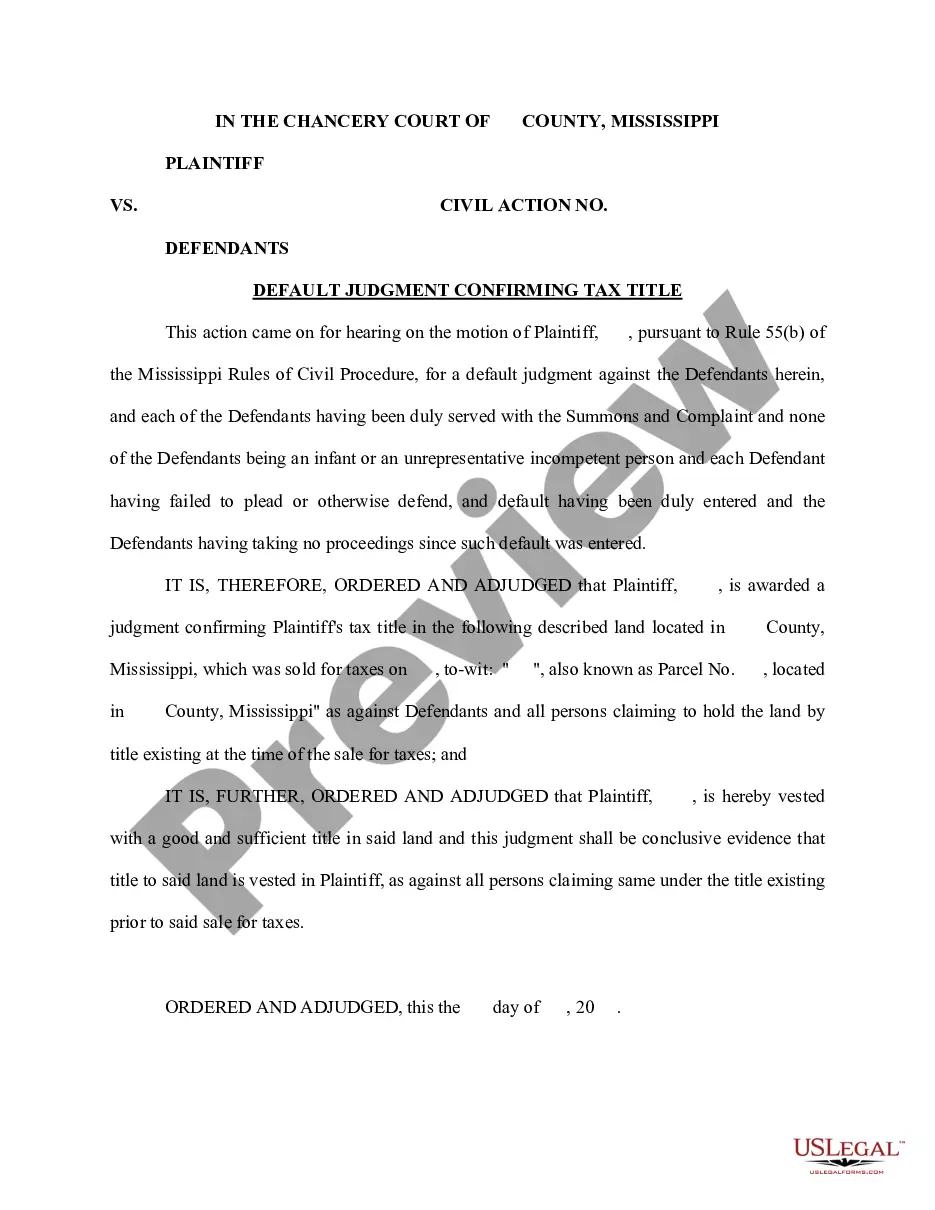

Mississippi Default Judgment Confirming Tax Title

Overview of this form

The Default Judgment Confirming Tax Title is a legal document used in cases where a party does not respond to a lawsuit regarding property tax sales. This judgment confirms that the plaintiff holds the tax title to a specific parcel of land, effectively establishing legal ownership. It differs from other legal forms by its focus on confirming tax title ownership in situations where the defendants fail to appear or respond in court.

What’s included in this form

- Identification of the plaintiff and defendants involved in the case.

- Civil action number for tracking the case.

- Order confirming the plaintiff's tax title to the described land.

- Details of the property sold for taxes, including location and tax parcel number.

- Judicial affirmation of the plaintiff's good and sufficient title to the land.

- Signature and date fields for official court acknowledgment.

Situations where this form applies

This form is necessary when a plaintiff seeks to confirm ownership of a property due to tax lien sales and the defendants have failed to respond to the legal action. Situations may include disputes where prior ownership claims exist, and the plaintiff needs to protect their rights to the property acquired through tax sale.

Who can use this document

- Property owners who have purchased land at tax sales and need legal confirmation of their ownership.

- Attorneys representing plaintiffs in civil actions concerning tax titles.

- Individuals needing to resolve property disputes resulting from unpaid property taxes.

Steps to complete this form

- Identify the parties involved: fill in the names of the plaintiff and defendants.

- Specify the civil action number assigned to your case.

- Detail the property being discussed, including its location and tax parcel number.

- Enter the date the property was sold for taxes.

- Provide the date the judgment is issued and have it signed by a judge.

Is notarization required?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include the civil action number, which may lead to confusion.

- Not detailing the property information correctly, risking potential legal challenges.

- Omitting signatures or necessary dates, which can invalidate the judgment.

Benefits of completing this form online

- Convenience of downloading and completing the form from home.

- Easily editable document formats allow for quick adjustments.

- Access to professionally drafted templates ensures compliance with legal standards.

Looking for another form?

Form popularity

FAQ

The IRS allows you to check the status of your payment by using its online Get My Payment tool. For eligible stimulus payment recipients, it will show how much you're getting, how you're getting it (mail or direct deposit) and when it was sent to you.

Using the IRS Where's My Refund tool. Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.) Viewing your IRS account information. Looking for emails or status updates from your e-filing website or software.

If you did use a tracking service from the post office when you mailed the federal tax return, there is no way to verify that the return was received by the IRS. There is no IRS phone to call to verify that the return was received.

An acknowledgement can either be an acceptance or rejection of the return. The taxpayer then receives an email stating the status of the return - accepted or rejected.When the state sends the ACK, we e-mail the taxpayer whether the return has been accepted or rejected.