Mississippi Escrow Agreement

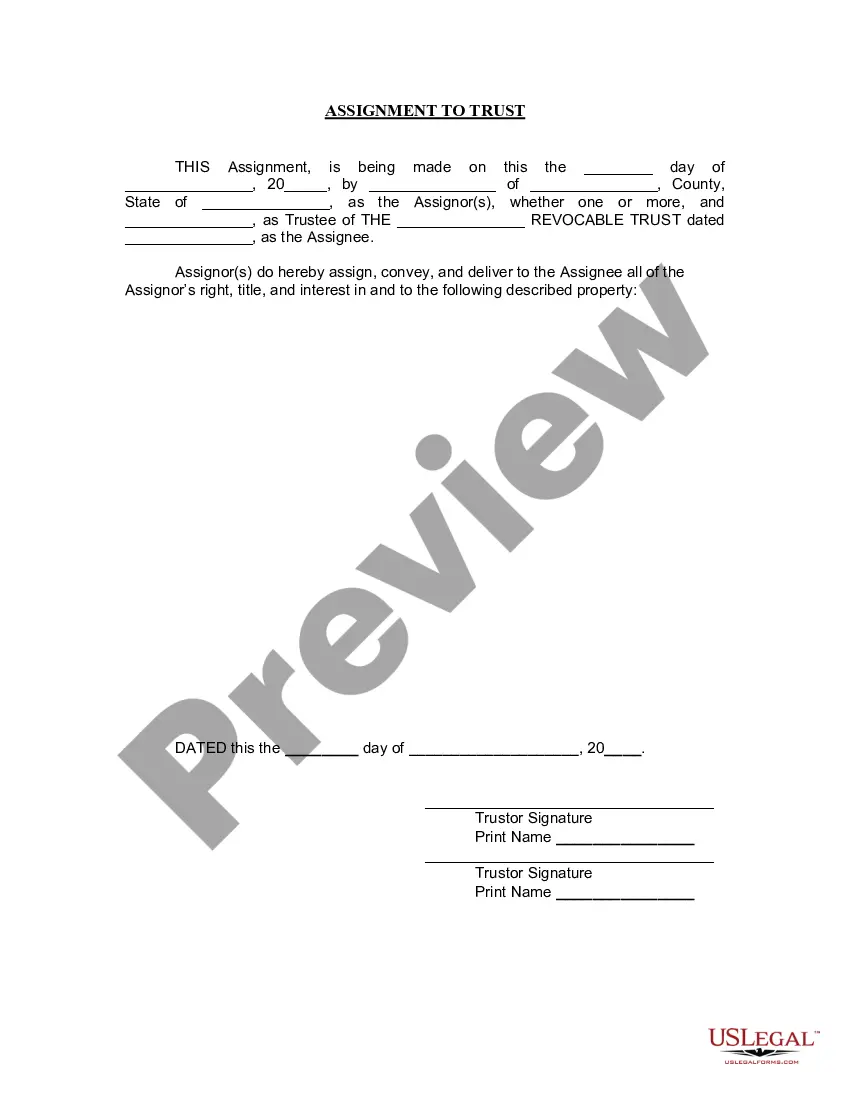

What this document covers

An Escrow Agreement is a legal document that outlines the terms between a buyer, seller, and an escrow agent, defining how funds will be managed during a transaction. This agreement is essential to ensure secure handling and distribution of the escrowed funds, thereby safeguarding the interests of all parties involved. Unlike simple contracts, the Escrow Agreement specifically addresses the roles and responsibilities of the escrow agent, making it a critical component in a variety of transactions, especially real estate deals.

Key parts of this document

- Deposit: Details how the escrow agent will receive and hold funds in escrow.

- Disbursements: Outlines the conditions under which funds will be disbursed to the seller.

- Liability of Escrow Agent: Clarifies the limited liability of the escrow agent in managing funds.

- Resolution of Disputes: Provides a process for resolving disagreements regarding the funds or documents.

Situations where this form applies

This form should be used when a buyer and seller agree to use an escrow agent to manage funds during a transaction. It is commonly utilized in real estate transactions where a deposit needs to be held securely until all parties fulfill their obligations. Additionally, it can be useful in any scenario where the parties want to ensure that funds are disbursed only when certain conditions are met.

Who should use this form

- Buyers and sellers who are involved in real estate transactions.

- Parties in an agreement that requires a neutral third party to manage funds.

- Escrow agents who need a structured agreement for their roles and responsibilities.

How to prepare this document

- Identify the parties involved: List the seller, buyer, and escrow agent accurately.

- Specify the funds: Clearly state the amount to be held in escrow.

- Define the disbursement conditions: Outline when and how funds will be released to the seller.

- Include signatures: Ensure all parties sign the agreement to validate it.

- Distribute copies: Provide copies of the signed agreement to all parties involved.

Is notarization required?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all parties' signatures, which can invalidate the agreement.

- Not clearly defining disbursement conditions, leading to disputes later.

- Omitting important details about the funds being escrowed.

Advantages of online completion

- Convenience: Downloadable forms save time and can be completed at your convenience.

- Editability: Fillable formats allow you to customize the agreement for your specific needs.

- Reliability: Forms drafted by licensed attorneys ensure legal compliance and reliability.

Looking for another form?

Form popularity

FAQ

Buyers stand to lose their earnest money if they jump ship on a real estate transaction.But, if a buyer decides to cancel the contract for a reason not covered by a contract contingency, earnest money is generally forfeited to the seller.

Closing costs: ~1-3% While the buyers will typically be responsible for the lion's share, sellers should expect to pay between 1-3% of the home's final sale price at closing. Based on the average home value in Mississippi of $136,000, that roughly translates to $1,000 to $4,000.

You pay escrow to seal the deal after a property owner accepts your offer. While these funds show the seller you're serious about purchasing the dwelling, if you can't close the loan, you could lose your escrow money.

Funds in Escrow Earnest money is refundable, but you might receive a partial refund or no refund under certain circumstances.Buyers must ensure that they understand the circumstances under which they forfeit the earnest money deposit before entering into a purchase agreement.

The contract terms will determine when you can move in after closing. In some cases, it will be immediately after the closing appointment. You will receive the keys and head straight to your new home. In other situations, the seller may request 30, 45 or even 60 days of occupancy after the closing of the home.

Does the Seller Ever Keep the Earnest Money? Yes, the seller has the right to keep the money under certain circumstances. If the buyer decides to cancel the sale without a valid reason or doesn't stick to an agreed timeline, the seller gets to keep the money.

Upon the close of escrow, the earnest money deposit is applied to the balance of the down payment.That doesn't mean you can't get your deposit back or lose it, if you aren't careful. From the time you put up the deposit until you close escrow, a lot can happen.

An escrow agreement is a contract that outlines the terms and conditions between parties involved, and the responsibility of each. Escrow agreements generally involve an independent third party, called an escrow agent, who holds an asset of value until the specified conditions of the contract are met.

The real estate commission is usually the biggest fee a seller pays 5 percent to 6 percent of the sale price. If you sell your house for $250,000, say, you could end up paying $15,000 in commissions. The commission is split between the seller's real estate agent and the buyer's agent.