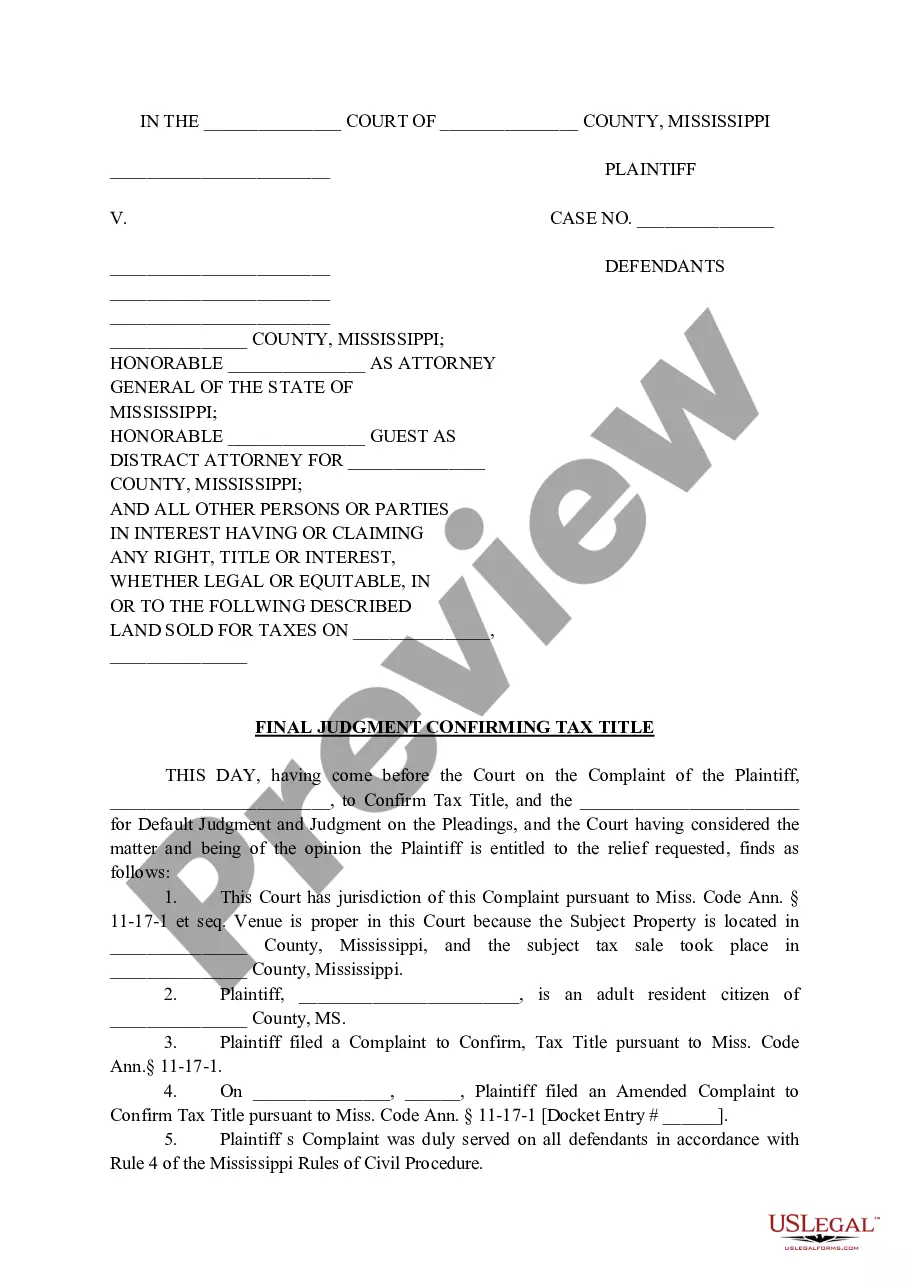

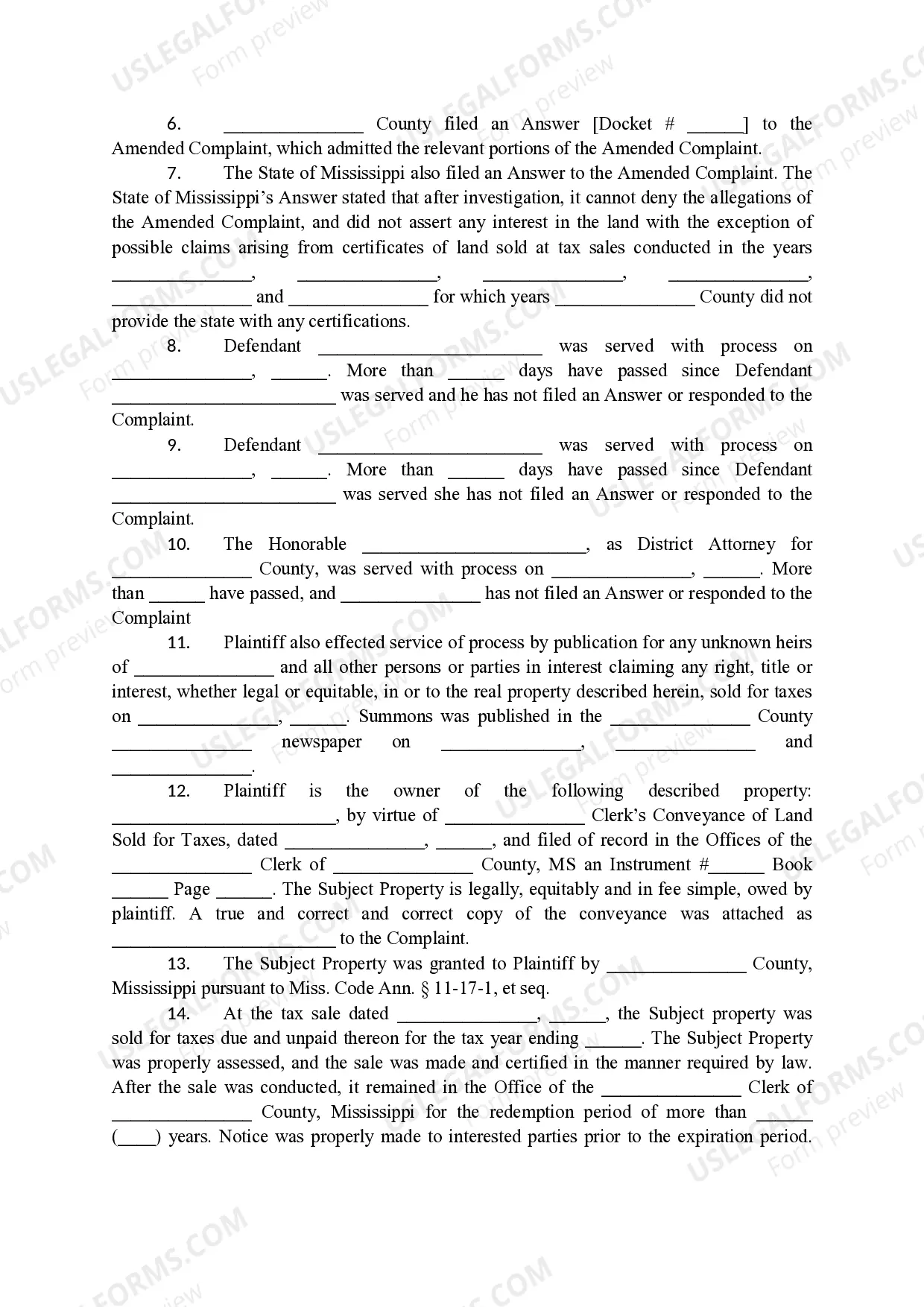

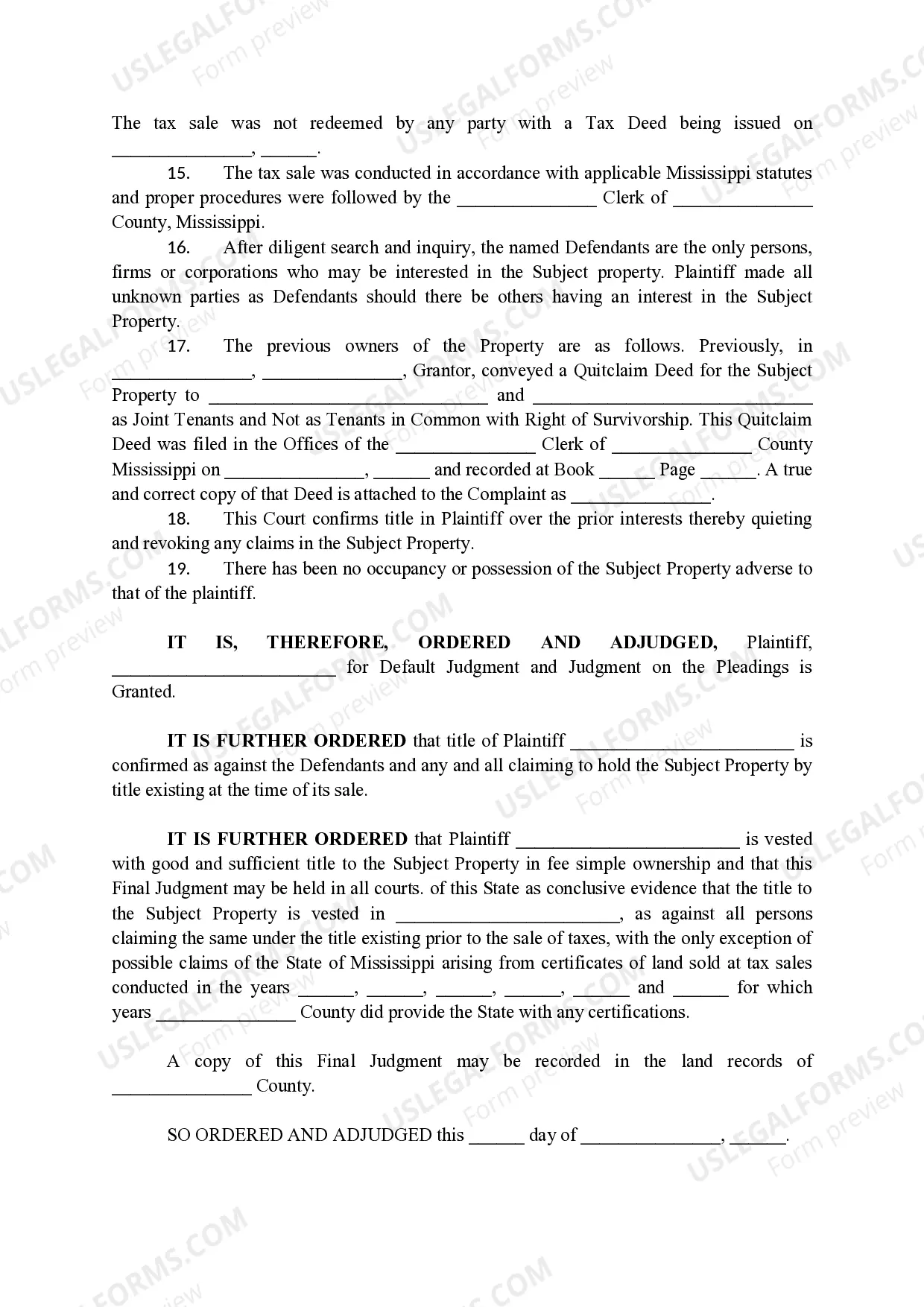

Mississippi Final Judgment Confirming Tax Title

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Mississippi Final Judgment Confirming Tax Title?

Acquire a printable Mississippi Final Judgment Confirming Tax Title in just a few clicks from the largest collection of legal e-documents. Discover, download, and print expertly prepared and certified templates on the US Legal Forms platform. US Legal Forms has been the top provider of affordable legal and tax forms for US citizens and residents online since 1997.

Clients who already have a subscription need to Log In directly to their US Legal Forms account, download the Mississippi Final Judgment Confirming Tax Title, and locate it in the My documents section. Customers without a subscription must follow the steps outlined below.

After you’ve downloaded your Mississippi Final Judgment Confirming Tax Title, you can complete it in any online editor or print it out and fill it in by hand. Utilize US Legal Forms to gain access to 85,000 professionally drafted, state-specific documents.

- Ensure your form fulfills your state's criteria.

