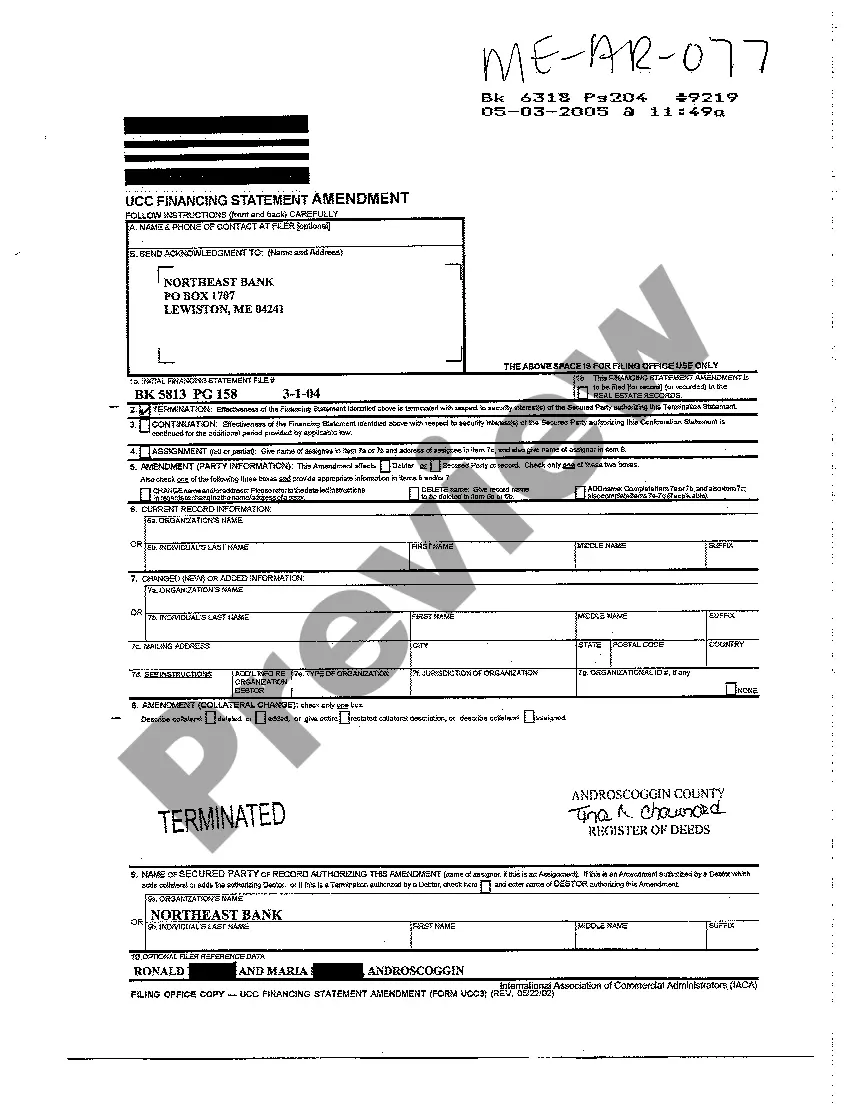

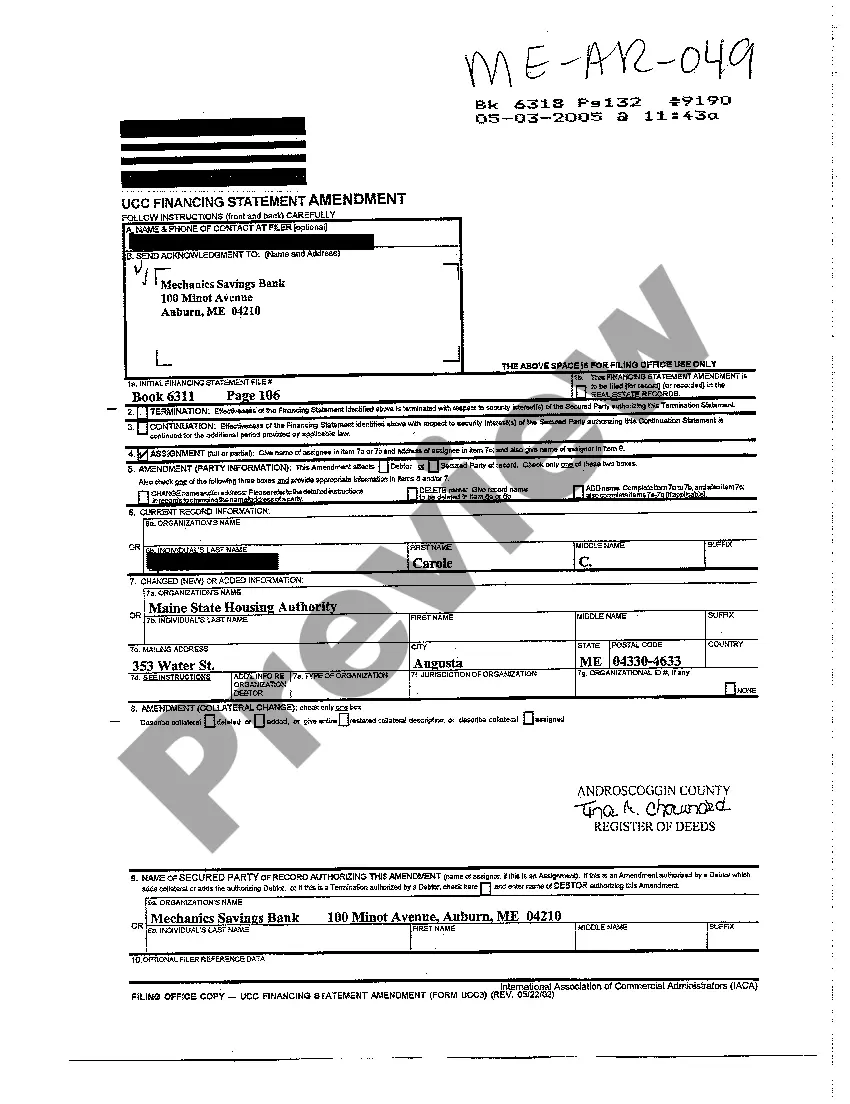

Maine UCC Financing Statement Amendment - Assignment

Description

How to fill out Maine UCC Financing Statement Amendment - Assignment?

Welcome to the largest legal document repository, US Legal Forms. Here, you can acquire any template, including the Maine UCC Financing Statement Amendment - Assignment templates, and download as many as you desire.

Prepare official documents in just a few hours instead of days or weeks, without incurring excessive fees with a legal professional. Access the state-specific form effortlessly and feel assured knowing it was created by our state-certified attorneys.

If you are already a registered user, simply Log In to your account and click Download next to the Maine UCC Financing Statement Amendment - Assignment you wish to obtain. Because US Legal Forms is an online solution, you will consistently have access to your downloaded templates, regardless of the device you are using. Find them under the My documents section.

Once you have completed the Maine UCC Financing Statement Amendment - Assignment, send it to your attorney for validation. It’s an additional step but a crucial one to ensure you are completely protected. Join US Legal Forms now and gain access to a multitude of reusable templates.

- If you do not possess an account yet, what are you waiting for? Follow our instructions below to get started.

- If this is a state-specific document, verify its relevance in your state.

- Review the description (if available) to ensure it's the appropriate template.

- Explore more details using the Preview feature.

- If the template meets your requirements, simply click Buy Now.

- To establish your account, select a subscription plan.

- Utilize a credit card or PayPal account to register.

- Download the document in the format you prefer (Word or PDF).

- Print the document and fill it out with your or your business's information.

Form popularity

FAQ

Yes, you can assign a UCC. An assignment of a UCC allows the original secured party to transfer their rights to another party. This process involves filing a Maine UCC Financing Statement Amendment - Assignment to reflect the new secured party in the records. By utilizing tools from the uslegalforms platform, you can efficiently manage and execute necessary assignments.

