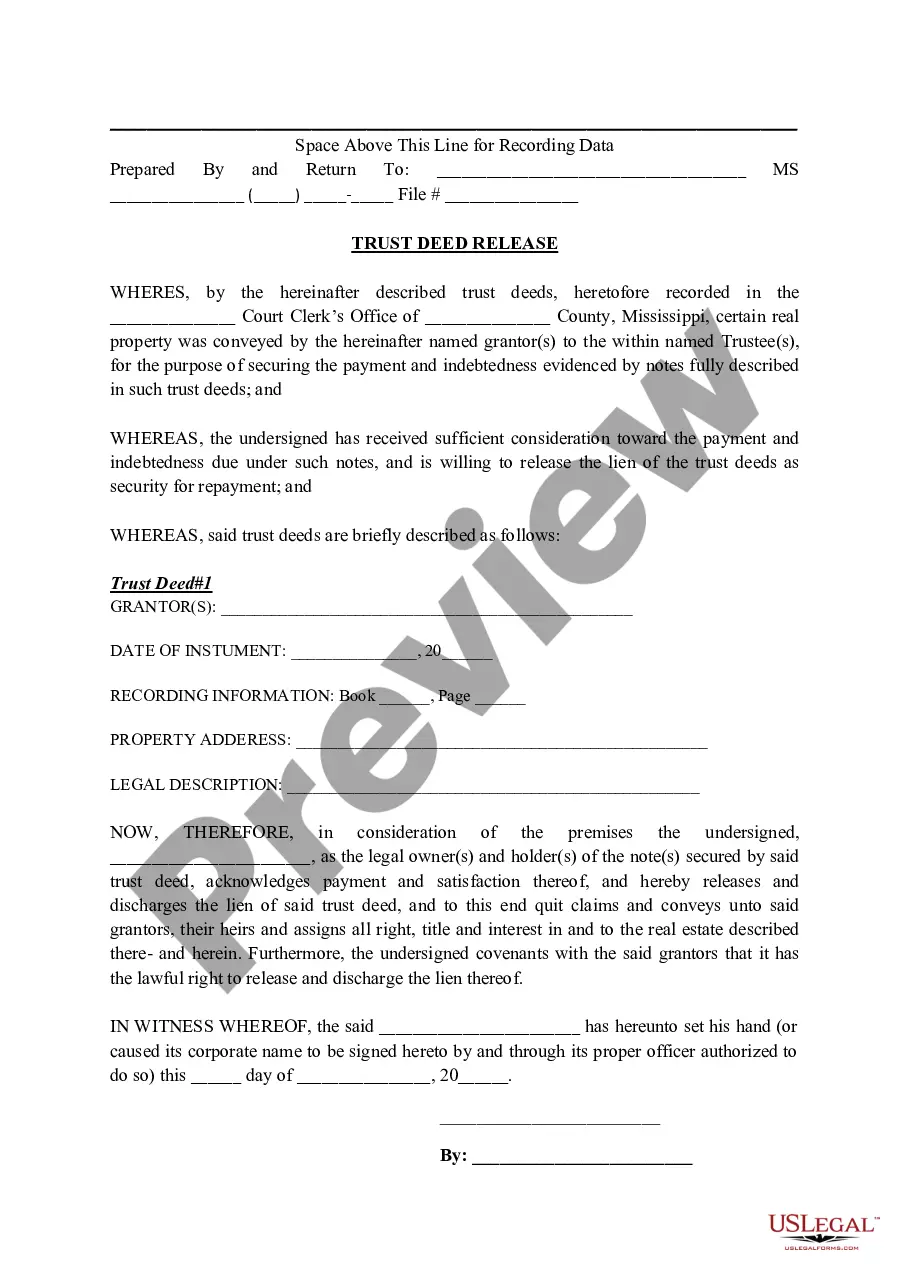

Mississippi Trust Deed Release

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Mississippi Trust Deed Release?

Acquire a printable Mississippi Trust Deed Release in just a few clicks from the largest collection of legal electronic documents.

Discover, download, and print expertly prepared and verified samples on the US Legal Forms platform. US Legal Forms has been the leading supplier of affordable legal and tax documents for US citizens and residents online since 1997.

Download the document in Word or PDF format. After downloading your Mississippi Trust Deed Release, you can fill it out in any online editor or print it and complete it manually. Utilize US Legal Forms to access 85,000 professionally drafted, state-specific documents.

