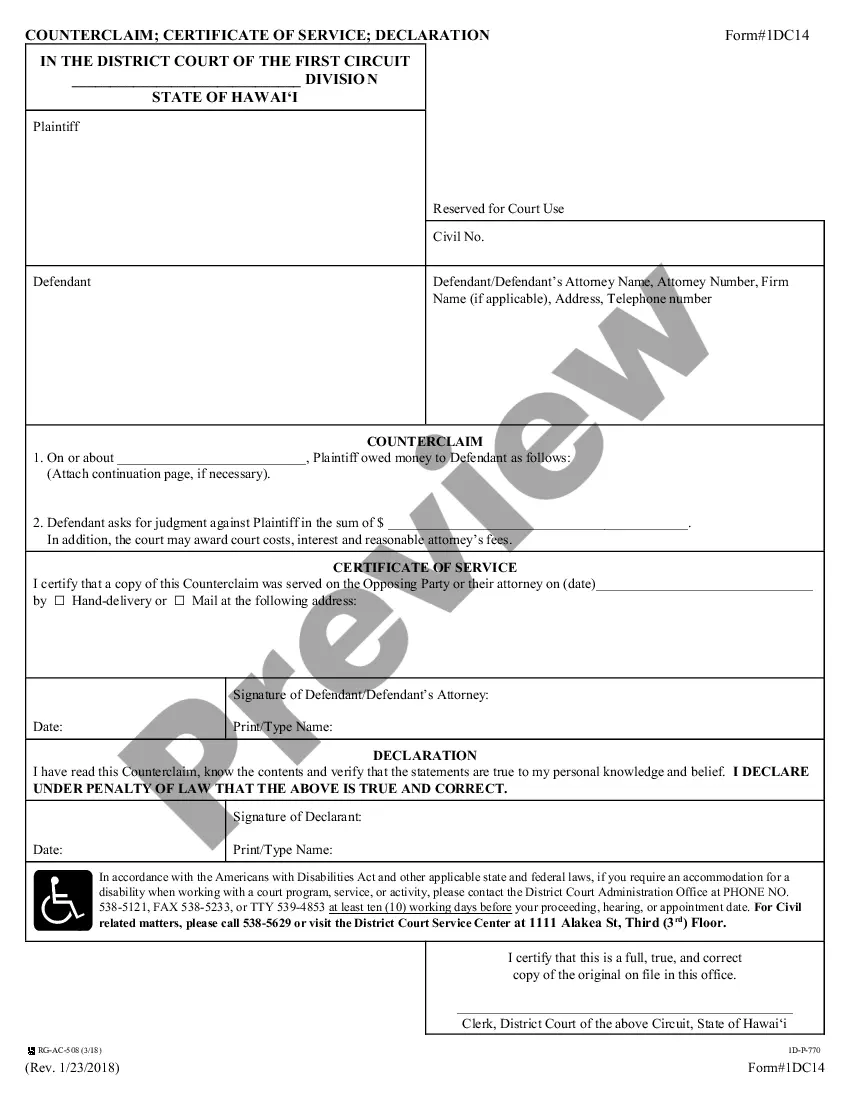

The Mississippi Forms Library and Fees Schedule is a comprehensive list of forms and documents related to the legal filing and processing of documents within the state of Mississippi. It includes various types of forms, such as civil, criminal, and probate, as well as associated fees for each type of form. The Library also contains forms related to business, such as LCS and corporations. Additionally, the Library contains forms related to taxes, estate planning, family law, and other related topics. The Mississippi Forms Library and Fees Schedule is updated regularly to ensure that all forms and fees are accurate. Different types of Mississippi Forms Library and Fees Schedule include Civil Forms and Fees Schedule, Criminal Forms and Fees Schedule, Probate Forms and Fees Schedule, Business Forms and Fees Schedule, Taxes Forms and Fees Schedule, Estate Planning Forms and Fees Schedule, and Family Law Forms and Fees Schedule.