- If provided, read the form’s description for additional details.

- If available, examine the form to see more information.

- Once you’re confident the template meets your needs, just click Buy Now.

- Create a personal account.

- Select a plan.

- Pay via PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

The answer is simple no. In Mississippi, paying the property taxes on someone else's land does not affect ownership in any manner. You simply cannot obtain title to someone's land by paying their taxes for them.

The Tax-Forfeited Inventory200b link provides access to the properties available for sale or you may contact the Public Lands Division in the Secretary of State's Office at 601-359-5156 or toll free (in-state) at 1-866-TFLANDS(835-2637). Approximately how long does the process take?

Purchasing a tax lien does not obligate you to pay any future property taxes that become delinquent or pay for other property liabilities.Unlike an investment in a tax lien, an investment in a tax deed requires that your adequately maintain the property until you are able to sell it.

According to Ted Thomas, an authority on tax lien certificates and tax deeds, 21 states and the District of Columbia are tax lien states: Alabama, Arizona, Colorado, Florida, Illinois, Indiana, Iowa, Kentucky, Maryland, Mississippi, Missouri, Montana, Nebraska, New Jersey, North Dakota, Ohio, Oklahoma, South Carolina,

In Mississippi, a tax sale will eventually take place if you don't pay the property taxes on your home. At the sale, the winning bidder buys the tax debt and gets a lien on the property. The purchaser receives a receipt along with the right to eventually get ownership of your property if you don't pay off the debt.

A tax lien recorded on the State Tax Lien Registry covers all property in Mississippi. To avoid having a tax lien filed against your property, send the Department of Revenue full payment before the due date as set forth in your Assessment Notice.

A tax lien recorded on the State Tax Lien Registry covers all property in Mississippi. To avoid having a tax lien filed against your property, send the Department of Revenue full payment before the due date as set forth in your Assessment Notice.

Use of land belonging to another. There must be a claim of ownership. The use must be adverse to the interests of the true owner. Open, notorious and visible. Continuous and uninterrupted. Exclusive use. Peaceful use. The fence or driveway exception.