- Customers who already have a subscription must Log In to their US Legal Forms account, download the Mississippi Trust Deed Release and find it saved in the My documents section.

- Users without a subscription need to adhere to the instructions outlined below.

- Ensure your document complies with your state's regulations.

- If available, examine the document's description for additional details.

- If provided, check the document to see more information.

- Once you are confident the template satisfies your needs, simply click Buy Now.

- Establish a personal account.

- Choose a subscription plan.

- Make a payment via PayPal or credit card.

Form popularity

FAQ

A deed of release or release deed is a legal document that removes the claim of a person from an immovable property and transfers his/her share to the co-owner. The release deed procedure is executed in the sub-registrars office and both the parties are required to be present for signing it.

The deed can be re-written to reflect changes, but it needs the consent of both parties. If you want to make substantial changes to the deed, it's typically best to get a new one written. If changes are only minor, you can enter a deed of variation.

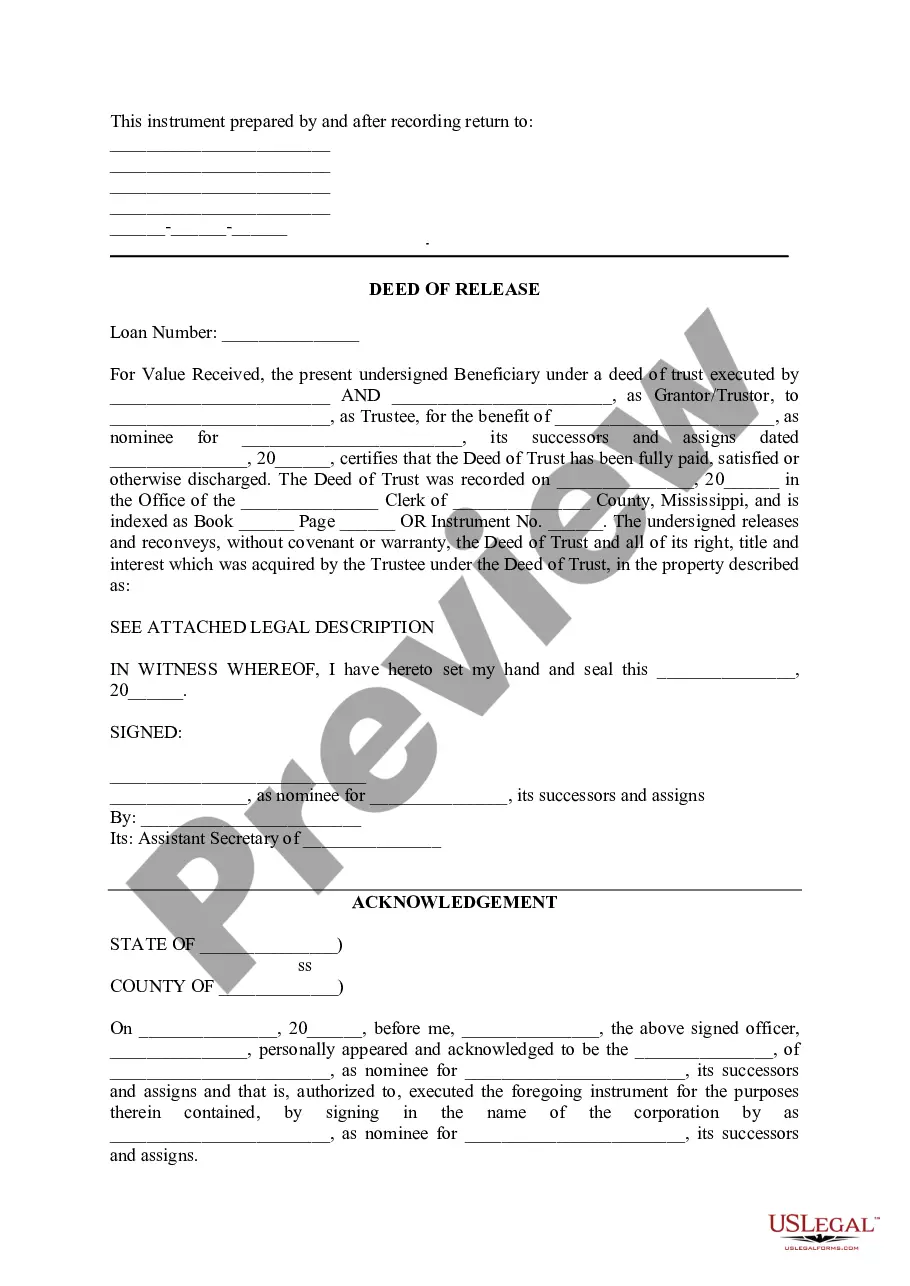

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

Parties need a deed of release to bring a dispute or agreement to an end.Alternatively, if you are an employer, you may want a departing employee to sign a deed of release to agree that they won't make any employment claims against you once they have gone.