Mississippi Forms Library and Fees Schedule

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

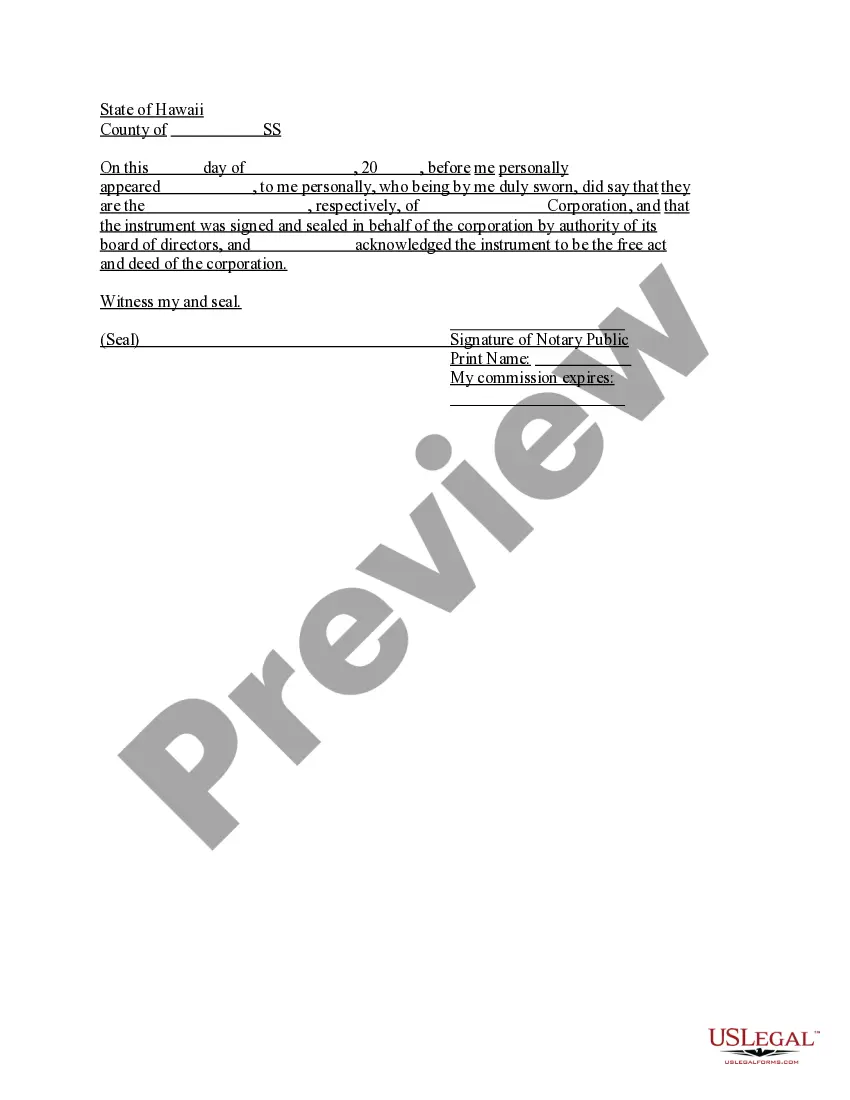

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Mississippi Forms Library And Fees Schedule?

How much effort and resources do you typically allocate to drafting official documents.

There’s a more effective option for obtaining such forms than engaging legal professionals or spending hours surfing the internet for an appropriate template. US Legal Forms is the top online repository that provides expertly crafted and validated state-specific legal paperwork for various purposes, such as the Mississippi Forms Library and Fees Schedule.

Another advantage of our service is that you can retrieve previously obtained documents that you securely store in your profile in the My documents tab. Access them anytime and redo your paperwork as often as necessary.

Conserve time and energy managing legal documents with US Legal Forms, one of the most dependable online solutions. Join us today!

