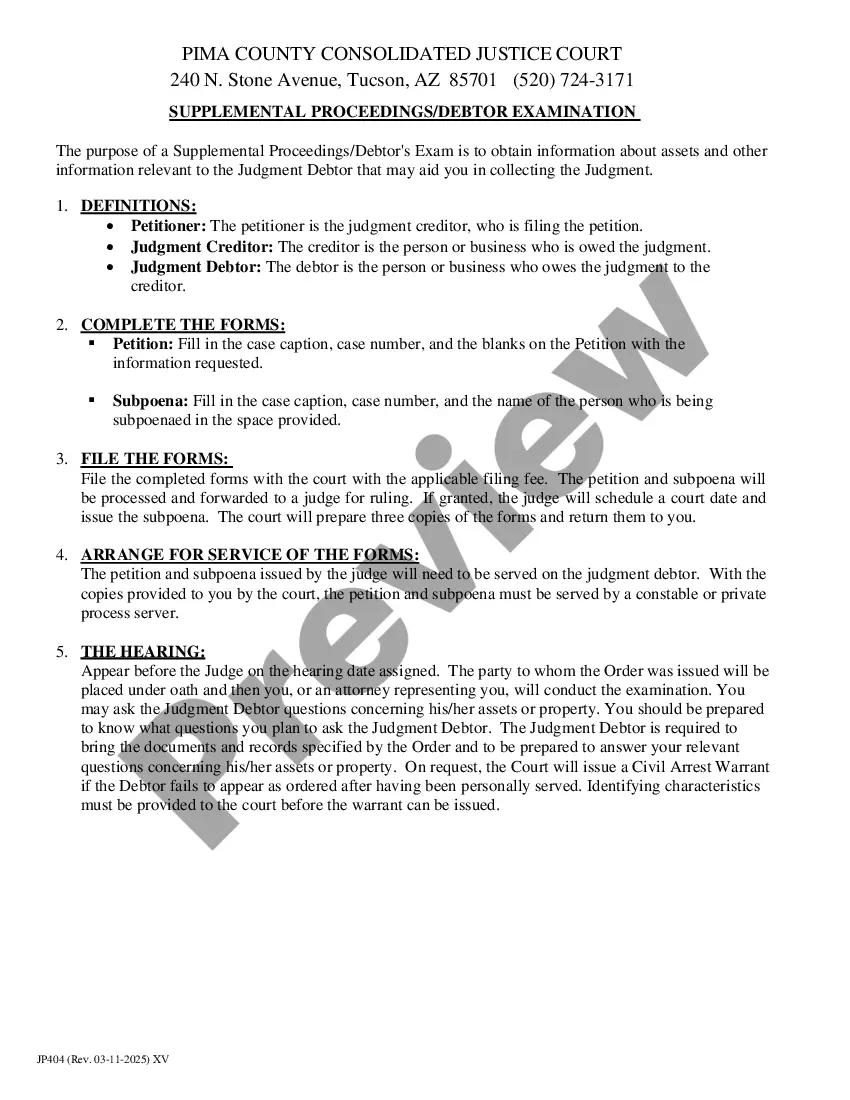

Arizona Petition and Notice of Small Claims Property Tax Appeal is a legal document filed with the County Assessor's office in Arizona by a property owner who wishes to contest his/her property taxes. The petition is used to challenge the assessed value of a property, the tax rate, or other issues in regard to the property tax. The Notice of Small Claims Property Tax Appeal is a notification of the appeal sent to the County Assessor and any other parties involved. There are two types of Arizona Petition and Notice of Small Claims Property Tax Appeal: 1) Formal Petitions, and 2) Informal Petitions. Formal Petitions require a judge to make a decision in the case, while Informal Petitions are usually heard by an administrative law judge. The filing fee for a Formal Petition is typically higher than for an Informal Petition.

Arizona Petition and Notice of Small Claims Property Tax Appeal

Description

How to fill out Arizona Petition And Notice Of Small Claims Property Tax Appeal?

Engaging with official documentation necessitates focus, accuracy, and the utilization of well-composed forms. US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your Arizona Petition and Notice of Small Claims Property Tax Appeal template from our platform, you can trust it adheres to federal and state regulations.

Using our platform is straightforward and quick. To retrieve the required document, all you will need is an account with an active subscription. Here’s a concise guide for you to acquire your Arizona Petition and Notice of Small Claims Property Tax Appeal in just minutes.

