Mississippi Tenant Improvement Lease

Description

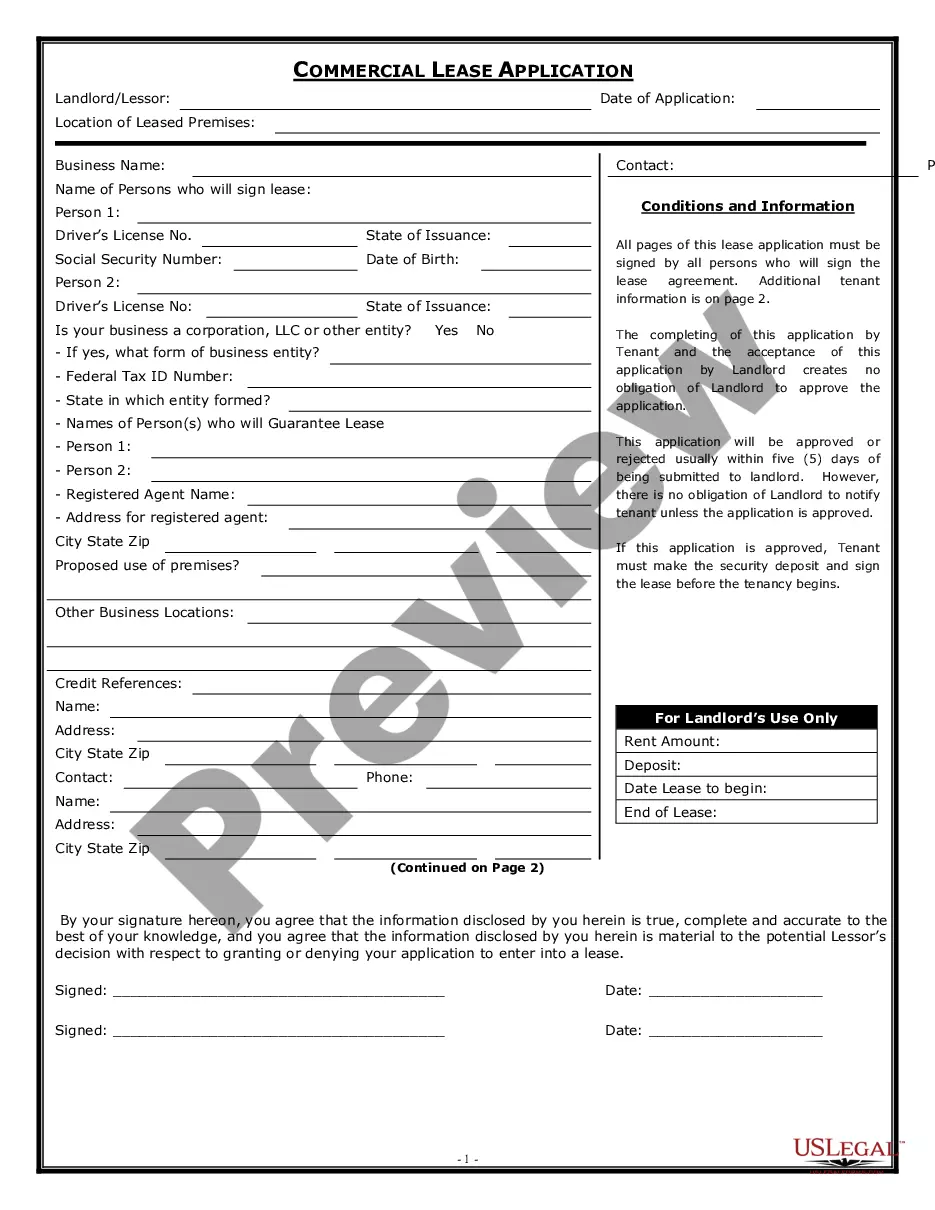

How to fill out Tenant Improvement Lease?

US Legal Forms - among the largest libraries of authorized types in America - delivers a wide array of authorized record themes you may obtain or produce. Using the web site, you will get a large number of types for business and specific reasons, sorted by categories, states, or keywords and phrases.You will find the most recent types of types like the Mississippi Tenant Improvement Lease in seconds.

If you already have a registration, log in and obtain Mississippi Tenant Improvement Lease from your US Legal Forms collection. The Down load switch will appear on every develop you view. You have access to all previously saved types within the My Forms tab of your respective account.

If you would like use US Legal Forms the first time, here are simple guidelines to obtain started out:

- Be sure you have selected the best develop for your personal city/area. Click the Review switch to analyze the form`s information. Browse the develop information to ensure that you have chosen the right develop.

- In the event the develop does not match your needs, make use of the Search discipline at the top of the display to obtain the one which does.

- In case you are pleased with the form, verify your option by clicking on the Purchase now switch. Then, select the prices program you like and give your qualifications to register to have an account.

- Procedure the purchase. Utilize your Visa or Mastercard or PayPal account to finish the purchase.

- Choose the formatting and obtain the form in your gadget.

- Make modifications. Fill up, change and produce and indicator the saved Mississippi Tenant Improvement Lease.

Every web template you included with your bank account does not have an expiry date which is the one you have permanently. So, if you want to obtain or produce one more backup, just visit the My Forms area and then click about the develop you will need.

Obtain access to the Mississippi Tenant Improvement Lease with US Legal Forms, one of the most substantial collection of authorized record themes. Use a large number of specialist and status-particular themes that meet your small business or specific requires and needs.

Form popularity

FAQ

In most cases, it's calculated based on the property's square footage. For instance, a landlord could agree to pay for $25 per square foot in the commercial space. If the space is 3,000 square feet in size, the tenant would agree to pay around $75,000 in construction costs to the tenant.

Landlords allow tenant improvement allowance to cover both hard and soft costs of any renovation to the rented space. Hard costs are improvements to the property that the tenant will leave behind that benefit the landlord. Examples of hard costs include new flooring, electrics, HVAC, windows, framing, and doors.

TIA is typically expressed as a per square foot amount. For example, if a landlord is offering $20.00 per square foot on a 2,500 square foot commercial space, the landlord has agreed to reimburse the tenant for $50,000 worth of construction costs.

From an accounting standpoint, leasehold improvements must be capitalized on the balance sheet, meaning the cost of the improvements is spread out over time in line with the company's use of space.

What are some examples of TI's? Every business has specific needs and TI's enable them to customize a lease space to meet specific needs. Some examples of TI's include adding walled offices, a break room or kitchen, an additional bathroom, conference rooms, drop ceilings and painting.

A key to maximizing deductions for tenant improvements is to properly characterize the property purchased as to whether it is personal property (e.g., equipment) that qualifies for more favorable tax benefits (faster depreciation over five or seven years), or real property (walls and structural components) that must ...

If the lessee owns the improvements, then the lessee initially records the allowance as an incentive (which is a deferred credit), and amortizes it over the lesser of either the term of the lease or the useful life of the improvements, with no residual value.