An irrevocable trust is one that generally cannot be changed or canceled once it is set up without the consent of the beneficiary. Contributions cannot be taken out of the trust by the trustor. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montana General Form of Irrevocable Trust Agreement

Description

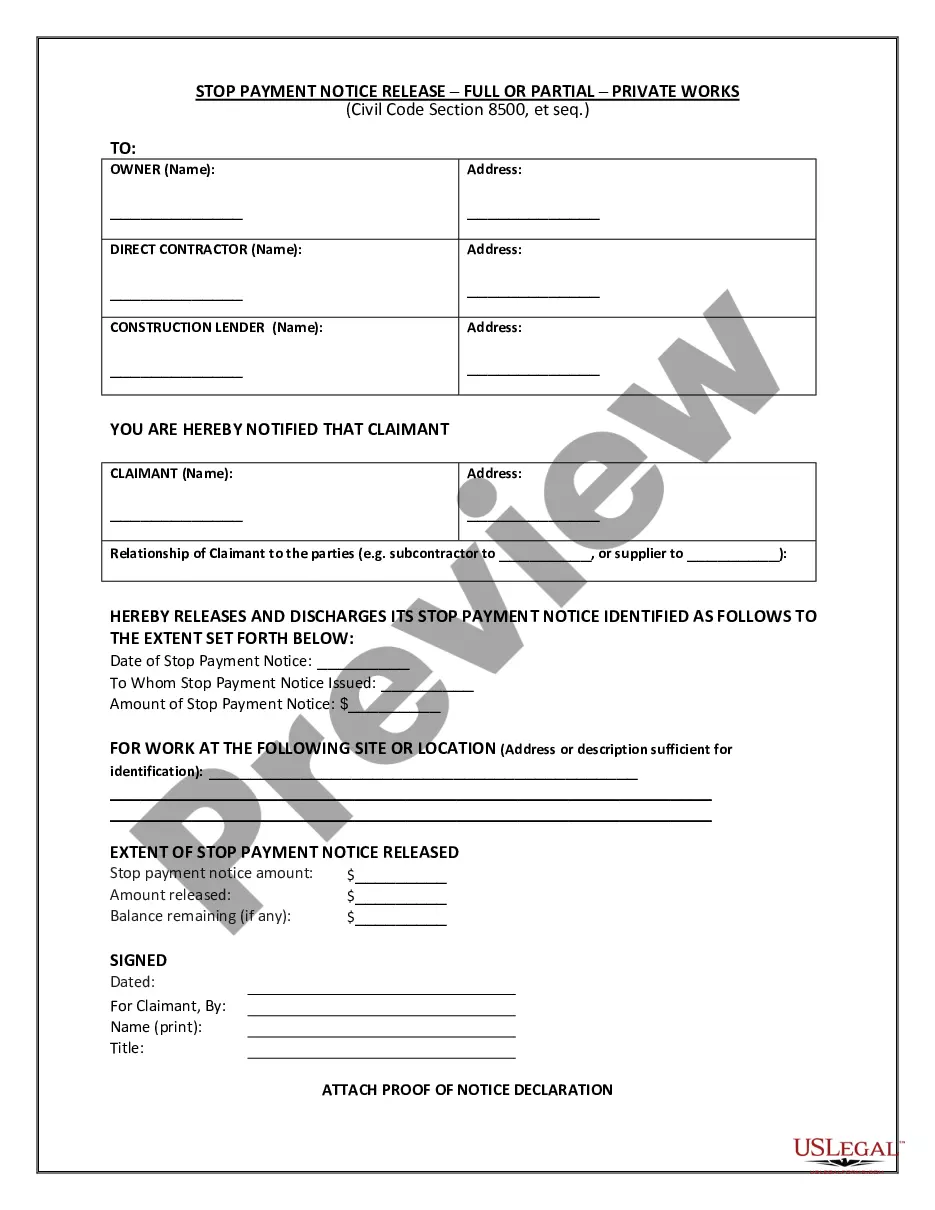

How to fill out General Form Of Irrevocable Trust Agreement?

If you wish to acquire, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's simple and user-friendly search to obtain the documents you need. A variety of templates for business and personal purposes are categorized by types and states, or by keywords.

