Montana General Form of Revocable Trust Agreement

Description

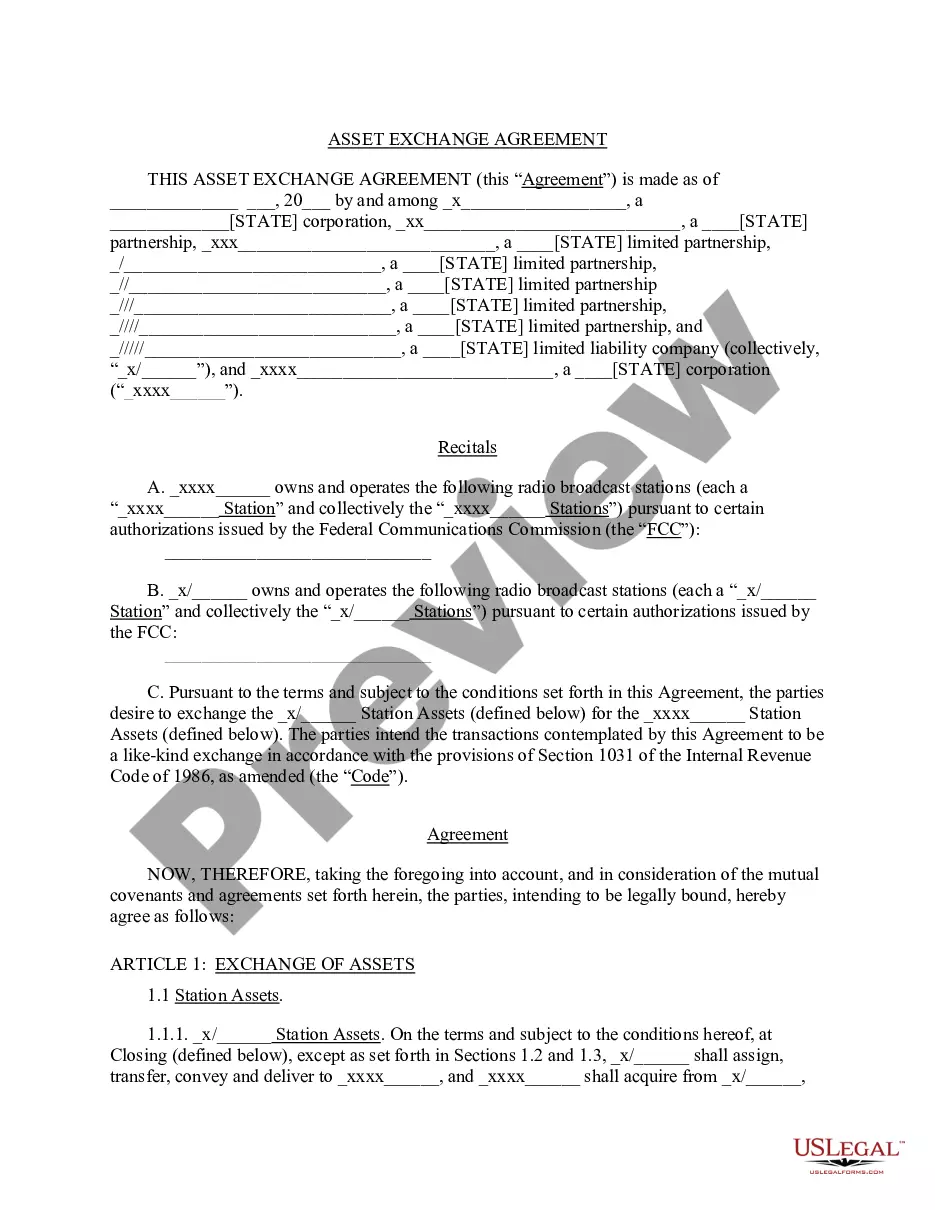

How to fill out General Form Of Revocable Trust Agreement?

You can spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal documents that can be reviewed by professionals.

You can obtain or print the Montana General Form of Revocable Trust Agreement through my assistance.

To find another version of the form, use the Search field to locate the template that meets your needs.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, edit, print, or sign the Montana General Form of Revocable Trust Agreement.

- Every legal document template you obtain is yours forever.

- To get an additional copy of the downloaded form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/city of choice.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

A revocable document refers to any legal document that can be altered or revoked during the lifetime of the individual who created it. In the context of estate planning, a Montana General Form of Revocable Trust Agreement is a prime example, allowing you to make changes as needed without complicated procedures. Additionally, such documents provide flexibility in managing your estate, reflecting your evolving wishes. Understanding these documents is crucial for effective estate management.

A revocable trust document is the legal instrument that establishes your revocable trust. Specifically, a Montana General Form of Revocable Trust Agreement details how you want your assets managed during your lifetime and how they should be distributed after your passing. This document outlines your wishes, including the appointment of trustees and beneficiaries, to ensure everything aligns with your intentions. It's a vital part of any comprehensive estate plan.

While a revocable trust offers various benefits, there are some downsides to consider. For instance, a Montana General Form of Revocable Trust Agreement does not protect your assets from creditors since you maintain control over them. Additionally, setting up a trust can involve legal fees and requires ongoing management, which some individuals may find burdensome. It is essential to weigh these considerations against the advantages of having a trust in place.

The main purpose of a revocable trust is to manage your assets during your lifetime and dictate their distribution after your death. A Montana General Form of Revocable Trust Agreement allows you to retain control over your assets, making changes whenever needed, while also avoiding the lengthy probate process. This type of trust can also provide privacy, as it does not become a matter of public record. Overall, it helps ensure that your estate is handled according to your wishes.

Suze Orman emphasizes the importance of having a revocable trust as part of your estate planning. She highlights that a Montana General Form of Revocable Trust Agreement allows individuals to maintain control of their assets while benefiting from flexibility. According to her, it ensures your wishes are honored and can simplify the distribution process for your heirs. By utilizing such a trust, you can reduce anxiety about the future for both yourself and your loved ones.

Typically, you should avoid putting assets like retirement accounts or life insurance policies in your revocable trust, as they often have designated beneficiaries. Additionally, personal property that you may want to distribute differently should also be considered separately. The Montana General Form of Revocable Trust Agreement can help you identify the right assets for inclusion and ensure your overall estate plan is effective.

Drafting a trust document involves clearly outlining your assets, choosing a trustworthy trustee, and defining the terms of the trust. You can use the Montana General Form of Revocable Trust Agreement as a template to guide you through this process. Always ensure that the document captures your intentions accurately and complies with Montana state laws.

Including bank accounts in your revocable trust can simplify the transfer of assets upon your passing, according to the Montana General Form of Revocable Trust Agreement. This strategy may help avoid probate, ensuring that your beneficiaries receive their inheritance more quickly. However, it is wise to consider the implications on your daily management of these accounts.

Yes, you can create a revocable trust on your own using resources like the Montana General Form of Revocable Trust Agreement. However, it is important to understand the legal requirements and implications involved. Working with a qualified attorney can ensure your trust meets all necessary regulations and addresses your specific needs.

Filing a revocable trust tax return involves including the trust's income on your personal tax return, as it is not considered a separate tax entity. Use Form 1040 to report this income, while incorporating the details from your Montana General Form of Revocable Trust Agreement. To ensure accuracy, utilize tax software or consult professionals who can provide clarity and guidance.