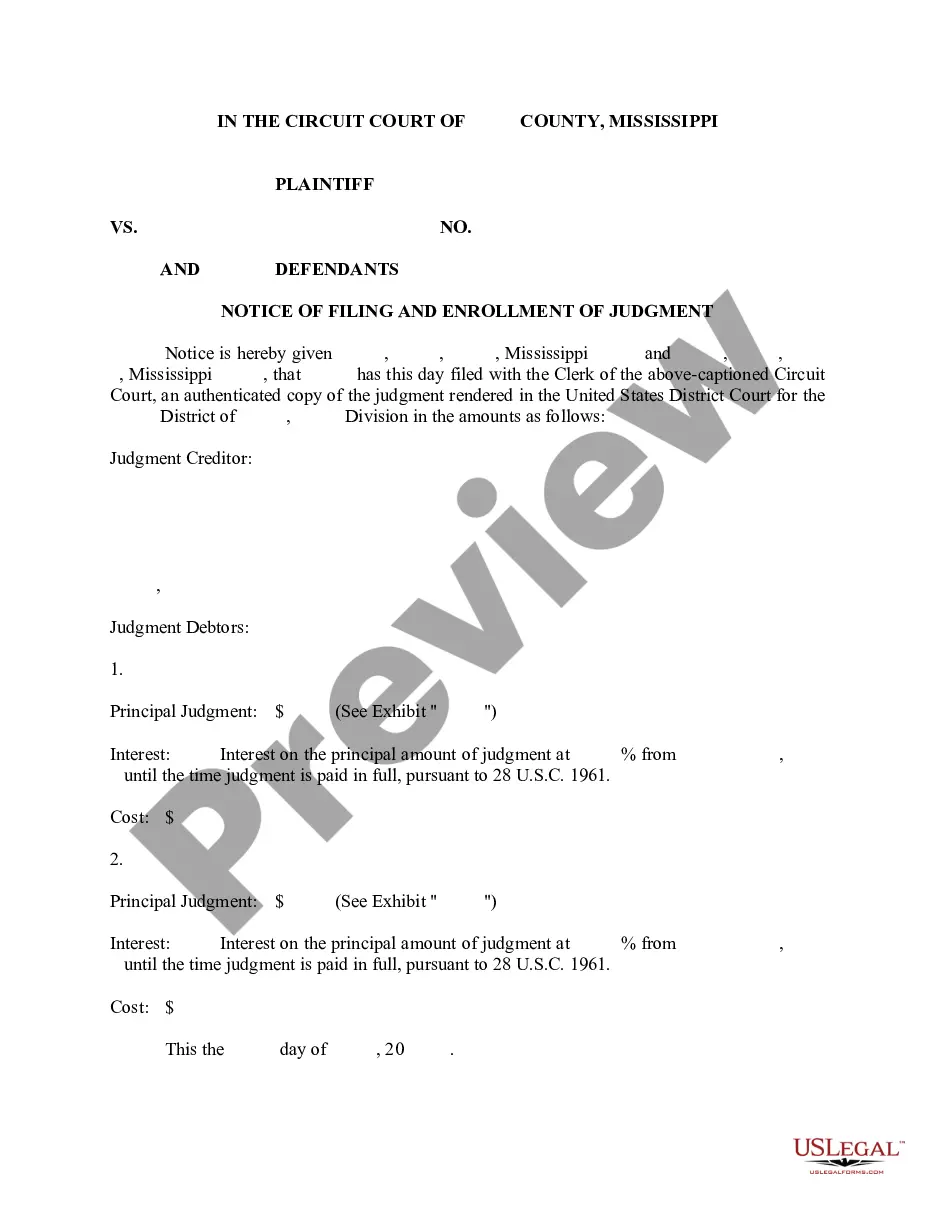

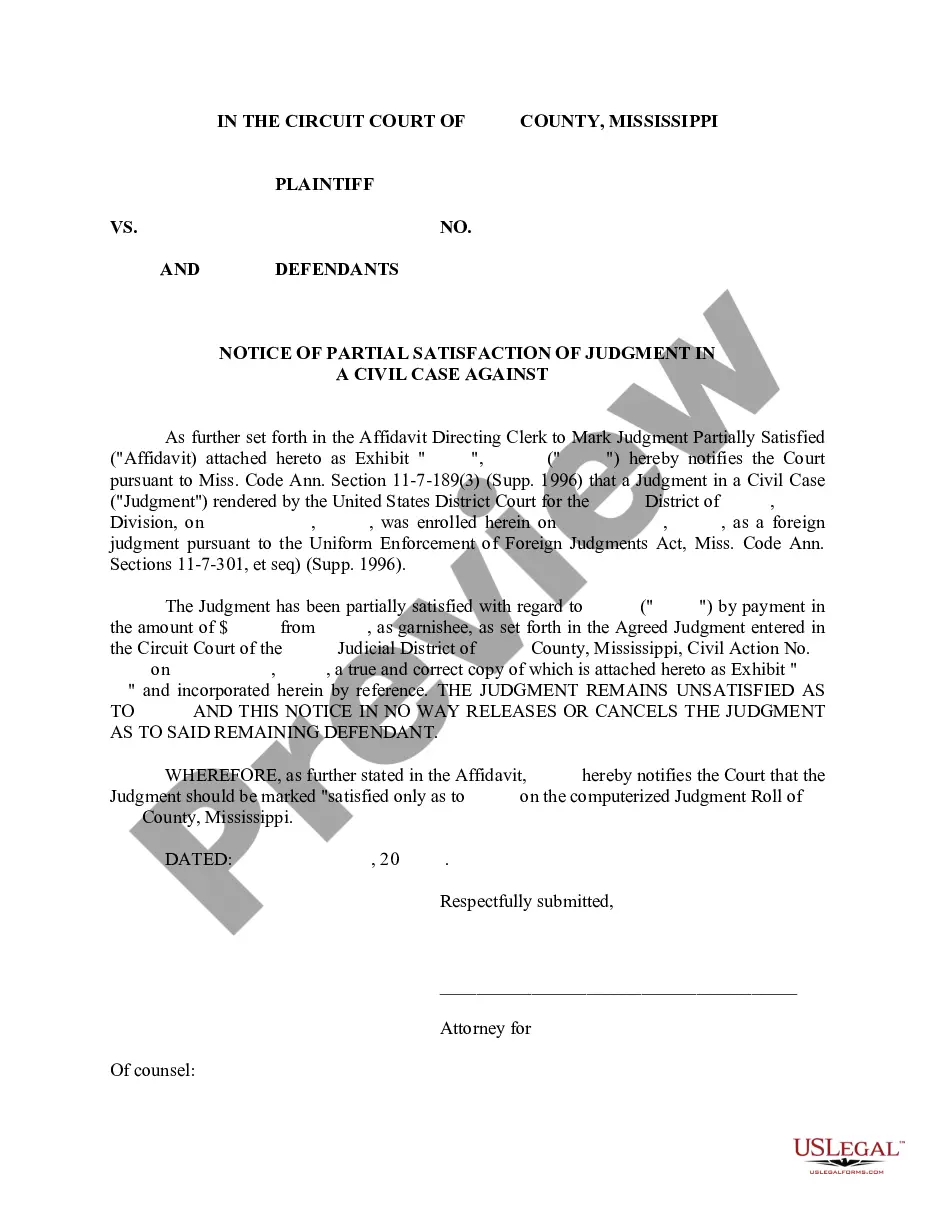

Mississippi Notice Of Filing And Enrollment Of Judgment

Description

How to fill out Mississippi Notice Of Filing And Enrollment Of Judgment?

Obtain a downloadable Mississippi Notice Of Filing And Enrollment Of Judgment in just a few clicks from the most extensive collection of legal electronic documents.

Discover, download, and print expertly prepared and verified samples on the US Legal Forms site. US Legal Forms has been the top provider of affordable legal and tax documents for US citizens and residents online since 1997.

After you have downloaded your Mississippi Notice Of Filing And Enrollment Of Judgment, you can complete it in any online editor or print it out and fill it out manually. Utilize US Legal Forms to access 85,000 expertly drafted, state-specific forms.

- Users with a subscription must sign in to their US Legal Forms account and download the Mississippi Notice Of Filing And Enrollment Of Judgment, which will be found in the My documents section.

- Users without a subscription need to follow these steps.

- Ensure your template complies with your state's specifications.

- If applicable, read the form's description to gain further insights.

- If accessible, examine the document to see additional details.

- Once you confirm the template suits your requirements, click Buy Now.

- Establish a personal account.

- Choose a subscription plan.

- Make a payment using PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

