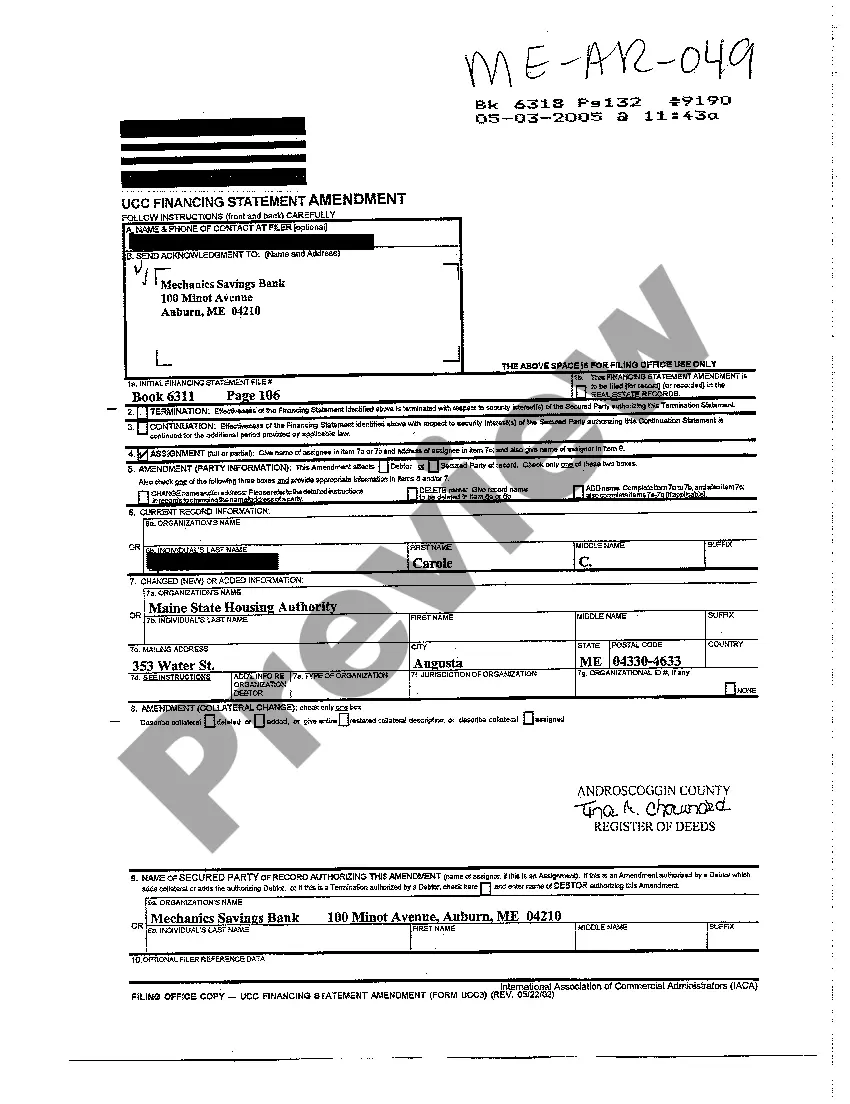

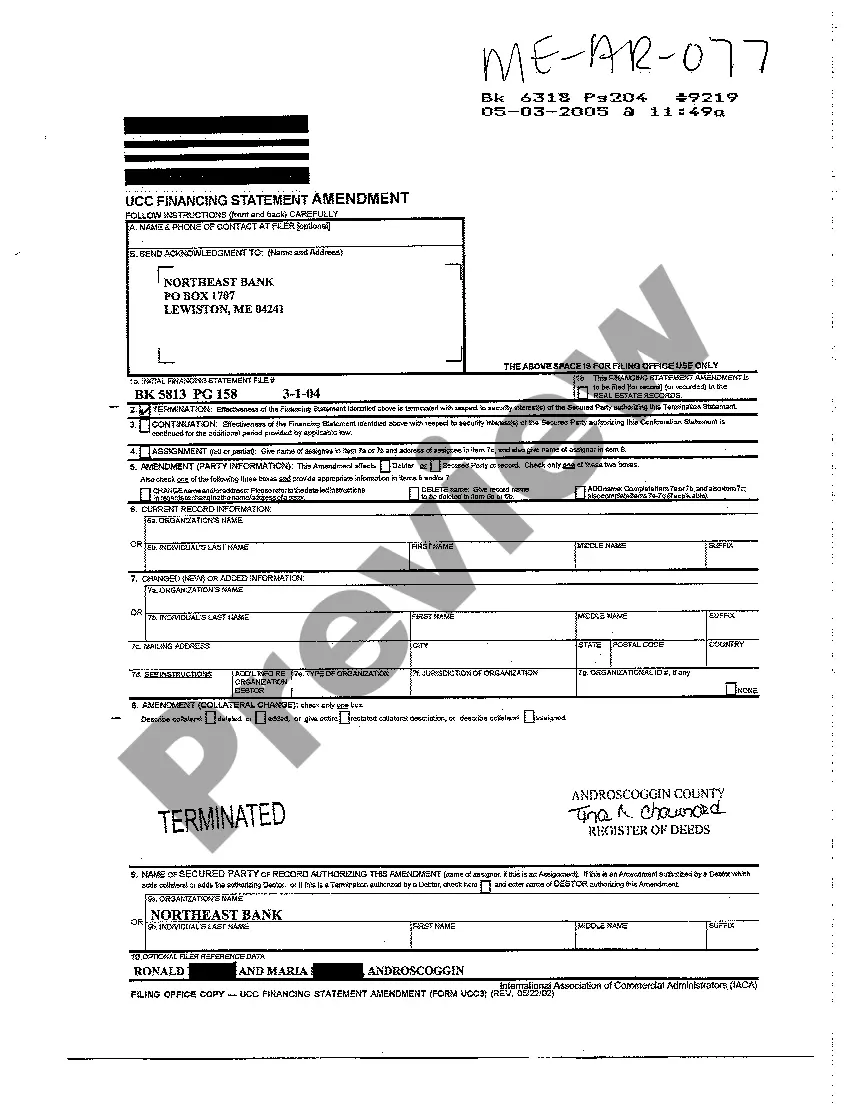

Maine UCC Financing Statement Amendment - Termination

Description

How to fill out Maine UCC Financing Statement Amendment - Termination?

Greetings to the finest legal documents collection, US Legal Forms. Here you will discover any template including Maine UCC Financing Statement Amendment - Termination samples and retrieve them (as many as you need/ desire). Assemble official documents in just a few hours, rather than days or weeks, without spending a fortune with a lawyer. Obtain the state-specific form in a few clicks and rest assured knowing it was created by our experienced legal experts.

If you’re already a registered user, simply Log In to your account and then select Download next to the Maine UCC Financing Statement Amendment - Termination you wish. Because US Legal Forms operates online, you’ll always have access to your saved templates, no matter the device you’re using. Find them within the My documents section.

If you haven't created an account yet, what are you waiting for? Follow our instructions below to begin.

After you’ve completed the Maine UCC Financing Statement Amendment - Termination, submit it to your lawyer for validation. It’s an important step but a crucial one to ensure you’re fully protected. Sign up for US Legal Forms now and gain access to a wide array of reusable templates.

- If this is a state-specific document, verify its compliance in your state.

- Review the description (if available) to determine if it’s the suitable template.

- Explore additional content using the Preview feature.

- If the document satisfies all of your necessities, click Buy Now.

- To establish your account, choose a pricing option.

- Utilize a credit card or PayPal account to register.

- Download the file in your desired format (Word or PDF).

- Print the document and fill it with your/your business’s details.

Form popularity

FAQ

