the My Forms tab of your bank account and acquire yet another duplicate from the file you want.

If you are a fresh customer of US Legal Forms, listed below are simple recommendations so that you can follow:

- Initial, make certain you have chosen the correct develop for the town/state. You are able to look over the shape using the Review button and read the shape information to make sure it will be the best for you.

- In the event the develop does not meet your needs, make use of the Seach industry to obtain the proper develop.

- Once you are positive that the shape is acceptable, select the Buy now button to obtain the develop.

- Select the costs program you need and enter in the required information. Build your bank account and pay money for the order utilizing your PayPal bank account or Visa or Mastercard.

- Select the submit structure and acquire the lawful file template for your device.

- Comprehensive, modify and printing and sign the attained Montana Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property.

US Legal Forms is definitely the most significant catalogue of lawful types for which you can see a variety of file layouts. Utilize the company to acquire expertly-made files that follow express requirements.

Form popularity

FAQ

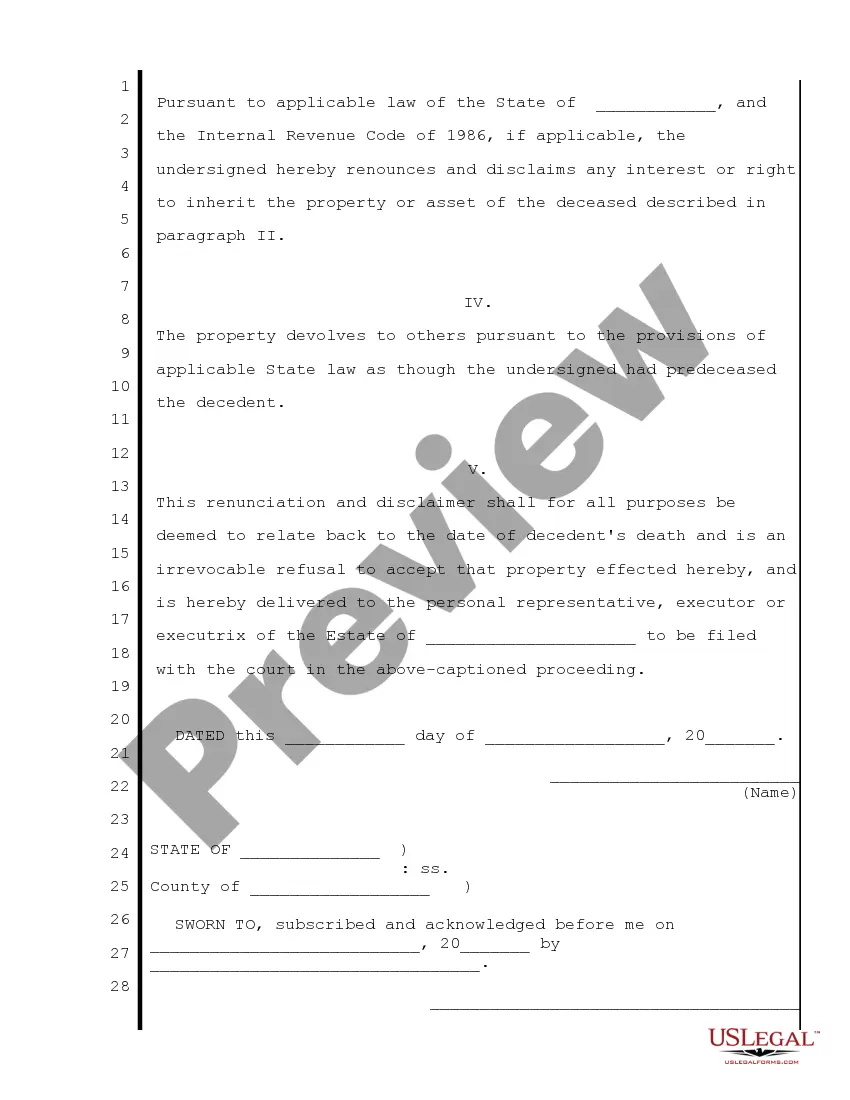

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

Renunciation of inheritance means that an heir renounces his/her right to inherit any of legacy when the heir does not want to inherit the legacy of the ancestor (a deceased person).

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal.

For example, in her will a decedent leaves $500,000 to her nephew if he survives her, but if he does not survive her, this amount passes to her nephew's children who survive the decedent. If the nephew disclaims the property, it passes to his children who survive the decedent.

You can also disclaim an inheritance if you're the named beneficiary of a financial account or instrument, such as an individual retirement account (IRA), 401(k) or life insurance policy. Disclaiming means that you give up your right to receive the inheritance.

A Disclaimer of Inheritance is a written statement in which a potential heir or beneficiary voluntarily renounces or disclaims their right to inherit assets or property from a deceased person's estate.

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

1. "Disclaim" the inherited retirement account. Regardless of your relationship with the account holder, you can opt to disclaim, or not accept, the inheritance and pass on the assets to an alternate beneficiary, such as another family member.

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place. The bequest passes either to the contingent beneficiary listed in the will or, if that person died without a will, ing to your state's laws of intestacy.