Due to a recent policy change by tax authorities (not eFile.com and other online tax websites), you can only efile a state tax return with your federal tax return. If you have already e-filed or filed your federal return, you can still prepare your state return on eFile.com.

The 2020 Mississippi State Income Tax Return forms for Tax Year 2020 (Jan. 1 - Dec. 31, 2020) can be e-Filed together with the IRS Income Tax Return by the April 15, 2020 May 17, 2021 due date. If you file a tax extension you can e-File your Taxes until October 15, 2021 without a late filing penalty.

Tax Day has come and gone, but it's not too late to file your 2018 state income tax return.April 15 was the deadline for taxpayers who owed tax. But if you didn't get around to filing, remember that everyone gets an automatic, six-month filing extension to file until Oct. 15.

Mississippi will follow the federal extension to file the 2020 individual income tax returns from April 15, 2021 to May 17, 2021. This extension only applies to the filing of the individual income tax return and payment of tax due.Beginning January 1, 2021, Miss.

If you are receiving a refund. P.O. Box 23058. Jackson, MS 39225-3058. All other income tax returns. P. O. Box 23050. Jackson, MS 39225-3050.

How you can file your return electronically. Use a tax preparer that is approved in the Mississippi e-file Program. (Make sure your tax preparer is approved by the IRS for e-file and signs your Form MS 8453, Mississippi State Declaration for Electronic Filing.)

Mississippi Residents As a resident you are required to file a state income tax return if you had any income withheld for tax purposes, earned more than $8,300 (single; add $1,500 per dependent) or earned more than $16,600 (married; add $1,500 per dependent).