Make use of US Legal Forms to access the Montana General Form of Irrevocable Trust Agreement in just a few clicks.

Every legal document template you purchase becomes your property permanently. You will have access to all forms you acquired within your account. Navigate to the My documents section and select a form to print or download again.

Complete and download, and print the Montana General Form of Irrevocable Trust Agreement with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are an existing US Legal Forms user, Log In to your account and then click the Download button to find the Montana General Form of Irrevocable Trust Agreement.

- You can also access forms you previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure that you have selected the form for your correct city/state.

- Step 2. Use the Review option to examine the form's content. Make sure to read the summary.

- Step 3. If you are not satisfied with the document, utilize the Search field at the top of the screen to find different versions of the legal document template.

- Step 4. Once you have identified the form you need, click the Buy now button. Choose your preferred pricing plan and provide your details to sign up for the account.

- Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Montana General Form of Irrevocable Trust Agreement.

Form popularity

FAQ

Recent changes in law regarding irrevocable trusts can impact your estate planning strategy, especially with a Montana General Form of Irrevocable Trust Agreement. These new regulations focus on improving transparency and ease of management, ultimately assisting you in safeguarding your assets. It's important to stay informed about these updates, as they may provide new options or requirements for trust administration. Utilizing platforms like US Legal Forms can help you navigate these changes effectively.

When considering a Montana General Form of Irrevocable Trust Agreement, it's crucial to know which assets may not be suitable for placement. Typically, assets that are intended for personal use, such as your primary residence or vehicles, should be approached with caution. Additionally, assets that are difficult to transfer or have complex ownership structures may not be appropriate. It's wise to consult with a legal expert to determine the best approach for your specific situation.

The major disadvantage of a trust is the complexity and potential costs associated with setting it up and maintaining it. A Montana General Form of Irrevocable Trust Agreement requires careful drafting and legal expertise, which can involve considerable fees. Additionally, noncompliance with legal requirements can lead to significant issues down the line, so ongoing management is necessary.

It can be advantageous for your parents to place their assets in a trust, especially a Montana General Form of Irrevocable Trust Agreement. Doing so can provide asset protection, minimize estate taxes, and specify how and when assets are distributed. However, it's essential to evaluate their specific needs and financial situations before making this decision.

The biggest mistake parents often make is not clearly communicating their intentions with potential beneficiaries. When setting up a Montana General Form of Irrevocable Trust Agreement, transparency is crucial. Failing to outline how the trust operates and the reasons behind its creation can lead to misunderstandings and family conflict. Establishing open dialogue can alleviate these issues.

A family trust, while beneficial for managing assets, can also bring about potential disadvantages, such as limited control. Once you place assets into a Montana General Form of Irrevocable Trust Agreement, you lose the ability to use those assets as you see fit. Additionally, family dynamics can complicate the situation, leading to disputes among beneficiaries if expectations are misaligned.

One significant downfall of having a trust is the lack of flexibility once it is established. With a Montana General Form of Irrevocable Trust Agreement, you cannot easily modify or dissolve the trust without following strict legal procedures. This can lead to challenges if your financial situation or intentions change. It's important to weigh these aspects before making a decision.

Yes, you can establish an irrevocable trust for yourself, but it is crucial to understand what that entails. Once you create a Montana General Form of Irrevocable Trust Agreement, you relinquish control over the assets placed in it. Therefore, this type of trust is often used for specific purposes, such as asset protection and tax benefits, but should be made with careful consideration.

The recent changes to the regulations on irrevocable trusts focus primarily on tax implications and reporting requirements. These updates can significantly impact the way assets are managed within a Montana General Form of Irrevocable Trust Agreement. It is essential to stay informed about these changes, as they may influence both estate planning and distribution strategies. Consulting with a legal expert can help you navigate these new rules effectively.

To file a trust in Montana, you need to create a written trust document, such as the Montana General Form of Irrevocable Trust Agreement, detailing the terms and assets involved. After drafting the document, submit it to the appropriate county authorities if required, and fund the trust. Consider using professionals like US Legal Forms to simplify and ensure compliance with all necessary legal steps.