Kentucky VETS-100 Report

Description

How to fill out VETS-100 Report?

If you wish to total, acquire, or produce legal document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online.

Leverage the site's user-friendly and efficient search feature to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Kentucky VETS-100 Report in just a few clicks.

Every legal document template you purchase belongs to you permanently.

You have access to each form you downloaded in your account. Navigate to the My documents section and pick a form to print or download again. Finalize and download, and print the Kentucky VETS-100 Report with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Kentucky VETS-100 Report.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first experience with US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

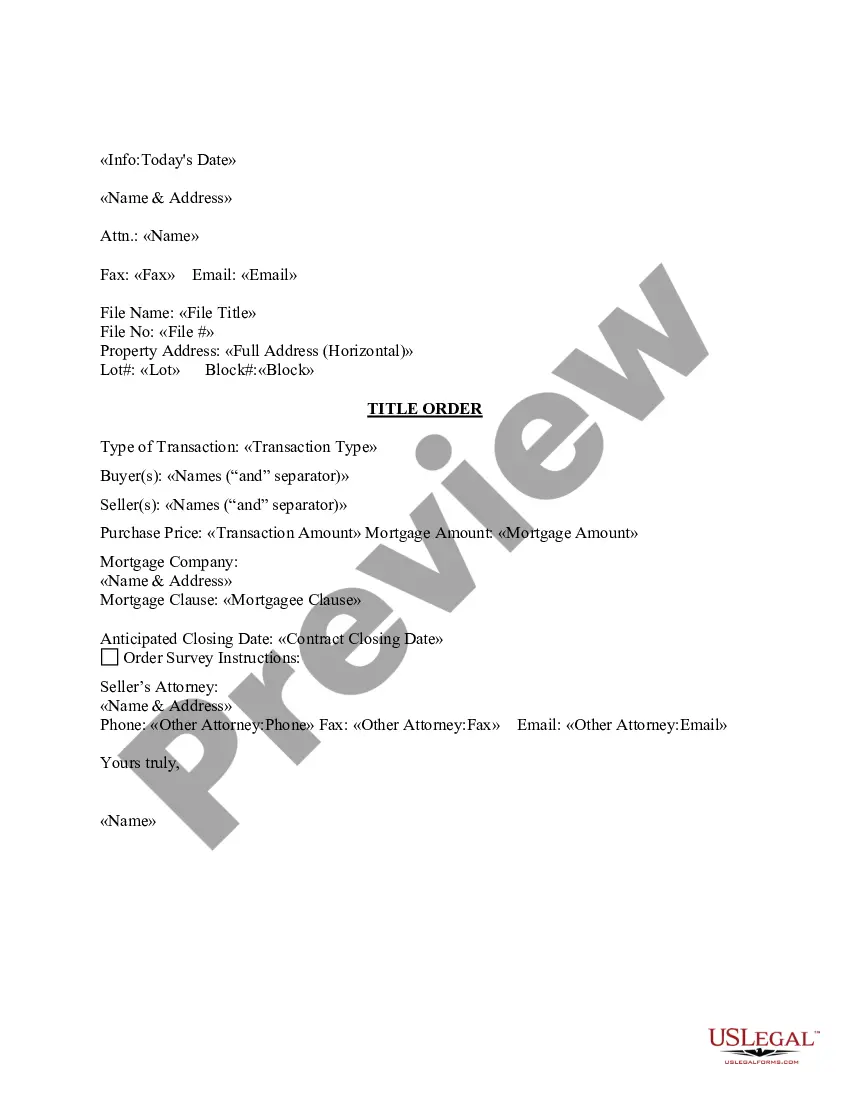

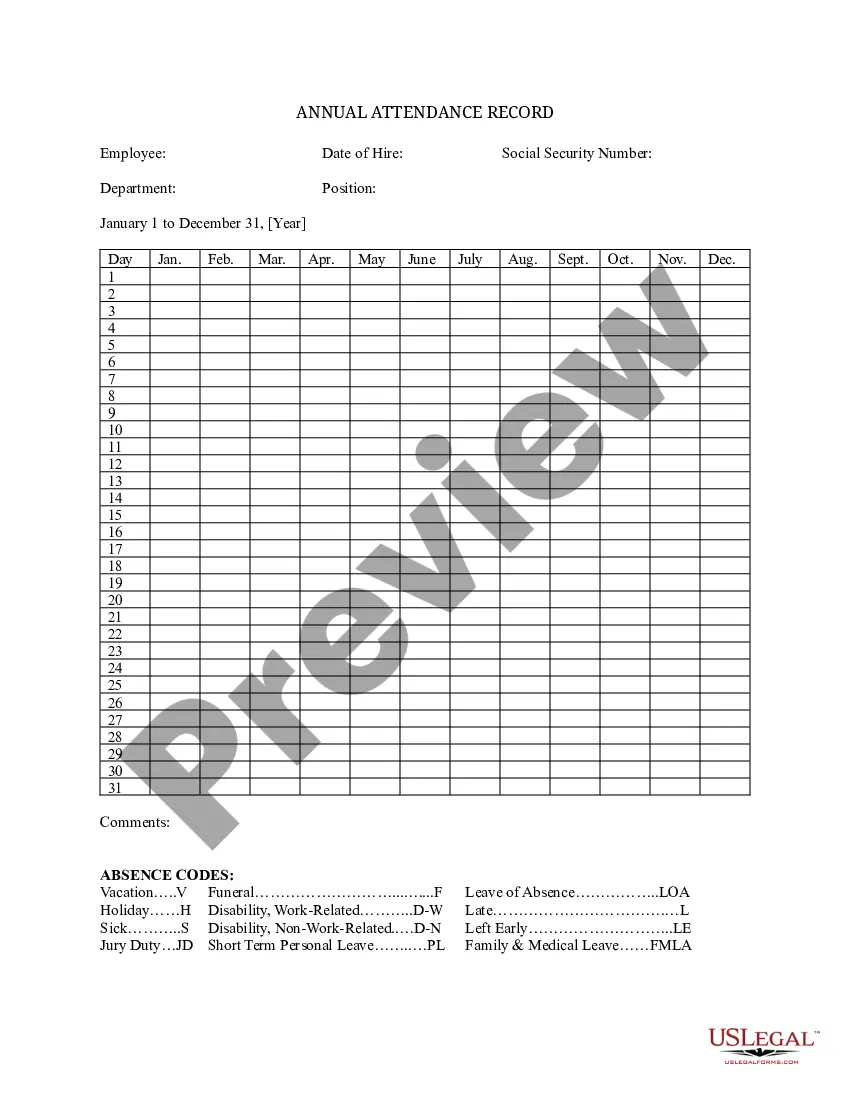

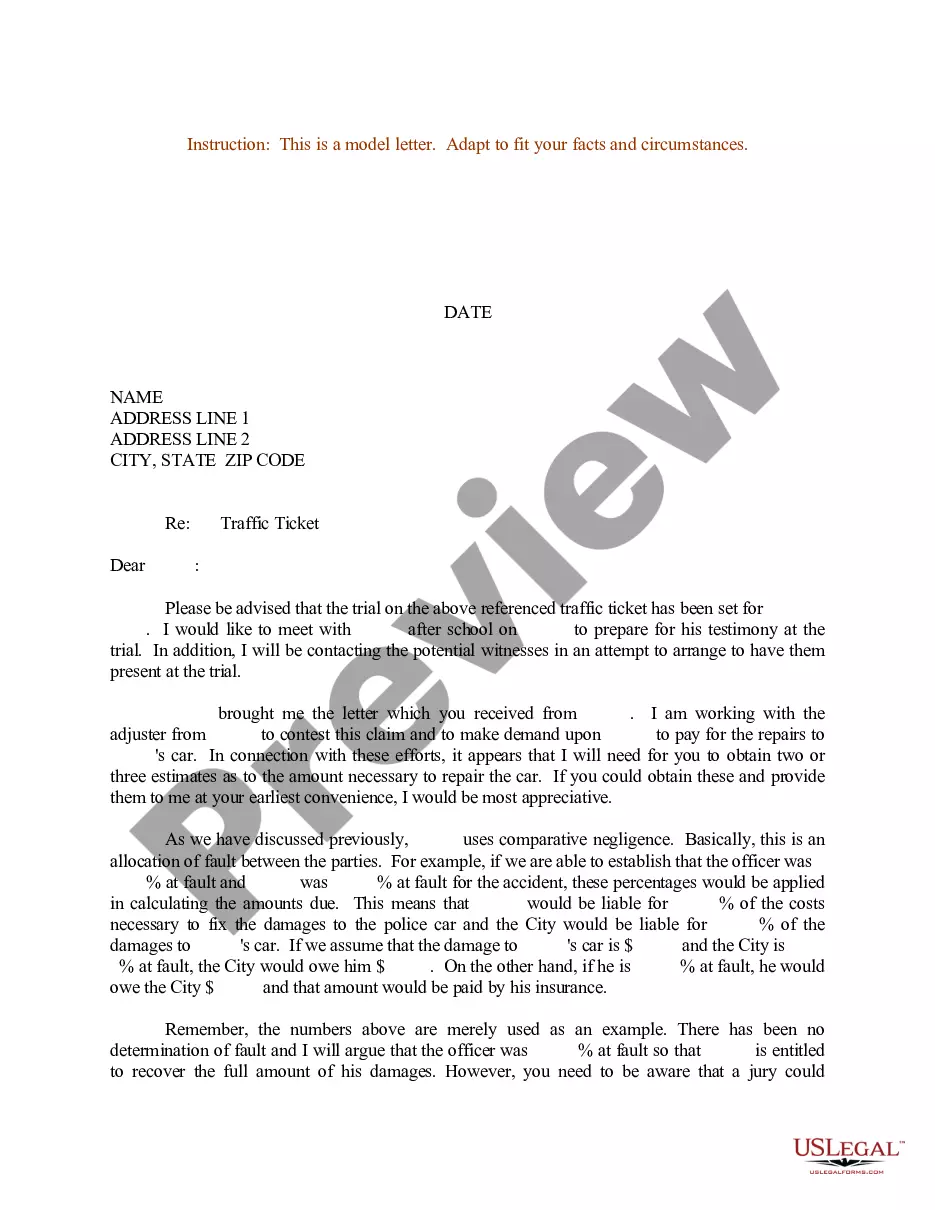

- Step 2. Use the Preview option to review the content of the form. Don't forget to read the instructions.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, click on the Buy now button. Select the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the payment process. You can utilize your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify and print or sign the Kentucky VETS-100 Report.

Form popularity

FAQ

