Mississippi Default Judgment Confirming Tax Title

About this form

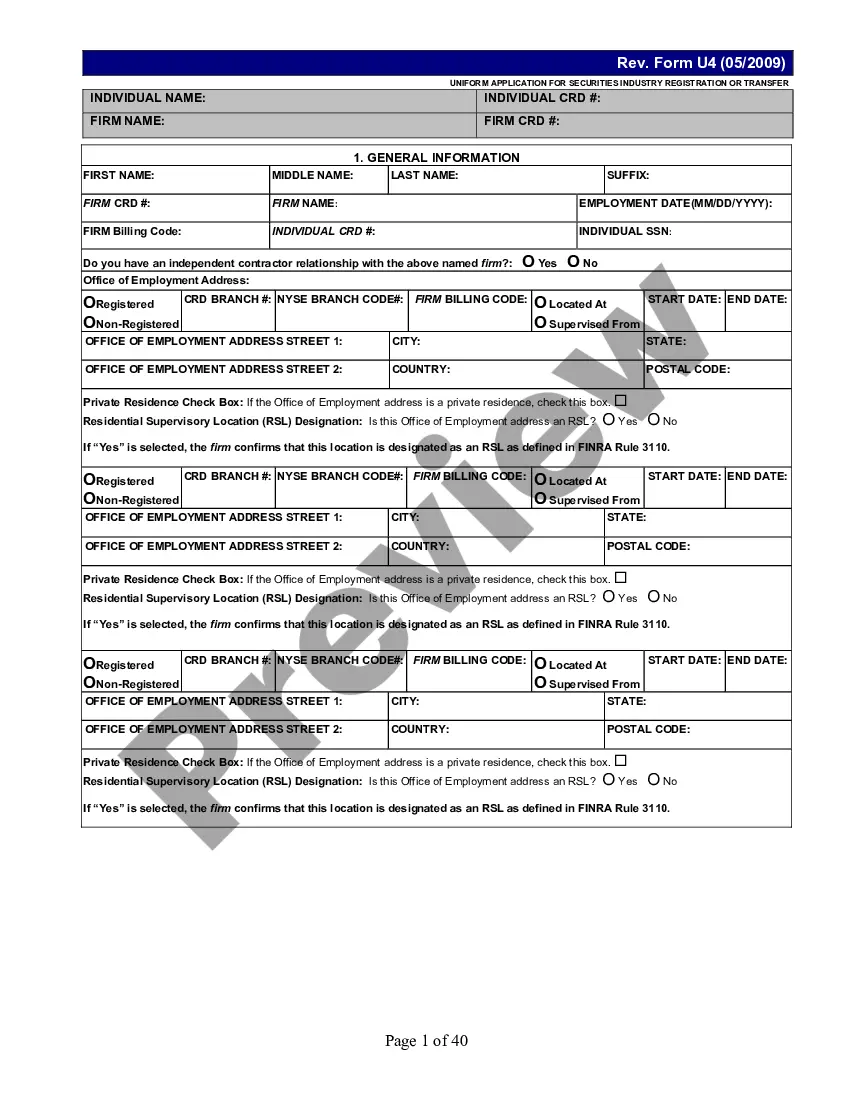

The Default Judgment Confirming Tax Title is a legal document used in Mississippi to affirm a judgment related to tax title disputes. This form serves to clarify ownership and rights to property when a tax default has occurred, differentiating it from other judgment forms by specifically addressing tax-related issues. It ensures that any claims regarding property taxes are properly adjudicated and recognized by the court.

Key parts of this document

- Identification of the property involved.

- Details of the tax assessment and default.

- Confirmation of judgment terms and conditions.

- Signatures from relevant parties, including the judgment creditor.

- Section for filing the judgment with the appropriate court.

When this form is needed

This form should be used when a taxpayer has not paid property taxes, leading to legal proceedings. It formalizes the court's decision to grant a default judgment, confirming the tax title of the disputed property. Use this form when seeking to secure rights to a property due to tax-default issues or when responding to enforcement actions regarding unpaid taxes.

Who can use this document

- Property owners facing tax judgment issues.

- Tax lien holders seeking to enforce their rights.

- Legal professionals representing clients in tax title disputes.

- Entities wishing to confirm their rights in court after a tax default.

Steps to complete this form

- Identify the parties involved, including the property owner and creditor.

- Provide specific details about the property, including address and tax identification number.

- Enter the particulars of the tax default, including dates and amounts owed.

- Include any relevant judgment details as mandated by Mississippi law.

- Ensure all necessary signatures are obtained and dated.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include accurate property identification information.

- Lacking required signatures from all parties involved.

- Not providing sufficient details about the tax default situation.

- Submitting the form without verifying compliance with local court preferences.

Benefits of completing this form online

- Convenient download options allow for immediate access to the form.

- Editability ensures you can customize the form for your specific needs.

- Access to reliable templates drafted by licensed attorneys ensures legal compliance.

- Easy navigation through the completion process aids in minimizing errors.

Looking for another form?

Form popularity

FAQ

Select Sales, then select Customers. Select the customer's name. Select Edit. Go to the Tax info tab in the Customer information screen. Select a Default tax code from the drop-down menu. Select Save and close.

This refers to the amount of tax paid as a proportion of the pretax value of whatever is taxed; sales tax rates are typically expressed in tax-exclusive terms. For example, suppose a good costs $100 before tax and a $10 sales tax.

Exclusive, as an adjective, is used to give the meaning limited or private. It also used to give a meaning of expensive. Inclusive, as an adjective, is used to give the meaning comprehensive or complete.

Inclusive tax - The taxes are already a part of the product's retail price, so no more taxes are added to the subtotal of the sales transaction. Exclusive tax - The taxes are not yet a part of the retail price, so the tax amount is added to the subtotal of the sales transaction, before the checkout is finalized.

In the Accounting menu, select Advanced, then click Tax rates. Click New Tax Rate. Enter a display name and select the tax type. Add the tax component name and GST percentage. Click Save.

Tax methodology for tax-exclusive pricing The tax amounts for all tax codes are added to the sub-total to derive the total for the transaction. You buy an item for 1,000 plus 10% goods and services tax. If the amount of 1,000 is tax-exclusive, 10% tax is added to it, increasing the total to 1,100.

Click the Gear Icon and select Accounts and Settings. Click Advanced, then Accounting. Click the drop down for Default tax rate selection and make your selection. Click Save, then click Done.

This means that the price charged for goods or services or both does not include tax. Tax is separately charged on the price. For example: If the price of good is Rs 200 exclusive and GST rate is 5%, then customer needs to pay Rs 210 as the price is exclusive of taxes. Tax exclusive inclusive from EZTax.in.