Terminating a UCC fixture filing involves submitting a Maine UCC Financing Statement Amendment - Termination specific to fixtures. You must provide accurate details of the original filing and confirm that all legal requirements are met. This may include obtaining the debtor's consent. For a streamlined experience, consider using the uslegalforms platform, which simplifies the filing process and helps ensure compliance with local regulations.

To clear a UCC lien, you need to file a Maine UCC Financing Statement Amendment - Termination. This process involves submitting the correct form to the appropriate government office, along with any required fees. Ensure that you follow the specific guidelines for your situation to successfully terminate the lien and remove any claims against your property. An easy way to navigate this process is by using the ulegalforms platform, which provides clear instructions and necessary documents.

A UCC-3 termination statement (a Termination) is a required filing that terminates a security interest that has been perfected by a UCC-1 filing. 1. A Termination for personal property is accomplished by completing and filing form UCC-3 with the Secretary of State's office in the appropriate state.

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.

When the debtor has satisfied all amounts owed to the lender, a UCC-3 termination statement (now called a UCC termination statement) is routinely filed to terminate the security interest perfected by the UCC-1 financing statement.

A UCC-3 termination statement (a Termination) is a required filing that terminates a security interest that has been perfected by a UCC-1 filing. 1. A Termination for personal property is accomplished by completing and filing form UCC-3 with the Secretary of State's office in the appropriate state.

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

After receiving your request, the lender has 20 days to terminate the UCC filing.

When the debtor has satisfied all amounts owed to the lender, a UCC-3 termination statement (now called a UCC termination statement) is routinely filed to terminate the security interest perfected by the UCC-1 financing statement.