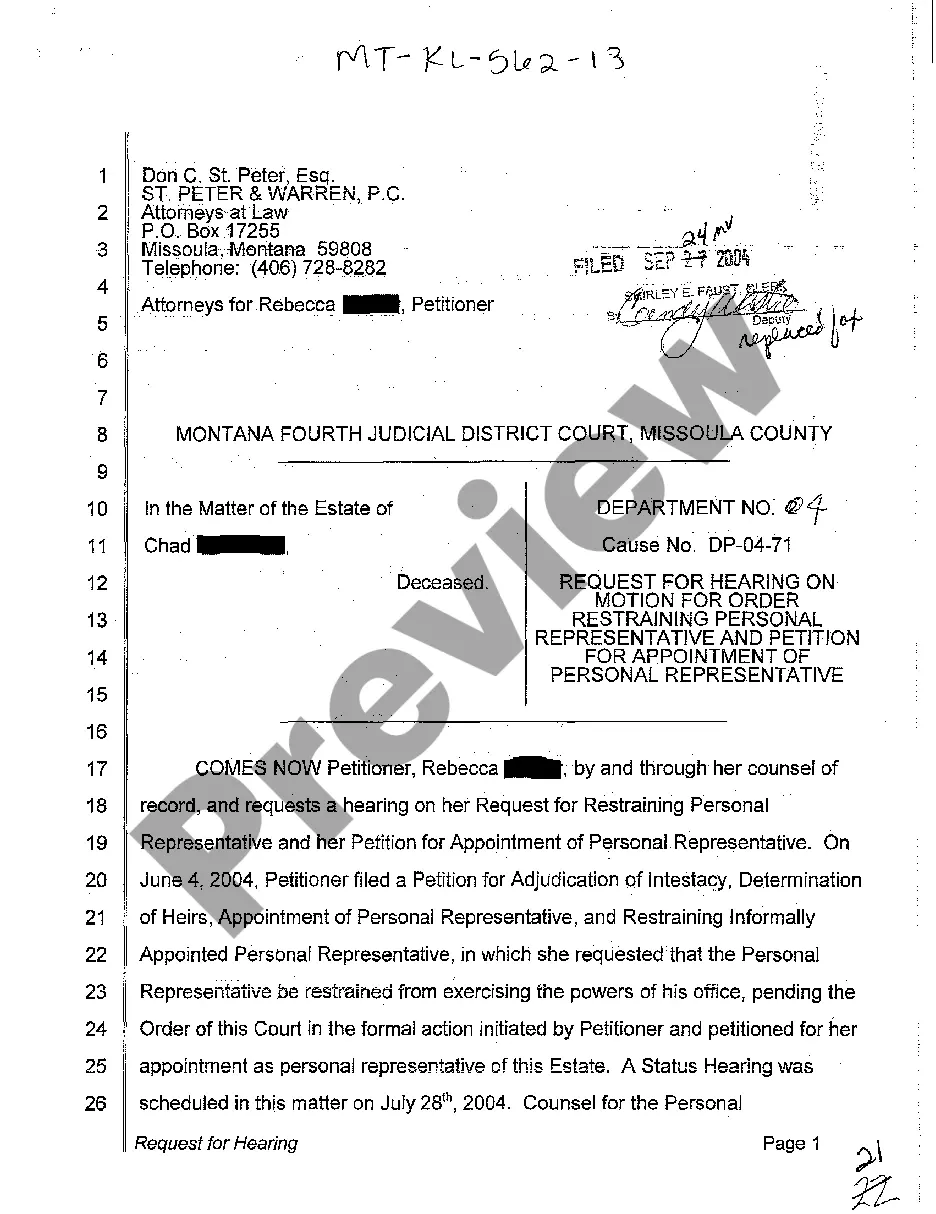

Montana Request for Hearing on Motion for Order Restraining Personal Representative and Petition for Appointment of Personal Representative

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Montana Request For Hearing On Motion For Order Restraining Personal Representative And Petition For Appointment Of Personal Representative?

Obtain a printable Montana Request for Hearing on Motion for Order Restricting Personal Representative and Petition for Appointment of Personal Representative with just a few clicks from the most extensive collection of legal electronic documents.

Discover, download, and print expertly prepared and certified templates on the US Legal Forms website. US Legal Forms has been the leading provider of cost-effective legal and tax forms for US citizens and residents online since 1997.

After downloading your Montana Request for Hearing on Motion for Order Restricting Personal Representative and Petition for Appointment of Personal Representative, you can complete it in any online editor or print it out and fill it in by hand. Utilize US Legal Forms to access 85,000 professionally drafted, state-specific documents.

- Clients who already have a subscription must Log In directly to their US Legal Forms account, download the Montana Request for Hearing on Motion for Order Restricting Personal Representative and Petition for Appointment of Personal Representative, and find it stored in the My documents section.

- Individuals without a subscription should follow the instructions outlined below.

- Ensure your template complies with your state’s regulations.

- If available, review the form’s summary to learn more.

- If provided, preview the document to see additional content.

- Once you confirm the form suits your needs, simply click Buy Now.

- Create a personal account.

- Choose a plan.

- Make payment through PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

Yes he can sue on behalf of the estate.

-712 provides that if the exercise of power concerning the estate is improper, the personal representative is liable to interested persons for damage or loss resulting from breach of fiduciary duty to the same extent as a trustee of an express trust. This means that if you are an interested party and you have

The process of removing a personal representative begins with filing a petition or removal. An heir or interested party must file the petition with the probate court and serve a copy of the petition on the personal representative. The probate court schedules a hearing date and time to hear the matter.

Under California Probate Code, the executor typically receives 4% on the first $100,000, 3% on the next $100,000 and 2% on the next $800,000, says William Sweeney, a California-based probate attorney. For an estate worth $600,000 the fee works out at approximately $15,000.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.

If a deceased specifically names a person or institution to act for him or her in his or her will, and if the will is accepted as valid, the named personal representative is known as the executor (male) or executrix (female).Corporate entities (banks and trust companies) are also called executors.

A personal representative in California is entitled to compensation for ordinary services provided to the estate. California Probate Code § 10800. These fees are also called statutory fees, because they are provided by statute.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

You can do this by simply signing your name and putting your title of executor of the estate afterward. One example of an acceptable signature would be Signed by Jane Doe, Executor of the Estate of John Doe, Deceased. Of course, many institutions may not simply take your word that you are the executor of the estate.