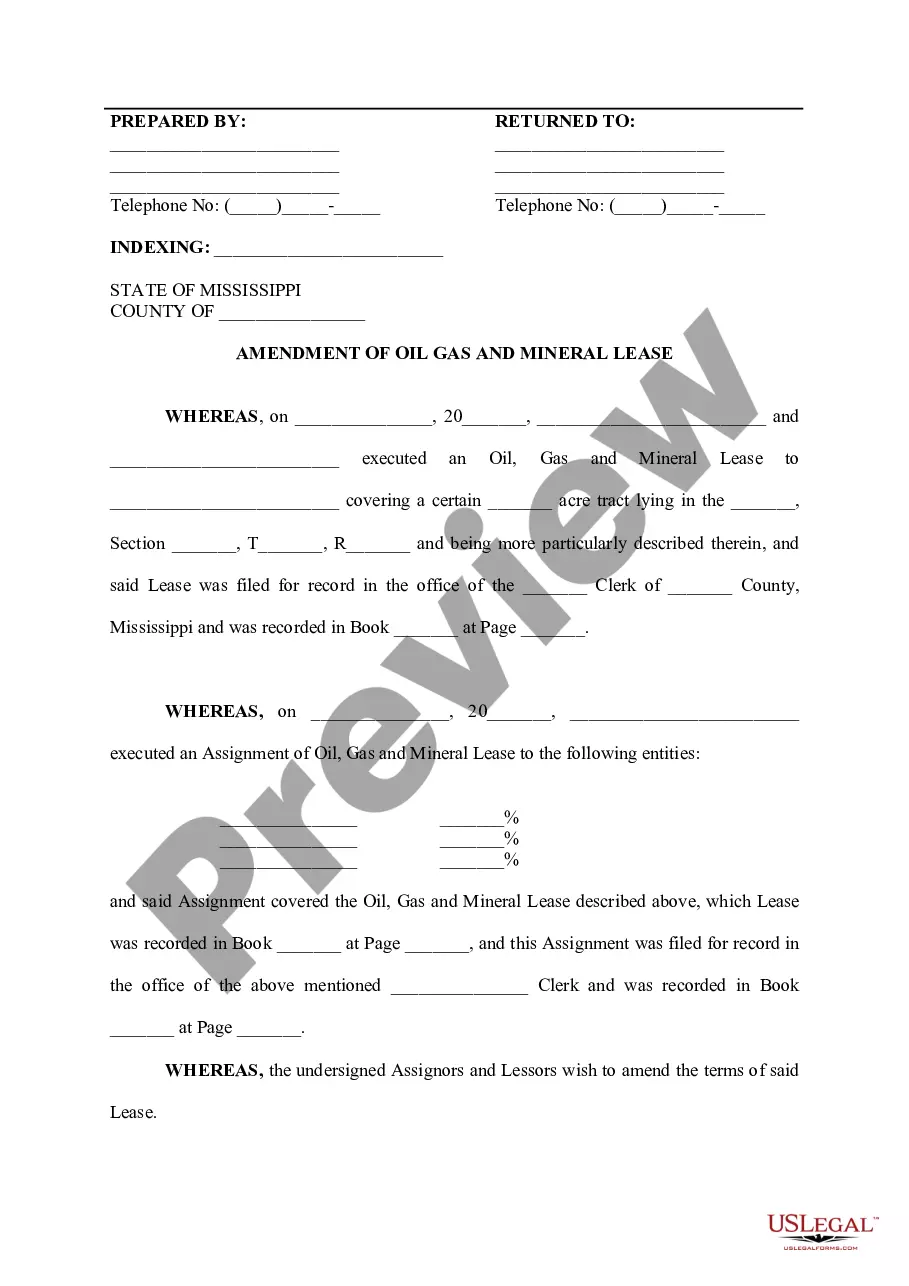

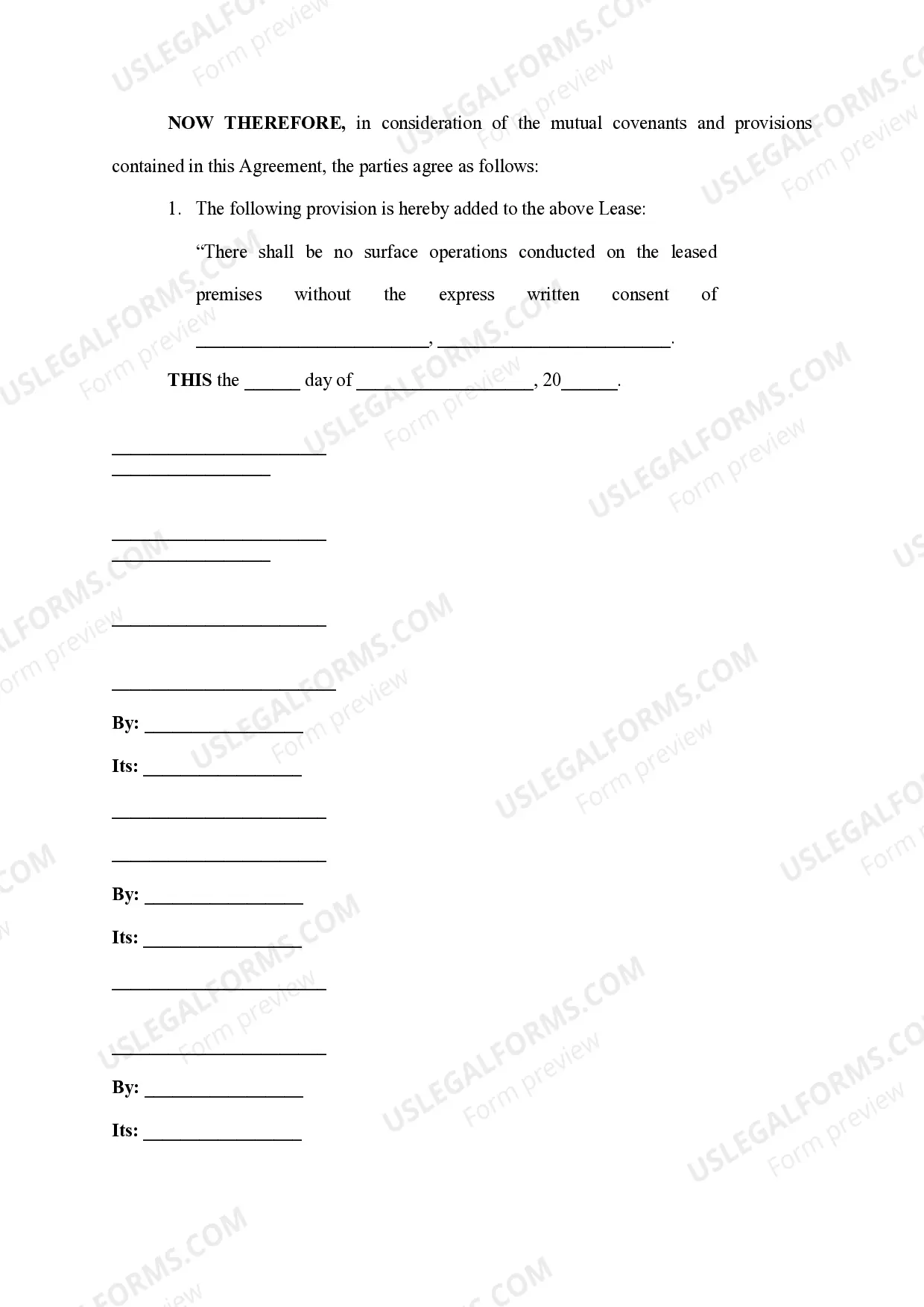