A Deed of Trustis a document where a borrower transfers the legal title for its property to a trustee who holds the property in trust as security for the payment of the debt to the lender. If the borrower pays the debt as agreed, the deed of trust becomes void and the lender executes a Deed of Reconveyance.

Yes, you can challenge the release deed/ relinquishment deed after the death of the person. but to challenge it you need to have solid grounds and proof stating that the deed was made fraudulently. if you dont have any proof then their is no point challenging it as the case may not sustain merit in the court.

The property's title remains in the trust until the loan is paid off, or satisfied, then it is released from the trust. To complete the release, the lender prepares a deed of reconveyance. This document states that the conditions of the loan have been met and you have no further financial obligations to the lender.

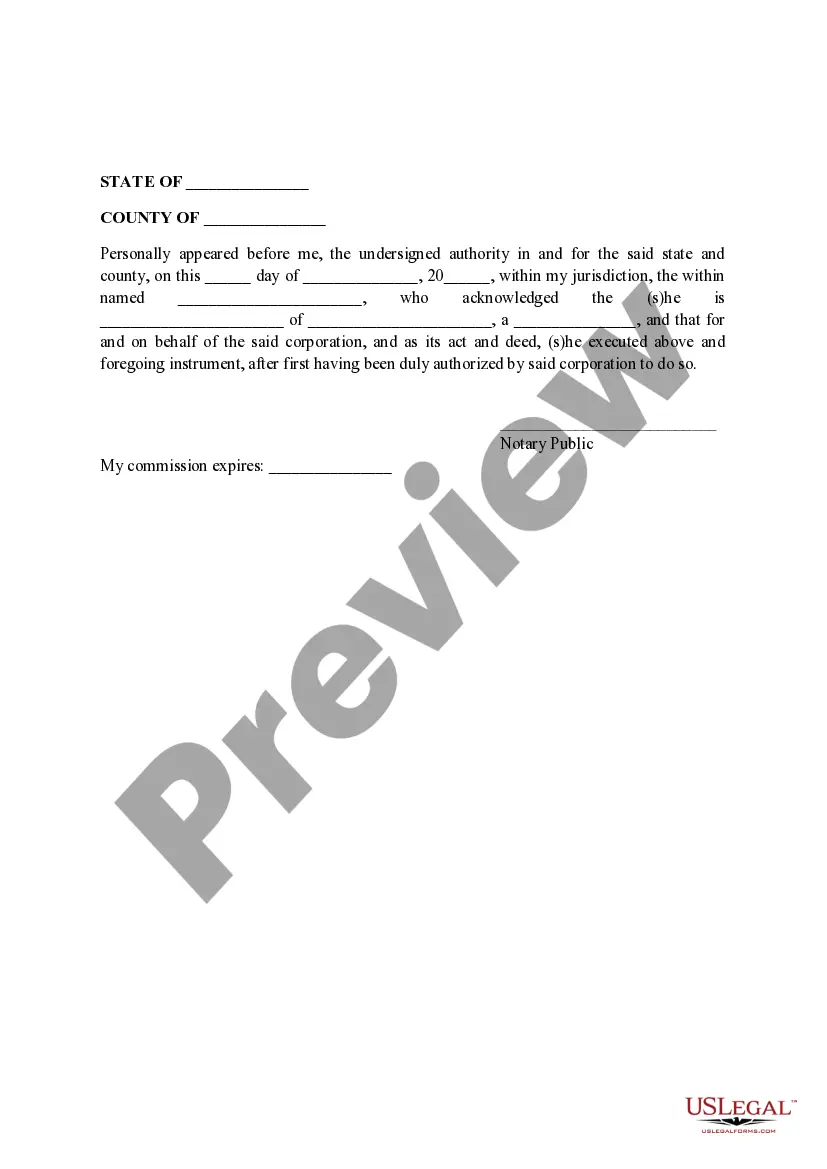

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.