Mississippi Performance Evaluation for Nonexempt Employees

Description

How to fill out Performance Evaluation For Nonexempt Employees?

Selecting the appropriate sanctioned document template can be a challenge. Naturally, there are numerous designs available online, but how can you find the legal form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Mississippi Performance Review for Nonexempt Employees, that can be utilized for professional and personal purposes. All forms are vetted by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Mississippi Performance Review for Nonexempt Employees. Use your account to browse the legal forms you have previously purchased. Go to the My documents tab in your account and retrieve another copy of the document you need.

Choose the document format and download the legal document template to your device. Complete, edit, print, and sign the acquired Mississippi Performance Review for Nonexempt Employees. US Legal Forms is the largest repository of legal forms where you can find various document templates. Take advantage of the service to obtain professionally crafted documents that comply with state regulations.

- First, ensure you have picked the correct form for your region/locality.

- You can view the form using the Preview option and read the form description to make sure it is suitable for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are confident that the form is correct, click on the Buy now button to acquire the form.

- Select the pricing plan you wish and input the required information.

- Create your account and complete your purchase using your PayPal account or credit card.

Form popularity

FAQ

Exempt Employees must meet basic salary threshold of $913/week $47,476/year) and meet applicable Department of Labor Tests for executive exemption, administrative exemption, professional exemption, or computer exemption. Exempt employees are paid a salary that covers the amount of time required to perform the job.

Executive, administrative, professional and outside sales employees: (as defined in Department of Labor regulations) and who are paid on a salary basis are exempt from both the minimum wage and overtime provisions of the FLSA.

10 Easy Ways to Evaluate an Employee's PerformanceLevel of execution.Quality of work.Level of creativity.Amount of consistent improvement.Customer and peer feedback.Sales revenue generated.Responsiveness to feedback.Ability to take ownership.More items...

