Mississippi Performance Evaluation for Exempt Employees

Description

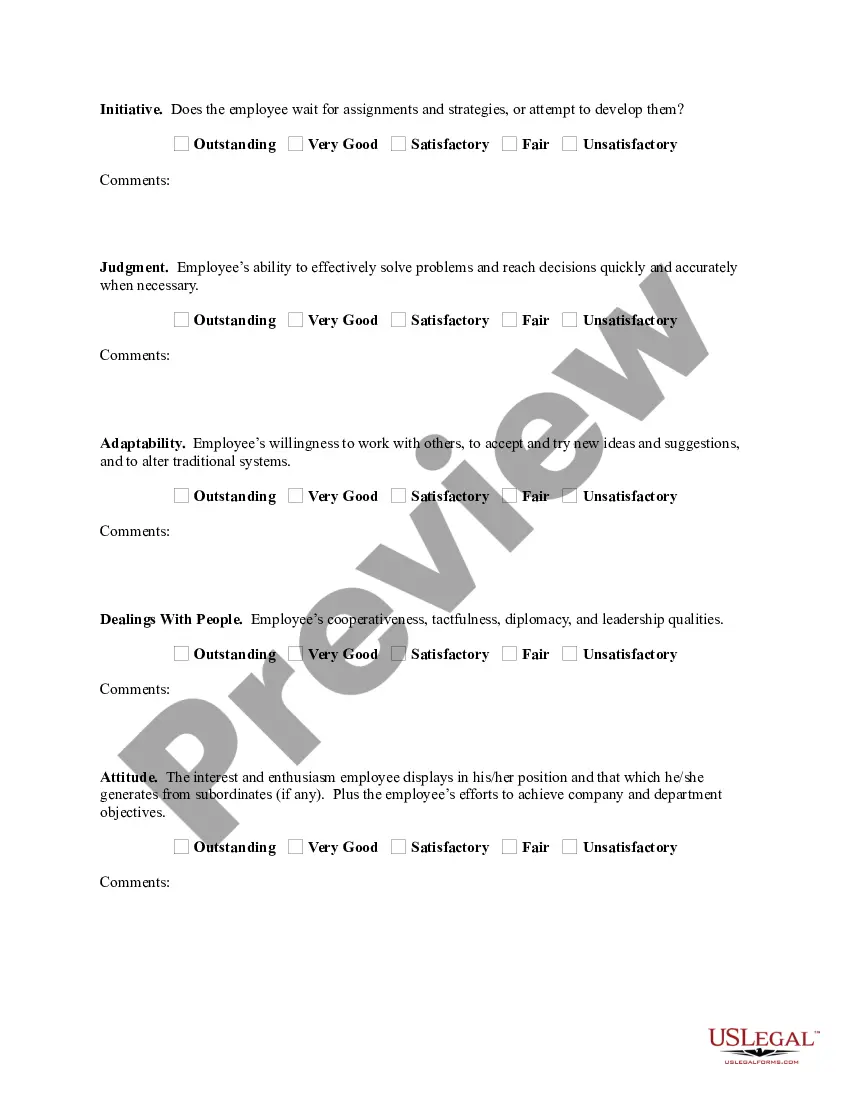

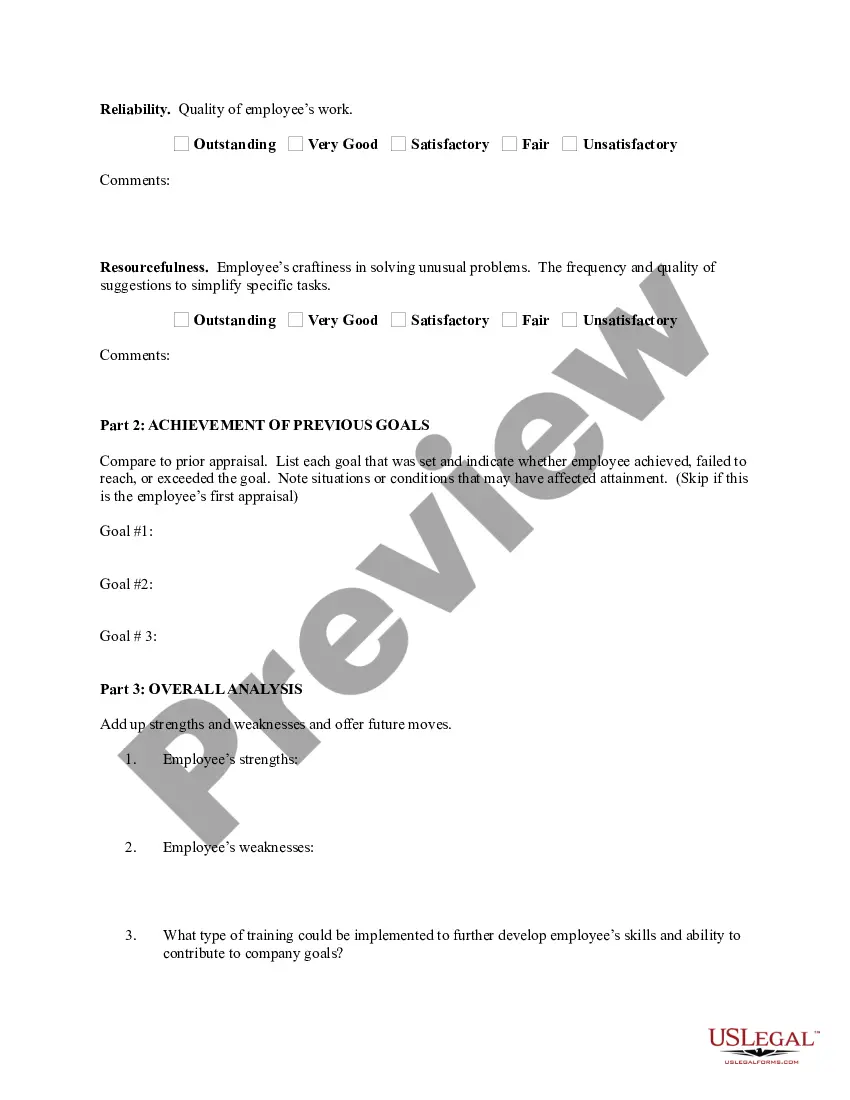

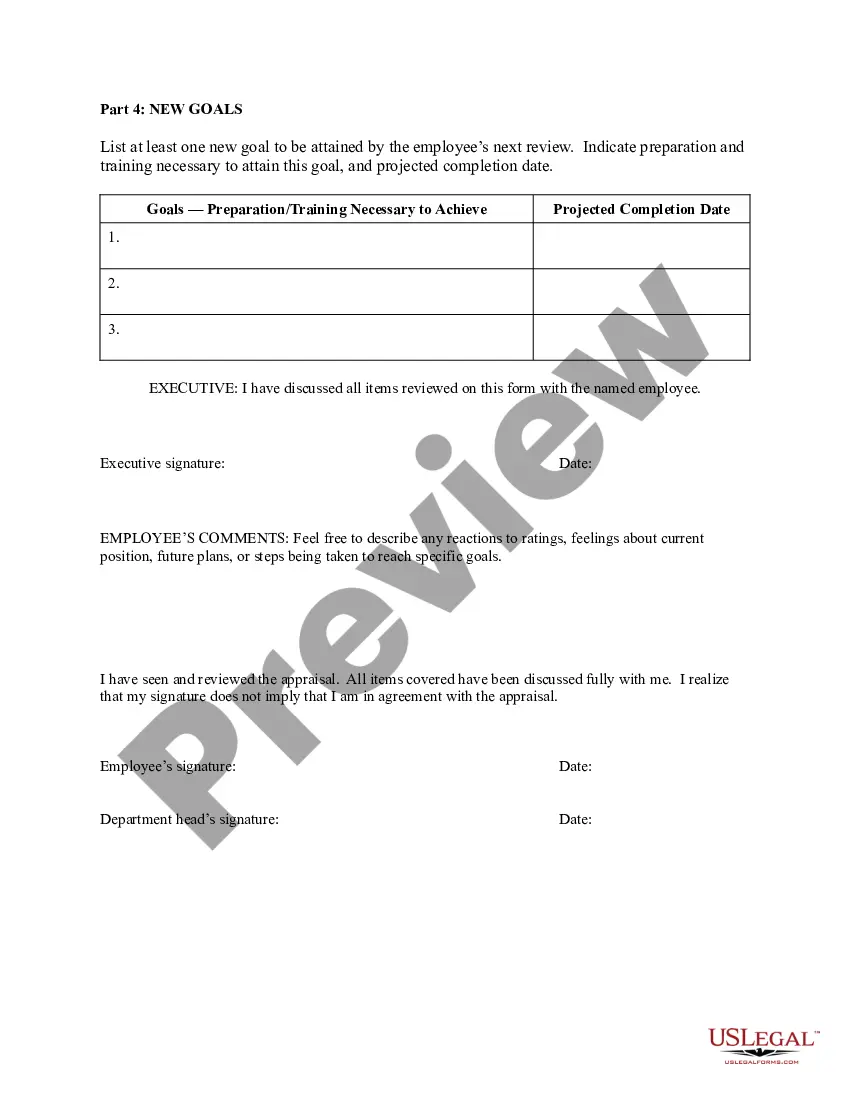

How to fill out Performance Evaluation For Exempt Employees?

Finding the suitable legal documents template can be a challenge.

Of course, there are numerous designs available online, but how will you discover the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Mississippi Performance Assessment for Exempt Employees, which can be used for business and personal purposes.

If the form does not meet your expectations, use the Search field to find the appropriate form. Once you are certain the form is suitable, click the Purchase now button to acquire it. Choose the pricing plan you prefer and enter the required details. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal documents template to your device. Complete, edit, print, and sign the obtained Mississippi Performance Assessment for Exempt Employees. US Legal Forms is the largest database of legal documents where you can locate various paper templates. Leverage this service to obtain properly crafted documents that meet state requirements.

- All forms are verified by professionals and adhere to state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Mississippi Performance Assessment for Exempt Employees.