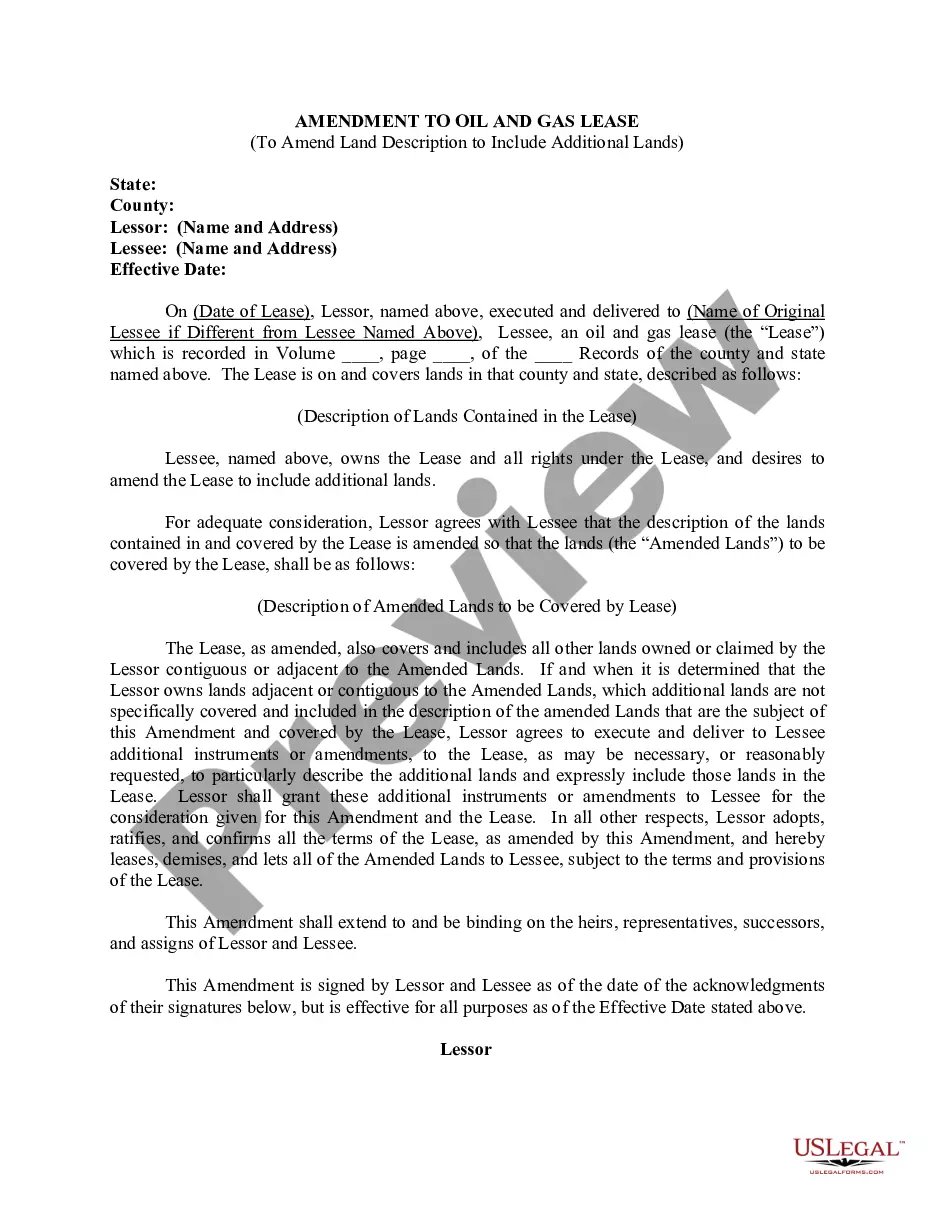

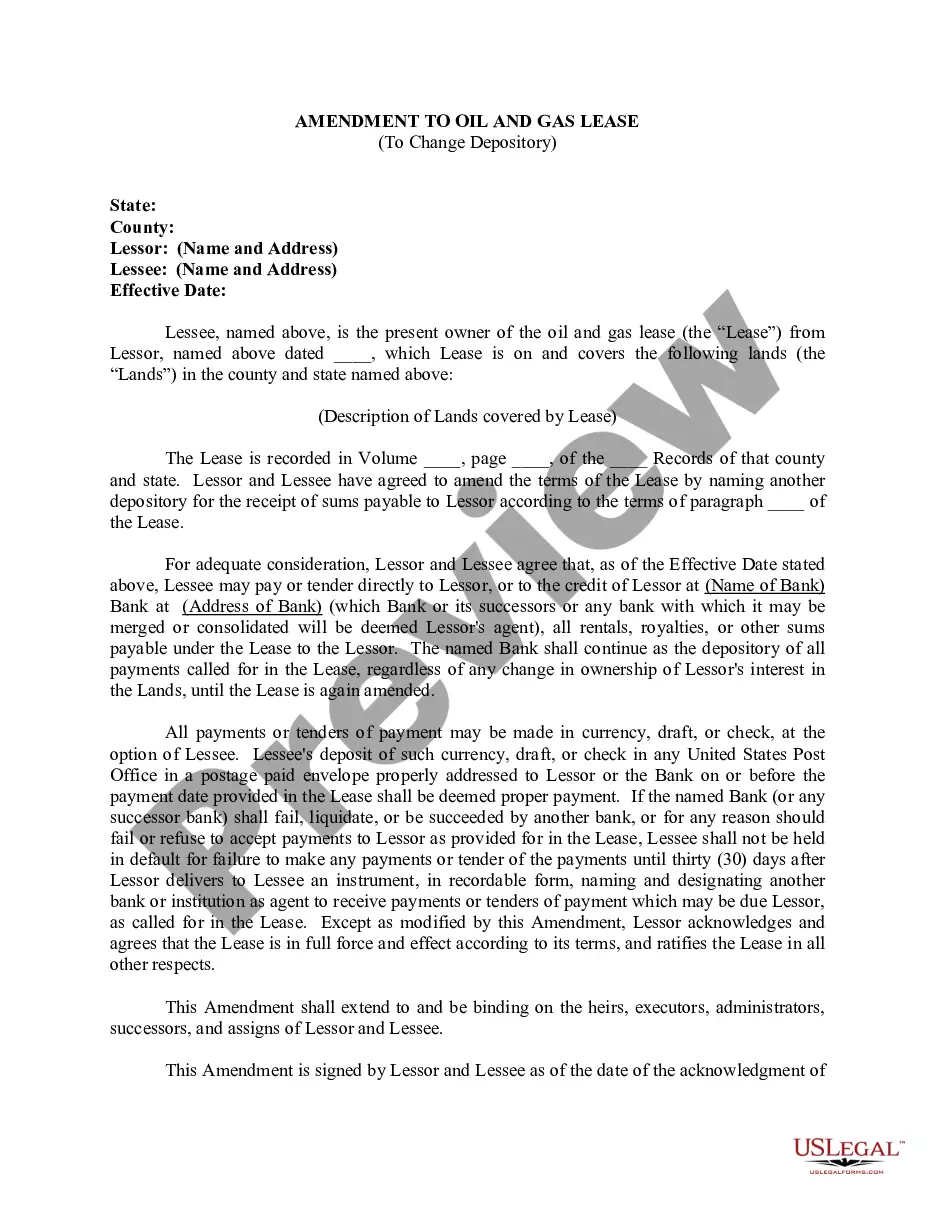

Mississippi Amendment to Oil Gas and Mineral Lease

Description

How to fill out Mississippi Amendment To Oil Gas And Mineral Lease?