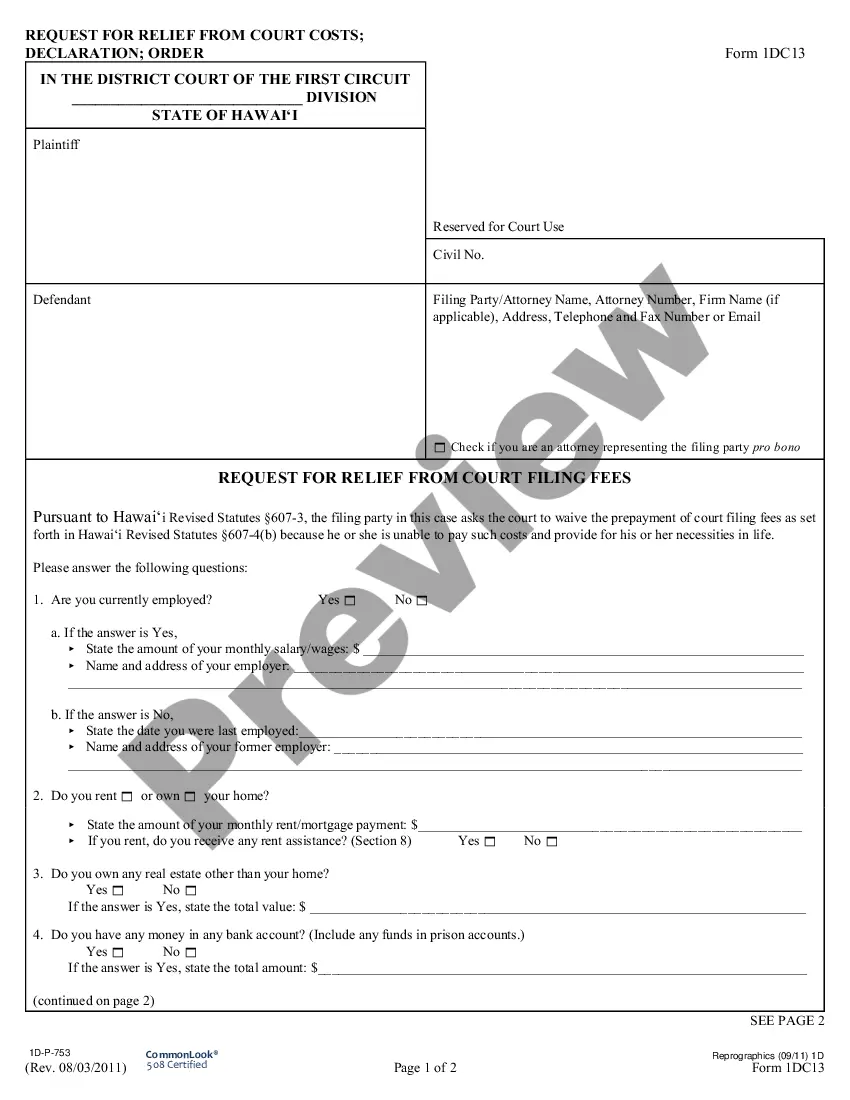

- Review the form content to ensure it satisfies your state regulations. To do this, consult the form description or utilize the Preview option.

- If your legal template doesn’t fulfill your requirements, search for another one using the search bar at the top of the page.

- If you already possess an account with us, Log In and retrieve the Mississippi Forms Library and Fees Schedule. Otherwise, proceed to the subsequent steps.

- Click Buy now once you identify the appropriate blank. Choose the subscription plan that best fits your needs to access our library’s complete service.

- Create an account and settle your subscription fee. You can process a payment with your credit card or through PayPal - our service is entirely trustworthy for that.

- Download your Mississippi Forms Library and Fees Schedule onto your device and complete it on a printed hard copy or digitally.

Form popularity

FAQ

If you are under age 59½, you will have to pay the 10% additional income tax on early distributions for any payment from the Plan (including amounts withheld for income tax) that you do not roll over, unless one of the exceptions listed below applies.

To check the status of your Mississippi state refund online, go to . Then, click ?Search? to see your refund status. For specific telephone numbers, refer to the Mississippi Department of Revenue Contact Us page.

JACKSON, MS (Mississippi News Now) - If you haven't received your Mississippi state income tax refund, there's a problem with it. Some refunds are being delayed due to an increase in the amount of review by the Department of Revenue.

State Taxes Retirement benefits are not subject to Mississippi State Income Tax; however, benefits paid by PERS to you as a resident of another state may be subject to taxation in that state.

Mississippi Corporation Annual Report Requirements: Agency:Mississippi Secretary of StateFiling Method:OnlineAgency Fee:$25 filing fee + $2.59 processing feeDue:Annually by April 15. Reports may be filed as early as January 1.Law:MS Code § 79-4-16.01.2 more rows

You remain a member of PERS as long as you leave your funds in your member account. Your membership can only be terminated by withdrawing your contributions after you leave covered service or upon your death. You cannot receive loans, partial refunds, or hardship withdrawals of your contributions.

You may request a balance of your account by contacting PERS Customer Service. You may call in your request at 800-444-7377 or 6601-359-3589, or you may fax your request to 601-359-6707 with the following information: Name.

Important information about PERS refunds PERS will issue your refund after final wages and contributions are posted to your account, which could take up to 90 calendar days from the date of their receipt.