All documents are crafted for versatile use, similar to the Arizona Petition and Notice of Small Claims Property Tax Appeal displayed on this page. If you require them in the future, you can complete them without additional payment - simply access the My documents tab in your profile and finalize your document whenever necessary. Experience US Legal Forms and complete your business and personal paperwork swiftly and in total legal conformity!

- Ensure to carefully review the content of the form and its alignment with general and legal criteria by previewing it or examining its description.

- Seek an alternative formal template if the one you previously accessed does not fit your circumstance or comply with state laws (the tab for this is located in the top corner of the page).

- Log In to your account and save the Arizona Petition and Notice of Small Claims Property Tax Appeal in your preferred format. If it’s your initial visit to our site, click Buy now to continue.

- Establish an account, select your subscription option, and make payment using your credit card or PayPal account.

- Choose the format in which you want to acquire your form and click Download. Print the document or upload it to a professional PDF editor for paper-free submission.

Form popularity

FAQ

While this guide focuses on Arizona, it's important to note that in California, you would initiate an appeal through a different process. You must file an appeal with your local county assessment office within a specified timeframe. Much like the Arizona Petition and Notice of Small Claims Property Tax Appeal, California has its own set of regulations and guidelines, so researching local laws thoroughly will serve you well. For assistance, consider reaching out to legal resources that can guide you through the nuances of California tax law.

In Arizona, property taxes do not automatically stop at a certain age, but there are exemptions for seniors, such as those 65 years and older meeting specific income requirements. Eligible seniors can benefit from deductions and assistance programs. It’s wise to check with your local tax authority to understand what options are available to you. Filing an Arizona Petition and Notice of Small Claims Property Tax Appeal may also be relevant if you're looking to reduce your overall tax burden.

Several factors can trigger a property tax reassessment in Arizona, including significant home renovations, changes in ownership, or alterations in the real estate market. If your property value has increased drastically, assessors may review it more closely. Understanding these triggers helps you stay informed about potential tax increases and prepares you for filing an Arizona Petition and Notice of Small Claims Property Tax Appeal if necessary. Keeping track of local market trends is beneficial.

The best evidence to protest property taxes includes recent sales of comparable properties, detailed photographs, and any professional appraisals you've secured. Collecting objective data that substantiates your claim is crucial for presenting a strong case. Keep in mind that the Arizona Petition and Notice of Small Claims Property Tax Appeal can offer guidance on what specific documentation is necessary. This evidence helps reduce your assessed value effectively.

To appeal a property tax assessment in Arizona, you need to file an Arizona Petition and Notice of Small Claims Property Tax Appeal with your local tax court. Start by gathering relevant documents, such as your current assessment notice and comparable property information. Make sure to submit your appeal within the specified timeframe to ensure the court hears your case. Utilizing platforms like uslegalforms can help streamline this process for you.

To appeal your property taxes in Maryland, you must file a formal appeal with your local property tax assessment office. Provide any evidence supporting your claim that the assessed value is too high. While this process differs from the Arizona Petition and Notice of Small Claims Property Tax Appeal, ensure you follow the specific guidelines set by Maryland law. Consider using the uslegalforms platform for resources and templates that guide you in crafting an effective appeal.

To write a protest letter for property taxes, start by clearly stating your intent to appeal the assessed value of your property. Include specific reasons why you believe the valuation is incorrect, supported by relevant data or comparable property assessments. You should express your request for a review and mention the Arizona Petition and Notice of Small Claims Property Tax Appeal, which provides a structured process for appealing in Arizona. Ensure to keep your tone respectful and provide your contact information for further communication.

To appeal your property taxes in Arizona, you start by reviewing your assessment notice and gathering supporting evidence that shows your property's market value is less than the assessed value. You'll then complete the Arizona Petition and Notice of Small Claims Property Tax Appeal, which provides a structured way to present your case. Once submitted, be prepared to attend a hearing where you can present your evidence in front of a hearing officer. This process offers you a clear pathway to potentially reduce your property tax liability.

In Arizona, seniors are not automatically exempt from paying property taxes based on age. However, those aged 65 and older may qualify for certain tax relief programs. These programs can reduce the property tax burden, but eligibility often depends on financial factors such as income and assets. It's good to explore options like the Arizona Petition and Notice of Small Claims Property Tax Appeal to ensure you are not paying more than necessary.