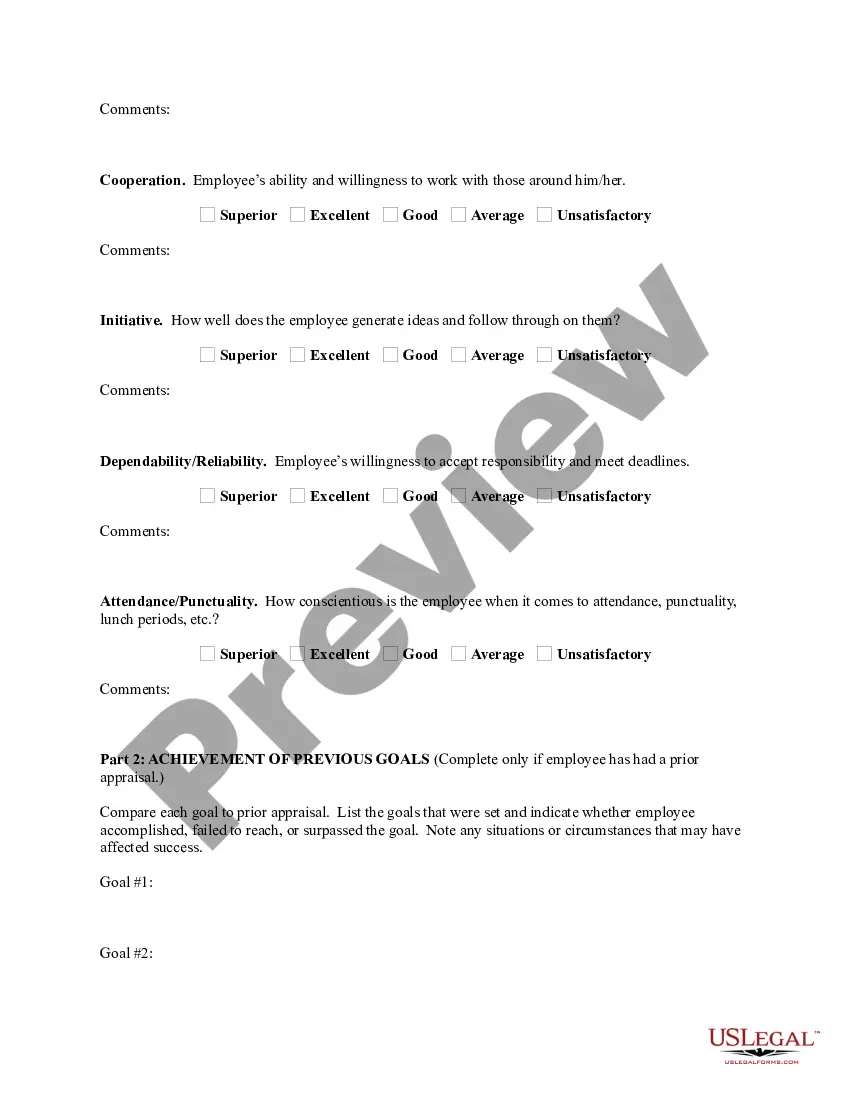

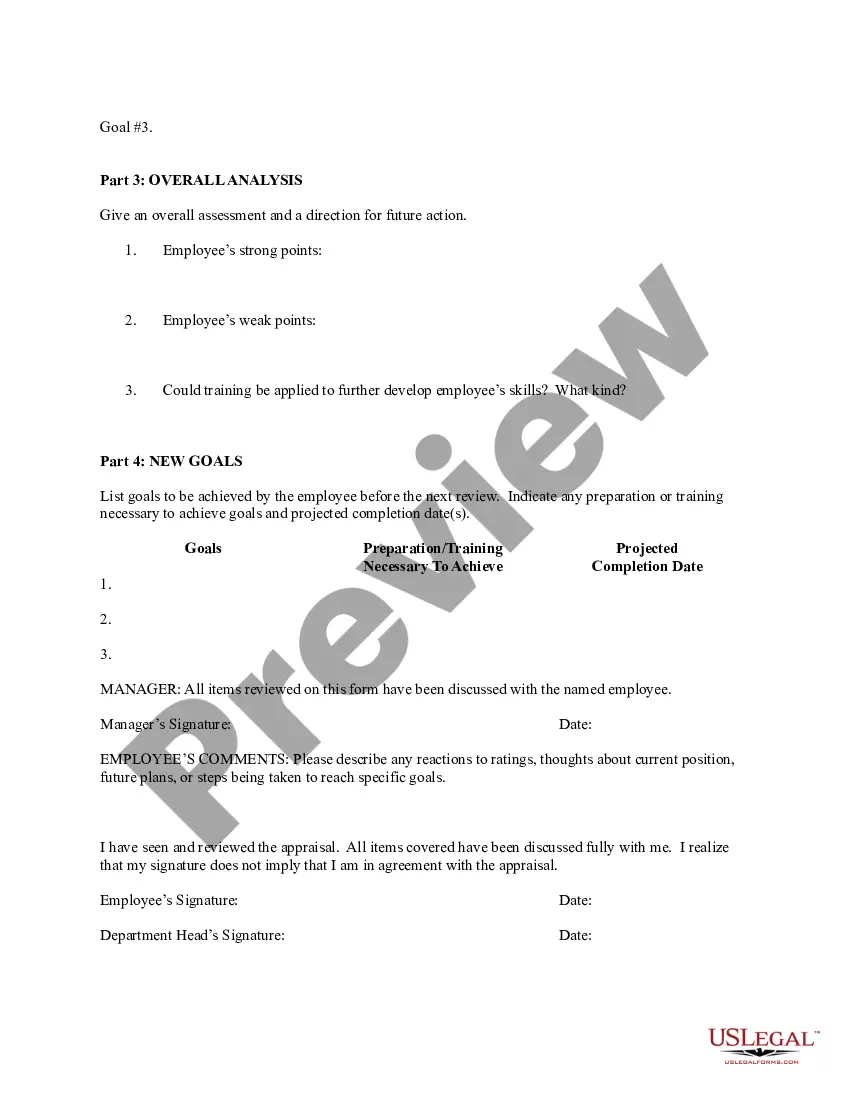

In an employee performance review, managers evaluate that individual's overall performance, identify their strengths and weaknesses, offer feedback, and help them set goals. Employees typically have the opportunity to ask questions and share feedback with their manager as well.

Why Employers Use Employee Evaluations Regular employee evaluation helps remind workers what their managers expect in the workplace. They provide employers with information to use when making employment decisions, such as promotions, pay raises, and layoffs.

In fact, employees' right to discuss their salary is protected by law. While employers may restrict workers from discussing their salary in front of customers or during work, they cannot prohibit employees from talking about pay on their own time.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

As a general rule, most companies conduct performance reviews every 3-6 months. This keeps employees' focused and motivated, and ensures feedback is relevant and timely.

Who is eligible for overtime pay? To qualify as an exempt employee one who does not receive overtime pay staff members must meet all the requirements under the duties and salary basis tests.

An employer must thereafter evaluate the productivity of each worker with a disability who is paid an hourly commensurate wage rate at least every 6 months, or whenever there is a change in the methods or materials used or the worker changes jobs.