Mississippi Extended Date for Performance

Description

How to fill out Extended Date For Performance?

Are you currently in a circumstance where you require documents for either business or personal reasons nearly every working day.

There are numerous legal document templates available online, but finding ones you can rely on is not easy.

US Legal Forms offers a vast collection of form templates, such as the Mississippi Extended Date for Performance, designed to comply with federal and state regulations.

Once you find the appropriate form, click Purchase now.

Choose the pricing plan you desire, fill in the required information to complete your payment, and finalize the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Mississippi Extended Date for Performance template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you need and confirm it is for the correct area/state.

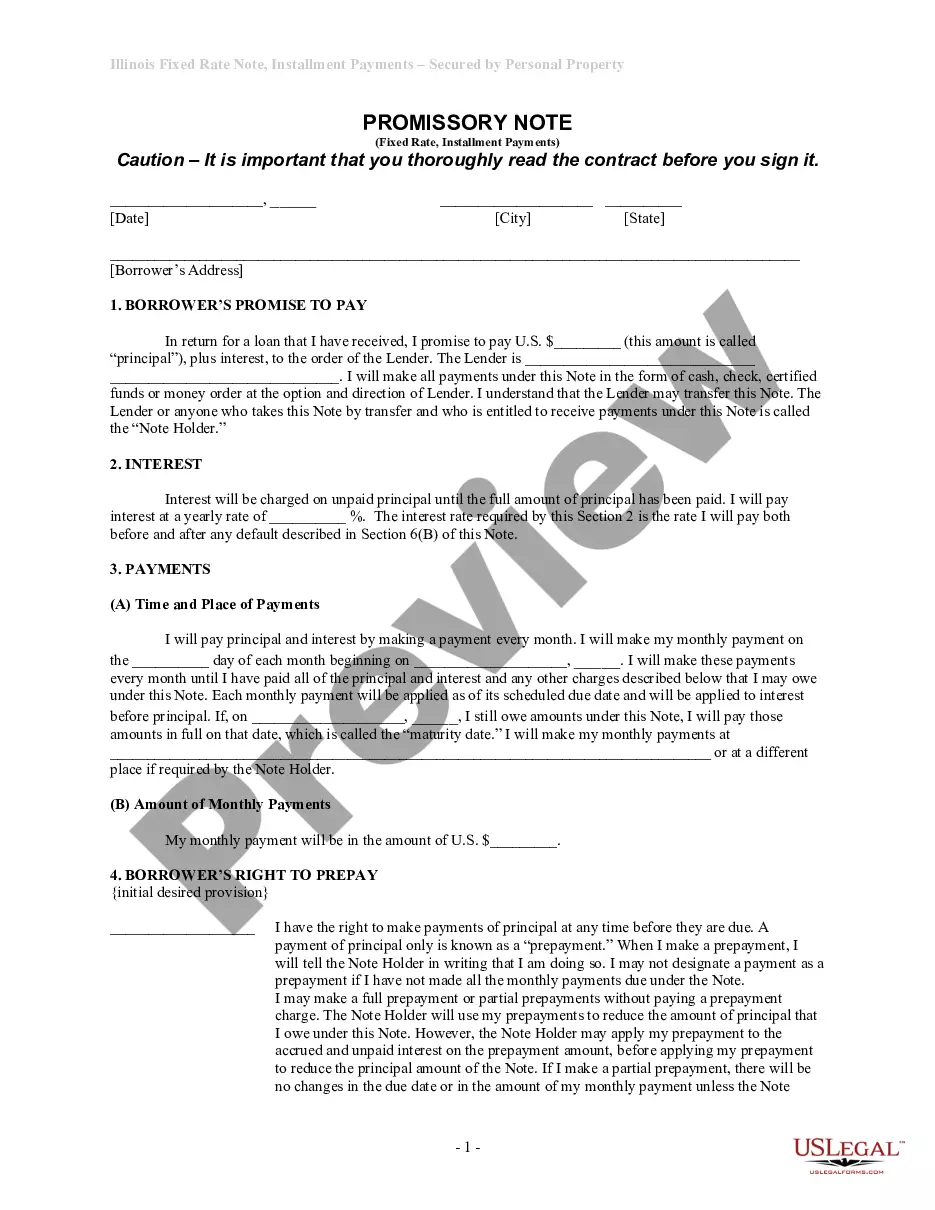

- Use the Review option to examine the form.

- Check the description to ensure you have chosen the right form.

- If the form is not what you seek, utilize the Research field to find the form that fits your needs and requirements.

Form popularity

FAQ

The extended filing deadline in Mississippi typically grants you an additional six months, pushing the due date back to November 15th. It is vital to keep track of this date to avoid penalties and interest on your tax payments. Utilize the Mississippi Extended Date for Performance to your advantage for thoughtful preparation and submission of your tax documents.

Yes, if you have tax obligations in multiple states, you will need to file an extension for each state where you owe taxes. This ensures you stay compliant with each state’s tax requirements. Understanding the specifics, such as the Mississippi Extended Date for Performance, can be helpful in managing your obligations effectively.

Filing an extension is essential if you believe you will not meet the tax deadline. An extension allows you more time to gather documentation, which can prevent errors that might lead to penalties. It is particularly important when you are concerned about meeting the Mississippi Extended Date for Performance efficiently.

Mississippi does not provide an automatic extension for filing your state taxes. Instead, you must actively file a request for an extension before the original deadline. This proactive step connects with the Mississippi Extended Date for Performance, ensuring you can file accurately and on time.

If you require more time to prepare your Mississippi tax return, filing a Mississippi extension is advisable. An extension grants you additional months to file without penalties, which can be beneficial for accurate tax presentation. Utilizing the Mississippi Extended Date for Performance can help you avoid rushing through your documentation.

Yes, if you cannot file your Mississippi state tax return by the original deadline, you should file for an extension. This extension allows you additional time to complete your return without incurring penalties. Filing for an extension also aligns with the Mississippi Extended Date for Performance, providing you with that necessary buffer for accuracy.

In Mississippi, if you fail to file your tax return by the due date, you may incur a late filing penalty. This penalty typically starts at 5% of the tax due for each month your return is late, up to a maximum of 25%. To avoid these penalties, it's crucial to understand the Mississippi Extended Date for Performance and consider filing an extension if you need more time.

When answering if you are exempt from withholding, you should consider your financial situation and income. If you had no tax liability in the previous year and expect none in the current year, you may qualify for exemption. Clearly state your status on the form, ensuring it reflects your tax situation accurately. If you require assistance, resources available through USLegalForms can help clarify your status and navigate the related processes, particularly in light of the Mississippi Extended Date for Performance.

To complete the Mississippi employee's withholding exemption form, begin by accurately listing your personal and financial details, including your name, address, and social security number. Follow the instructions carefully to indicate your exemption claims and any relevant deductions that apply to your situation. Double-check the form for errors or omissions before submission to avoid issues later on. For additional support, you can turn to USLegalForms, which provides valuable resources regarding the Mississippi Extended Date for Performance.

Filling out Mississippi employee's withholding exemption involves completing the designated form with accurate and up-to-date information about your earnings and exemptions. Make sure to check the specific guidelines provided by the Mississippi Department of Revenue to ensure compliance. It is best to review your form carefully for accuracy before submission, as mistakes can delay processing. USLegalForms can guide you through this process, especially when dealing with the Mississippi Extended Date for Performance.