The "look through" trust can affords long term IRA deferrals and special protection or tax benefits for the family. But, as with all specialized tools, you must use it only in the right situation. If the IRA participant names a trust as beneficiary, and the trust meets certain requirements, for purposes of calculating minimum distributions after death, one can "look through" the trust and treat the trust beneficiary as the designated beneficiary of the IRA. You can then use the beneficiary's life expectancy to calculate minimum distributions. Were it not for this "look through" rule, the IRA or plan assets would have to be paid out over a much shorter period after the owner's death, thereby losing long term deferral.

Montana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account

Description

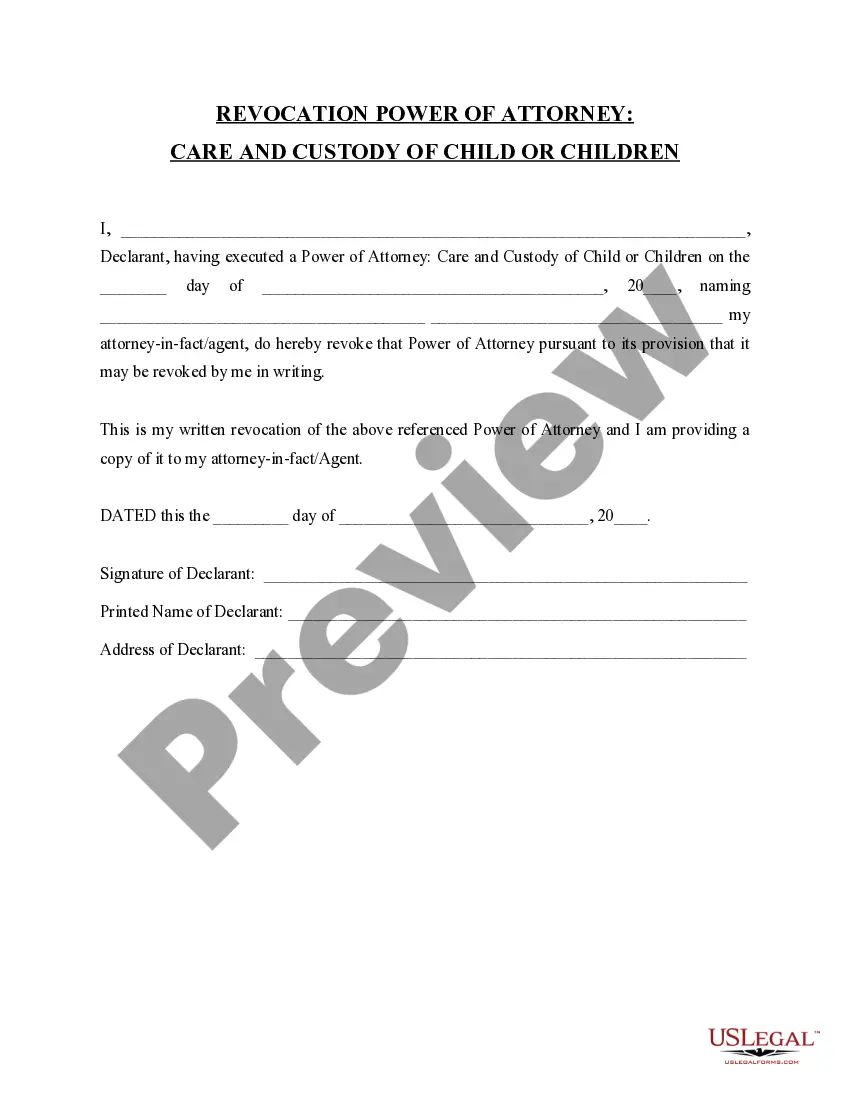

How to fill out Irrevocable Trust As Designated Beneficiary Of An Individual Retirement Account?

Are you situated in a location where you frequently require documents for either business or personal purposes? There are numerous official document templates accessible online, but finding forms you can trust isn’t simple.

US Legal Forms provides an extensive array of document templates, such as the Montana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, that are designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Afterwards, you can download the Montana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account template.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents list. You can download another copy of the Montana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account whenever needed. Simply click the desired form to download or print the document template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct city/region.

- Utilize the Review option to assess the form.

- Examine the summary to confirm you have selected the appropriate form.

- If the form isn’t what you need, use the Search field to find the form that meets your needs and specifications.

- Once you find the correct form, click Buy now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

The real beneficiary of an account is the person or entity that will receive the account's benefits upon your passing. This can include individuals or a Montana Irrevocable Trust as designated beneficiary of an Individual Retirement Account. Defining this clearly in your beneficiary designations is crucial, as it determines how your assets will be managed and distributed after your death.

The beneficiary of a solo 401k is the person or entity you name to receive the account's assets upon your death. You can designate individuals or a Montana Irrevocable Trust as the beneficiary. Utilizing a trust can offer enhanced control over how and when the funds are distributed, particularly in line with your estate planning goals.

The beneficiary of an Individual Retirement Account is the person or entity you specify to receive the account’s funds after your death. You can choose individuals, such as family members, or a Montana Irrevocable Trust as a designated beneficiary of an Individual Retirement Account. It is important to revisit this designation periodically, especially after major life changes, to ensure it reflects your intentions.

The beneficiary of an individual retirement annuity is typically the individual you designate to receive the annuity's benefits upon your passing. This designation can include a spouse, children, or even a Montana Irrevocable Trust as the designated beneficiary of an Individual Retirement Account. This choice can impact tax implications and how funds are distributed, so choose wisely to align with your overall estate planning strategy.

Filling out a beneficiary designation is a straightforward process. First, obtain the designated form from your IRA provider. Clearly identify the beneficiary’s name, contact information, and their relationship to you. If you are considering a Montana Irrevocable Trust as a designated beneficiary of your Individual Retirement Account, ensure you provide the trust's full name and date of establishment to avoid complications.

Choosing between a spouse or a Montana Irrevocable Trust as the designated beneficiary of an Individual Retirement Account depends on your specific financial goals and circumstances. A spouse may have certain advantages, such as the ability to roll over the account into their name. However, naming a Montana Irrevocable Trust can provide more control over distributions and can help manage tax implications. It’s essential to consult a financial advisor to determine the best option for your situation.

Choosing to name a Montana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can be beneficial, depending on your financial situation and goals. This decision can offer protection for your heirs and provide specific instructions for fund distribution. However, it is essential to evaluate your overall estate plan and possibly consult a professional to ensure that this choice aligns with your objectives and needs.

Yes, you can name a Montana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. This approach allows you to control how the funds are distributed to your beneficiaries after your death. Trusts can provide better asset protection and can help manage your estate according to your wishes, making them an effective option for many estate plans.

When you name a Montana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, the trust will receive the funds upon your passing. This means that the 401k's value may be placed into the trust, potentially benefiting your heirs according to the trust's terms. However, this arrangement can lead to complex tax implications, so it is wise to consult a legal or financial expert who understands the nuances of estate planning.

Naming a trust as the beneficiary can offer various advantages, such as maintaining control over the distribution of assets. Designating a Montana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can protect your heirs and ensure funds are used as intended. Additionally, this strategy can help minimize taxes and preserve benefits for family members who need assistance.