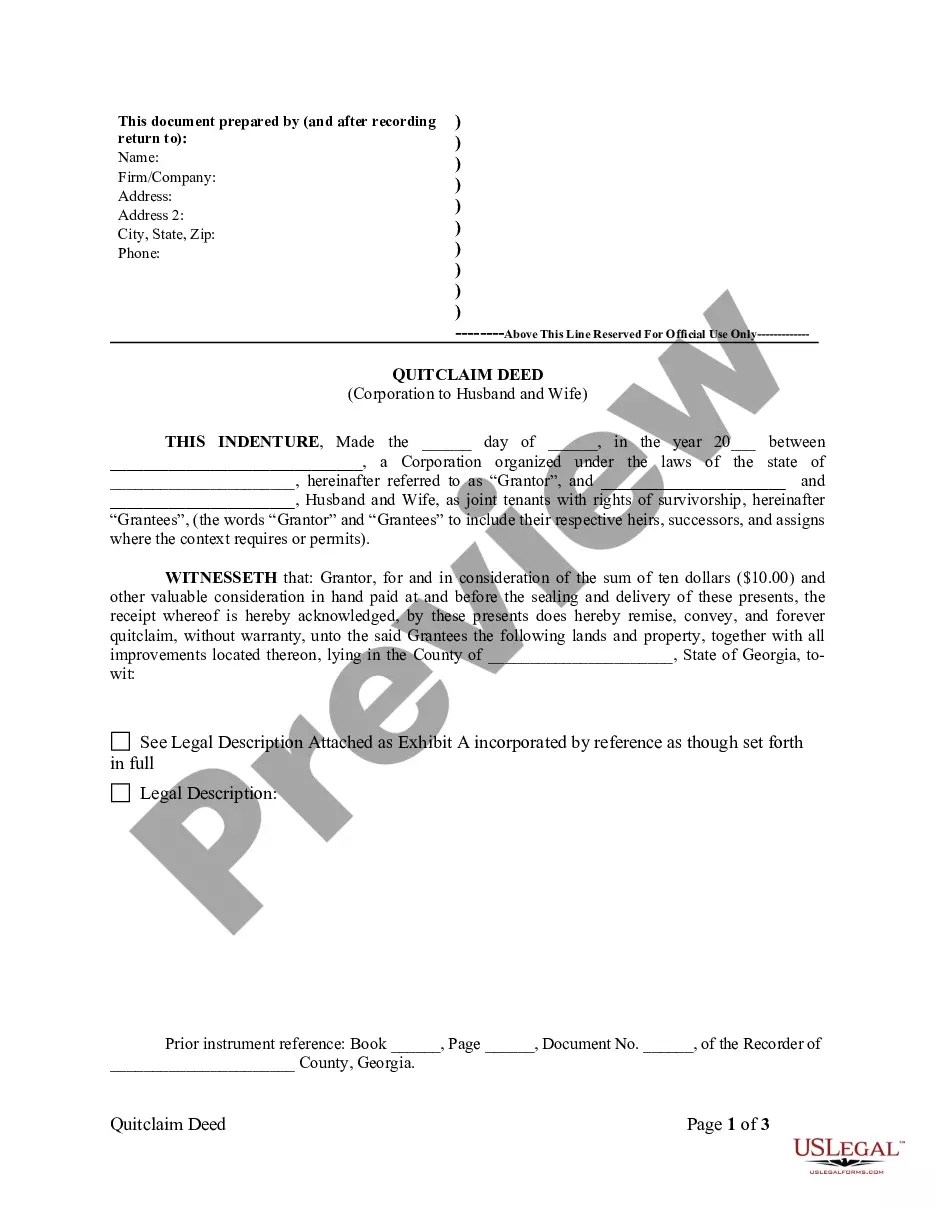

Get a printable Mississippi Amendment to Oil Gas and Mineral Lease within just several mouse clicks in the most comprehensive catalogue of legal e-files. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the Top supplier of affordable legal and tax forms for US citizens and residents online since 1997.

Users who have already a subscription, must log in directly into their US Legal Forms account, get the Mississippi Amendment to Oil Gas and Mineral Lease and find it saved in the My Forms tab. Customers who never have a subscription must follow the tips below:

- Make certain your form meets your state’s requirements.

- If provided, read the form’s description to find out more.

- If readily available, review the shape to see more content.

- When you’re sure the template is right for you, click Buy Now.

- Create a personal account.

- Select a plan.

- via PayPal or bank card.

- Download the form in Word or PDF format.

As soon as you’ve downloaded your Mississippi Amendment to Oil Gas and Mineral Lease, you may fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

When it comes to mineral rights, the standard admonition has long been consistent and emphatic: Avoid selling them. After all, simply owning mineral rights costs you nothing. There are no liability risks, and in most cases, taxes are assessed only on properties that are actively producing oil or gas.

If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

Oil and gas rights extend vertically downward from the property line. Unless explicitly separated by a deed, oil and gas rights are owned by the surface landowner. Oil and gas rights offshore are owned by either the state or federal government and leased to oil companies for development.

Mineral rights are ownership claims against the natural resources located beneath a plot of land. In the United States, mineral rights are separate from surface rights. 1feff Mineral rights are often "severed" from surface rights in states such as Texas, Oklahoma, Pennsylvania, Louisiana, Colorado, and New Mexico.

If you are ready to list or purchase mineral rights, the best mineral rights value rule of thumb to use is the current market price. Today, your mineral rights may sell for $2,000 an acre, but if the developers drill a few dry wells tomorrow, that value could plummet.

Owning mineral rights (often referred to as a "mineral interest" or a "mineral estate") gives the owner the right to exploit, mine, and/or produce any or all minerals they own.

A mineral owner's rights typically include the right to use the surface of the land to access and mine the minerals owned.Additionally, to protect the land owner and the environment, state and local laws regulating mining and drilling typically contain restrictions on mineral extraction activities.

Mineral interests and royalty interests both involve ownership of the minerals under the ground. The main difference between the two is that the owner of a mineral interest has the right to execute leases and collect bonus payments and the owner of royalty interests does not execute leases or collect bonus payments.

Mineral rights often include the rights to any oil and natural gas that exist beneath a property. The rights to these commodities can be sold or leased to others. In most cases, oil and gas rights are leased.