Washington Attachment for Residential Split Adjustment is a form used by Washington State homeowners to adjust their residential property tax assessments when their properties are split. This form is used when the owner has split their home into two or more residential properties, either for sale or rental, and the Tax Assessor has not yet identified the separate properties. The form is used to adjust the tax assessment for the separate properties and to ensure that the owner is not over-taxed. There are two types of Washington Attachment for Residential Split Adjustment: Primary Residential Attachment and Secondary Residential Attachment. The Primary Residential Attachment is used when two or more properties are split for sale or lease, and the tax assessment must be adjusted. The Secondary Residential Attachment is used when a property is split for rental purposes only, and the tax assessment must still be adjusted. Both forms must be completed and submitted to the Tax Assessor to finalize the adjustment.

Washington Attachment for Residential Split Adjustment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Washington Attachment For Residential Split Adjustment?

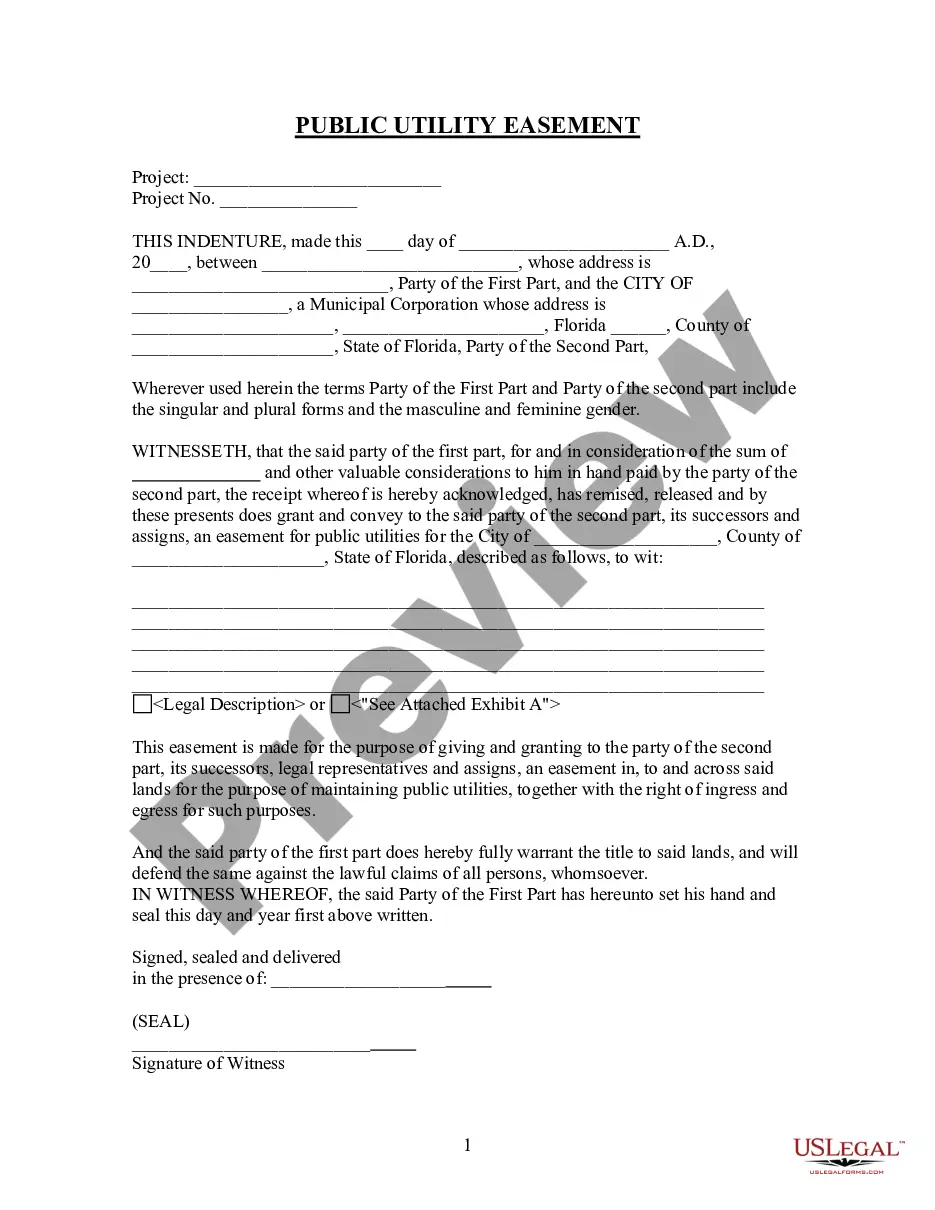

If you’re searching for a way to properly prepare the Washington Attachment for Residential Split Adjustment without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every private and business scenario. Every piece of paperwork you find on our web service is created in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Follow these straightforward instructions on how to obtain the ready-to-use Washington Attachment for Residential Split Adjustment:

- Make sure the document you see on the page meets your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the form name in the Search tab on the top of the page and select your state from the dropdown to locate another template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Washington Attachment for Residential Split Adjustment and download it by clicking the appropriate button.

- Import your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

When a parent is awarded primary physical custody of a child (custodial parent), the other (noncustodial) parent will have regular visitation rights under Washington's child custody guidelines. At a minimum, the noncustodial parent must receive one weeknight visit and every other weekend.

The statute provides for a review and potential adjustment of child support every two years. If 24 months have passed from the date of the entry of the child support order or since the last modification (whichever is latest), the order may be adjusted without a showing of substantially changed circumstances.

Even with 50/50 shared custody, the economically stronger parent will often be ordered to pay child support to the economically weaker parent.

Who Pays Child Support? In typical circumstances, the noncustodial parent (the parent who has the kids for less than 50% of the time) pays support to the custodial parent. When child support is being calculated by the court, the custodial parent is expected to pay child support too.

Typically, the noncustodial parent (parent who spends less than 50 percent of the time with the child) pays child support. The custodial parent (parent who lives with the child) is responsible for child support too, but Washington child support laws assume that the custodial parent spends money directly on the child.

Generally, a Motion to Adjust is quicker than a petition. It can take a month or less. How long a Petition to Modify Child Support Order takes will depend in part on the county you are filing in, if the other parent lives in Washington, and how you have your court papers served on them.

In Washington, you can choose how to set up your residential plan. You can choose to do a joint custody plan, such as a 50/50 residential plan, or you can choose to do a sole custody plan. The courts encourage parents to design parenting plans themselves whenever possible.

The factors include the number of children, their ages, and the incomes of the parents. Depending on the variables plugged into the formula, the base child support payment will be anywhere from $200 up to $3,500 per month.