A UCC must be filed in the appropriate state office, typically with the Secretary of State. In Maine, this filing ensures that your Maine UCC Financing Statement Amendment - Assignment is officially recognized. Each state has its own rules for filing, so it’s important to understand the local requirements. You can easily accomplish this through platforms like uslegalforms, which guide you through the filing process.

A financing statement is not identical to a UCC, but it is closely related. The Uniform Commercial Code (UCC) provides the legal framework for creating and filing financing statements. Specifically, the Maine UCC Financing Statement Amendment - Assignment involves updating or modifying such statements to reflect current interests. Understanding this distinction is crucial for ensuring your filings are accurate and effective.

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

Under the Uniform Commercial Code, a UCC-3 is used to continue, assign, terminate, or amend an existing UCC-1 financing statement (UCC-1).

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

Form UCC3 is used to amend (make changes to) a UCC1 filing.However, it is important to note that for a UCC1 filing a termination is only an amendment and that the UCC1 filing may be amended further, even after a termination has been filed. Box 3 Continuation A UCC1 filing is good for five years.

Also known as a UCC-3, and, depending on the context, a UCC-3 financing statement amendment, a UCC-3 termination statement, and a UCC-3 continuation statement. Under the Uniform Commercial Code, a UCC-3 is used to continue, assign, terminate, or amend an existing UCC-1 financing statement (UCC-1).

If you're approved for a small-business loan, a lender might file a UCC financing statement or a UCC-1 filing. This is just a legal form that allows for the lender to announce lien on a secured loan. This allows for the lender to seize, foreclose or even sell the underlying collateral if you fail to repay your loan.

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.