- You can use your account to browse the legal forms you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/county. You can review the template using the Preview button and read the document description to confirm it’s the right one for you.

Form popularity

FAQ

Starting July 1, 2025, several labor regulations in Mississippi will come into effect, significantly impacting the Mississippi Performance Evaluation for Exempt Employees. These changes may involve updates to employee benefits and classification criteria. Businesses must stay informed about these laws to ensure compliance and to align their evaluation processes accordingly. Uslegalforms can provide clarity on how these laws affect your business practices.

In the context of Mississippi Performance Evaluation for Exempt Employees, there is no specific limit on the number of hours a salaried employee can work. However, employers must comply with federal regulations, which may require compensation for overtime hours if the employee does not qualify as exempt. It's essential for managers to properly evaluate employee workloads to ensure fair treatment and to avoid burnout. For guidance on salaried employee classifications, consider exploring the resources available through Uslegalforms.

Performance evaluations are not mandatory, according to the U.S. Department of Labor. They are a matter between you and your employees or your employees' representative. Performance evaluations help you to determine merit increases and come up with employee development strategies.

No law requires companies to conduct job reviews, but businesses that do may have a better understanding of their employees. The information gained from performance reviews can be used to determine raises, succession plans and employee-development strategies.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

Exempt Employees must meet basic salary threshold of $913/week $47,476/year) and meet applicable Department of Labor Tests for executive exemption, administrative exemption, professional exemption, or computer exemption. Exempt employees are paid a salary that covers the amount of time required to perform the job.

An employer must thereafter evaluate the productivity of each worker with a disability who is paid an hourly commensurate wage rate at least every 6 months, or whenever there is a change in the methods or materials used or the worker changes jobs.

Under federal law, it's illegal to discriminate against a worker on the basis of age (over 40), disability, race, nationality, gender, religion or pregnancy status. Many states add additional categories to this list, too.

Performance appraisals can be highly useful in the talent management process and can help ensure that employers are doing their best to retain high-performing employees.

The Fair Labor Standards Act (FLSA) does not require performance evaluations. Performance evaluations are generally a matter of agreement between an employer and employee (or the employee's representative).