Missouri Clauses Relating to Dividends, Distributions

Description

How to fill out Clauses Relating To Dividends, Distributions?

Are you currently within a place in which you need to have paperwork for both organization or personal purposes virtually every working day? There are tons of authorized document themes available on the net, but locating ones you can trust isn`t easy. US Legal Forms gives thousands of develop themes, like the Missouri Clauses Relating to Dividends, Distributions, that are created in order to meet state and federal requirements.

Should you be currently informed about US Legal Forms site and get an account, simply log in. Following that, it is possible to download the Missouri Clauses Relating to Dividends, Distributions web template.

Should you not provide an profile and want to start using US Legal Forms, abide by these steps:

- Find the develop you need and ensure it is for your right area/area.

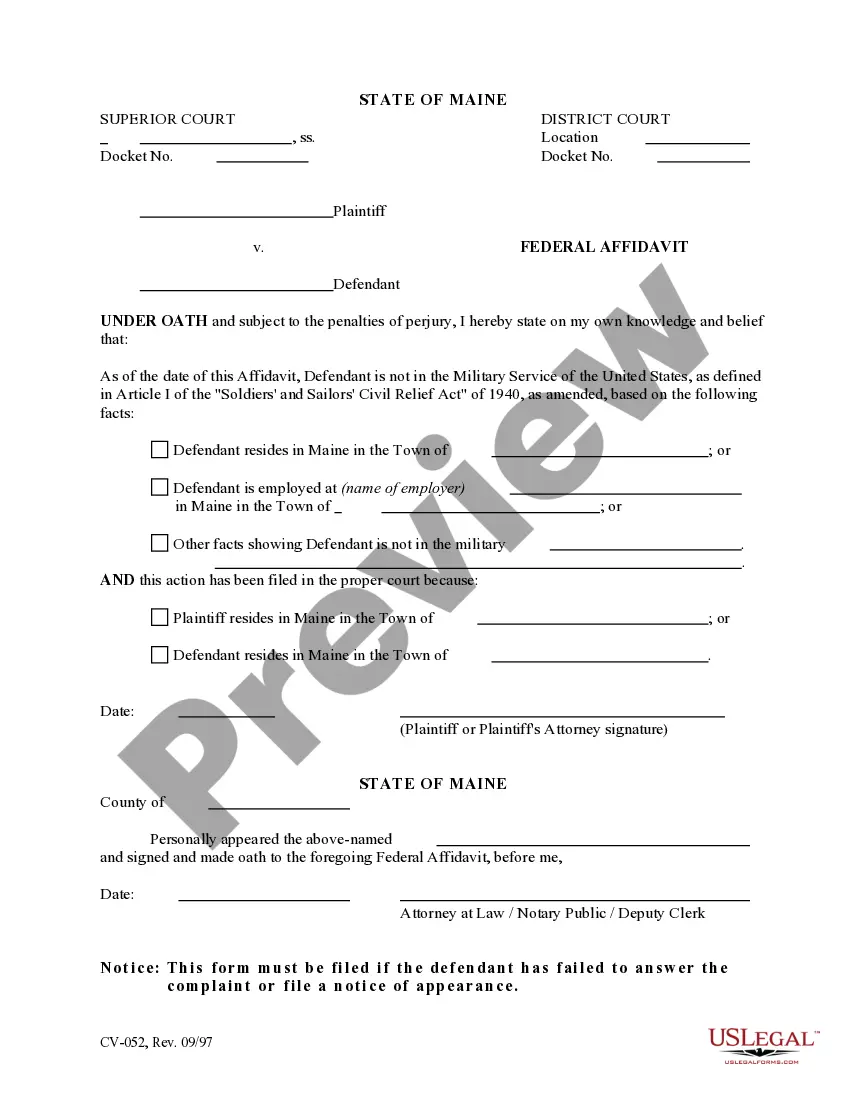

- Utilize the Review switch to examine the form.

- Browse the outline to ensure that you have chosen the right develop.

- In the event the develop isn`t what you`re trying to find, take advantage of the Lookup industry to find the develop that meets your needs and requirements.

- If you find the right develop, simply click Purchase now.

- Pick the prices plan you would like, fill in the required info to create your account, and pay money for an order making use of your PayPal or Visa or Mastercard.

- Choose a handy data file formatting and download your duplicate.

Get each of the document themes you may have purchased in the My Forms menus. You may get a more duplicate of Missouri Clauses Relating to Dividends, Distributions anytime, if needed. Just select the needed develop to download or print the document web template.

Use US Legal Forms, one of the most comprehensive assortment of authorized forms, to save lots of some time and stay away from errors. The support gives professionally made authorized document themes which you can use for an array of purposes. Create an account on US Legal Forms and initiate generating your life a little easier.

Form popularity

FAQ

Dividends: Dividends to the extent included in federal taxable income are subtracted in determining Missouri taxable income. Dividends from a Missouri payor are apportioned and then subtracted from apportioned income.

Missouri LLCs are taxed the15. 3% federal self-employment tax rate (12.4% for social security and 2.9% for Medicare).

A composite return is allowed by the Missouri Department of Revenue for any partnership, S corporation, limited liability partnership, or limited liability company (treated as a partnership for tax purposes) with nonresident partners or S corporation shareholders not otherwise required to file a Missouri individual ...

Missouri franchise tax is paid by all corporations doing business in the state. Companies required to pay the tax must file Form MO-1120 or Form MO-1120S when paying their tax bill. Missouri has been collecting franchise tax from businesses since 1970.

Tax Rate Changes ? Indexed for Inflation If the Missouri taxable income is...The tax is...$0 to $1,207$0Over $1,207 but not over $2,4142.00% of excess over $1,207Over $2,414 but not over $3,621$24 plus 2.50% of excess over $2,414Over $3,621 but not over $4,828$54 plus 3.00% of excess over $3,6214 more rows

Tax Penalties The MO DOR assesses a 5% penalty per month up to 25% of the unpaid balance if you don't file your tax return on time. The state also charges a one-time 5% penalty if you pay your taxes late. MO DOR assesses both penalties the first day you are late.

PURPOSE: This rule explains the proper Missouri income tax treatment of net operating losses by corporations.

The NOL deduction cannot exceed the corporation's taxable income (after special deductions). An NOL deduction cannot be used to increase a loss in a loss year or to create a loss in a profit year.