Yes, if you are a federal contractor or subcontractor, you need to file the VETS-4212 report annually. This report helps ensure you're compliant with the law regarding employment of veterans. Additionally, you should be aware of the Kentucky VETS-100 Report, as it also highlights your commitment to veteran employment. Using platforms like US Legal Forms can simplify the filing process for both reports.

The Kentucky VETS-100 Report centers on the employment of veterans and is specifically required of federal contractors, while the VETS-4212 report is more comprehensive, focused on all veteran hiring practices. VETS-100 emphasizes the number of veterans employed and their job types. Understanding these differences is vital for compliance. The US Legal Forms platform can assist you in navigating both reports effectively, ensuring you meet all legal requirements.

All federal contractors and subcontractors that meet certain criteria must complete the Kentucky VETS-100 Report. Specifically, organizations with a contract valued at over $150,000, and those that employ veterans, are included. The report helps monitor veteran employment and ensures companies fulfill their legal obligations. Using the US Legal Forms platform can simplify the process of filing this important report.

In Kentucky, a 100% disabled veteran can access various benefits, including monthly compensation, healthcare services, and property tax exemptions. These benefits enhance the quality of life for veterans and their families. Completing the Kentucky VETS-100 Report is crucial to ensure you receive these entitlements without missing out on any assistance.

The State of Kentucky offers qualified disabled veterans a discount on hunting and fishing combo licenses via the Senior or Disabled Sportsman License program, open to a variety of qualifying ages and conditions that include residents of Kentucky who are VA-rated at 50% disabled or greater.

Kentucky Property Tax Exemptions Disabled veterans are eligible for the same homestead tax break that Kentucky residents aged 65 and older (or who are declared as totally disabled as determined by a government agency in-state) get.

Disabled veteran registration fee waiverDisabled veterans are eligible for one Disabled Veteran license plate free of charge. To qualify, you must be a resident, or a non-resident stationed in Kentucky, with a service-connected disability of at least 50%, who has been provided a vehicle by the Veterans Administration.

The VETS-100A Report adopts the job categories used on the revised EEO-1 Report, while the VETS-100 Report has a single Officials and Managers job category. Source: US Department of Labor, Veterans' Employment and Training Service, .

50-69 percent may receive a $10,000 exemption from the property's value. 30-49 percent may receive a $7,500 exemption from the property's value. 10-29 percent may receive a $5,000 exemption from the property's value. Veterans with a full 100% disability rating are fully exempt from property taxes.

The Vietnam Era Veterans' Readjustment Act (VEVRAA) requires covered federal contractors and subcontractors to file the VETS-4212 Report. The VETS-4212 Report requires a company to indicate the type of contractual relationship that it has with the federal government.